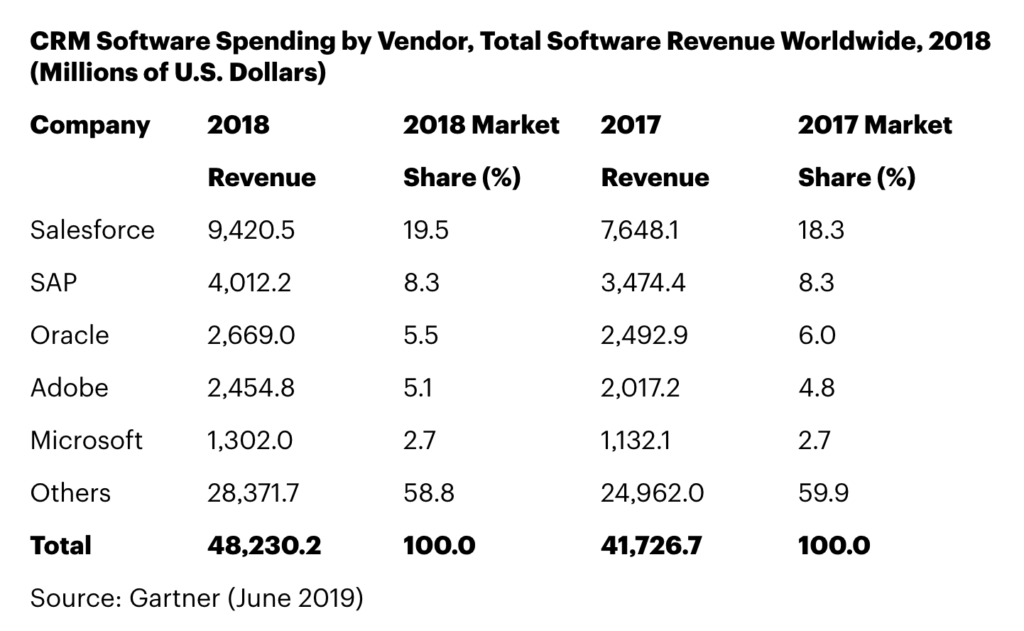

In the world’s largest and fastest-growing enterprise-applications category, Salesforce racked up CRM market share of 19.5% in 2018. The combined share for SAP, Oracle and Adobe was 18.9%, Gartner said earlier this week.

Pegging the market’s total size for 2018 at $48.2 billion, Gartner said the CRM sector grew 15.6% for the year and remains the biggest slice of the $193.6-billion enterprise-apps pie.

“Approximately 72.9% of CRM spending was on software as a service (SaaS) in 2018, which is expected to grow to 75% of total CRM software spending in 2019, with agility and flexibility being big drivers, along with the requirement for remote and mobile users,” Gartner said in a press release.

In conjunction with its Customer Experience and Technologies Summit held in Sydney, Australia this week, Gartner released the following table showcasing the 2018 revenue and market-share performances for #1 Salesforce, #2 Oracle, #3 SAP, #4 Adobe, and #5 Microsoft.

Gartner Data:

With the fairly new initiative among companies in every industry to create and deliver great experiences for customers, it’s not surprising that the CRM space continues to grow at heady levels.

At the same time, the traditional CRM marketplace is undergoing enormous changes as its entire focus shifts from being aimed at helping sellers “manage” their relationships with customers (when surely it’s the customers who’ll be doing the managing!) to a new focus on delivering great experiences at every point in the relationship.

Here’s a look at some of our recent Cloud Wars coverage of these upheavals:

Why Google Cloud and Salesforce Are Pumping $18 Billion into Analytics and BI:

Salesforce agrees to shell out a staggering 40x revenue to acquire Tableau for $15.3 billion. The expectation is that Tableau will allow Salesforce to empower business customers to make better, data-driven decisions.

Attention Workday, SAP and Oracle: Is Salesforce Jumping into HCM?

Salesforce expands its definition of “CRM” to include the employees of its business customers. Because those employees are, of course, indispensable in delivering great experiences to customers.

Salesforce’s New Strategy: All-In on ‘Customer 360,’ Powered by MuleSoft:

Co-CEO Marc Benioff says he’s repositioning his company—and therefore the CRM market—around the notion of his Customer 30 Initiative.

Under Armour Targets Mass Personalization at Scale via SAP and Qualtrics:

A widespread customer of both SAP and its newly acquired Qualtrics unit, Under Armour will use experience data and operational data to derive new insights into not only what customers want, but also how Under Armour must respond.

SAP and Microsoft Revolutionize the Cloud Market:

In an expansion of their long-time strategic relationship, Microsoft (which Gartner says had 2.7% share of the 2018 CRM market) and SAP (Gartner said its 2018 share was 5.5%) are helping customers optimize their journeys to the cloud. On top of that, a portion of Microsoft’s sales org will begin selling SAP’s cloud applications.

From Financial Services to Manufacturing, Here’s the #1 Priority for CEOs:

That priority is creating excellent experiences for customers. With CEOs now firmly behind that reality, the market is sure to remain strong for years to come.

How Microsoft, SAP and Adobe Plan to Revolutionize CRM and Rock Salesforce:

The proof is in the numbers.

Disclosure: at the time of this writing, SAP, Microsoft and Oracle were clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!