With Oracle declaring its intentions to displace Workday as the world leader in cloud HCM, Larry Ellison last week claimed that industry analysts rate his Fusion HCM applications as superior to Workday’s HCM solutions. (See Oracle Calls Out Workday on HCM Growth, Customer-Sat Scores, Loss of Goldman Sachs.)

That’s not a surprising claim from Ellison—every tech-industry CEO will attempt to present his or her company in the most favorable light.

Nor has it been surprising over the past few quarters when Workday CEO Aneel Bhusri has said that Oracle cannot successfully land clients within the Fortune 100 (see Workday CEO: Oracle and SAP Can’t Match Us in Fortune 100), although Oracle just won the JPMorgan Chase account for 256,000 employees.

So who’s right? Which HCM vendor—Workday or Oracle—gets the top billing from industry analysts?

“Go look at the reports”

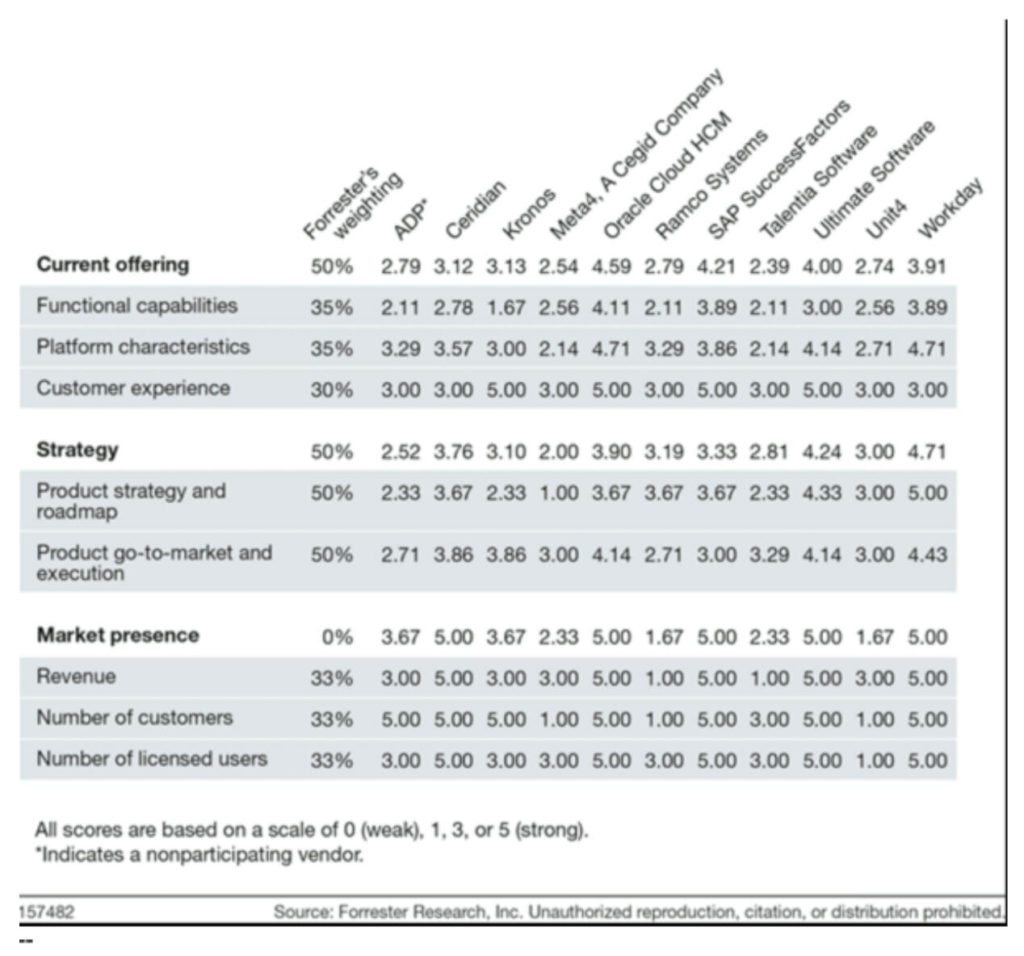

Oracle shared with me the below graphic from Forrester Research showing its numerical ratings for Oracle, Workday and several other HCM vendors. Let’s take a look at which vendor came out on top.

The first number I’d like to look at relates to a specific claim made by Ellison during Oracle’s fiscal-Q4 earnings call last week and highlighted in my article noted above. Here’s how Ellison framed the thinking of the industry analysts on the issue of Oracle HCM versus Workday HCM:

“It’s interesting to note that both Gartner and Forrester Research rate Oracle HCM much higher than Workday,” Ellison said on the call. “Don’t believe me, go look at the reports—they’re online. [No doubt they are, but subscriptions are required.] And where we really distinguished ourselves in addition to capabilities and also other things was in customer satisfaction.

“Look at the Gartner report, look at the Forrester report,” Ellison urged. “Our customer-sat rating is 5.0, right at the top. Workday is right in the middle with 3.0, far behind us.”

I have no idea what Gartner did or didn’t say, so we’ll focus here on the Forrester Wave for HCM, which was released last month.

1. Per Ellison’s claim, does Forrester rate Oracle HCM “much higher” than Workday HCM?

Well, yes and no. Forrester rated the two companies on 8 distinct attributes spread across 3 different categories.

For those 3 categories, Oracle came out on top in Current Offering. Workday came out on top in Strategy. And the two companies tied for Market Presence.

2. Per Ellison’s claims about the “customer-satisfaction” scores, did Oracle get a 5.0 and Workday a 3.0?

Again, it’s kinda/sorta yes and no, although I believe the essence of Ellison’s point is right on the mark. And that’s a major win for Oracle.

Forrester did not measure “customer satisfaction” but rather “customer experience.” It’s a close call, and Ellison should have been more precise by using the term “customer experience” instead of “customer satisfaction.” But without question, the numbers cited by Ellison are right on the mark: for “customer experience,” Oracle received a 5.0, and Workday a 3.0.

What I find particularly interesting about in those numbers is that SAP’s HCM offering, SuccessFactors, also scored a 5.0 for customer experience, tied with Oracle and well ahead of Workday. In fact, in the Current Offering category that includes “customer experience,” SAP scored better than Workday.

3. Workday tops Oracle in Strategy category

In the category of Strategy, Workday topped Oracle with an overall score of 4.71 to Oracle’s 3.90. Within the Strategy category, in the attribute called Product Strategy and Roadmap, Workday scored a 5.0 while both Oracle and SAP got 3.67.

4. In Market Presence, sheer perfection from all 3 vendors

This one had me scratching my head a bit—I don’t believe in coincidences, yet this one was overflowing with what appear to be coincidences. The Market Presence category includes 3 attributes: revenue, number of customers, and number of licenses. Forrester awarded perfect 5’s to Oracle, SAP and Workday for every one of those attributes, and so for Market Presence overall. That’s more than a little weird, but that’s what the numbers show.

Final thoughts

Quirks and all, this effort by Forrester to quantify the capabilities and features and execution of the major HCM vendors is a good one. In my opinion, the numbers in this Forrester Wave should serve to give business customers inspiration about the questions they should ask, rather than being absolute answers on which vendor to choose.

Workday has always prided itself on its customer relationships and its unconditional devotion to customer success, customer satisfaction and customer experience. Yet this Forrester Wave says Workday falls well short of what both Oracle and SAP are delivering to customers.

Why is that?

What could and should Workday be doing differently—and better?

Or is there some issue with the approach taken by Forrester in how it measures and ultimately grades “customer experience”?

And please say it with me: in the Cloud Wars, the big winners are the business customers who benefit enormously from all the innovation and excellence driven by the savage competition among the Cloud Wars Top 10.

RECOMMENDED READING

Workday CEO: Oracle and SAP Can’t Match Us in Fortune 100

Oracle Calls Out Workday on HCM Growth, Customer-Sat Scores, Loss of Goldman Sachs

Workday CEO Hammers Oracle and SAP over Shortcomings in Fortune 500

Will Workday Whack Oracle and SAP Again on Earnings Call?

10 Reasons Larry Ellison Believes Oracle Can Beat Amazon and Microsoft

Microsoft-SAS Alliance Is Great, But When Will Microsoft Buddy Up with Amazon?

Hey Larry Ellison: Microsoft’s #1 Priority Is Replacing Oracle Database

Disclosure: at the time of this writing, Oracle, SAP and Workday were among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!