While various diverse metrics can be used to evaluate the cloud-infrastructure business, Oracle dominates in the category of cloud-region buildouts with 101 regions across the globe while Microsoft has more than 60, Google Cloud has 42, and AWS has 36.

That very large and fast-growing network of cloud regions is clearly vital for everything from global presence to data sovereignty to latency issues and more — but at the same time, that number has to be considered in the context of other factors, such as:

- pricing,

- security,

- related services, and

- availability of all services in all regions.

In Oracle’s favor, large organizations in every industry are definitely focused more on regulatory issues such as data residency and sovereignty, privacy, and the impact that the rise of AI is having on everything from privacy laws to cybercrime. As those issues take on more urgency and become board-level decisions, Oracle’s large number of cloud regions give it a geographic-presence advantage that I have not seen the other hyperscalers address.

What I find a bit surprising is that this disparity in cloud-region numbers did not just pop up overnight: Oracle CTO Larry Ellison has been touting it for the past few years, explaining that while Microsoft and Google Cloud and AWS continue to build small numbers of very large cloud data centers, Oracle is going in the opposite direction by building a large number of small data centers (with some truly massive “AI data centers” thrown into the mix as well).

To learn more about the various cloud-region plans the big cloud providers, Microsoft describes its 60-plus facilities here, Google Cloud outlines its cloud regions here, and AWS lays out its cloud regions here.

I’m not sure if those other three companies feel Ellison’s strategy is flawed, or if their commitment to their current architecture for cloud data centers does not give them the flexibility to complement their existing networks of very large facilities with some smaller ones as well.

So if we ask this question — “Do customers want their cloud provider to have lots of cloud regions across the globe?” — then one of the ways to answer it is by looking at the financial results: do Oracle’s financial results reflect strong customer demand for Oracle’s unique approach?

To answer that, here are some relevant — and eye-popping — numbers from Oracle’s fiscal-Q3 earnings call for the period ended Feb. 28.

- “Our RPO balance is now $130 billion, up from $97 billion last quarter and up from $80 billion last year,” said CEO Safra Catz. “That’s a growth rate of 63% year over year…. The RPO figure is the leading indicator of demand for our cloud services.”

- “AI demand drove Oracle Cloud Infrastructure revenue up 51% in Q3,” Catz said. “Our infrastructure cloud services now have an annualized revenue of $10.6 billion.”

- OCI consumption revenue was up 67% as “demand continues to dramatically outstrip supply,” Catz said, which is another factor in Oracle’s desire to rapidly build out many more cloud regions across the globe.

- GPU consumption revenue is up 3.5X from Q3 last year.

- Cloud database services were up 28% and now have annualized revenue of $2.3 billion.

- Autonomous Database consumption revenue was up 42%, a much faster growth rate from last year’s Q3 number of 32%. “So again, we have acceleration as we get bigger,” Catz said.

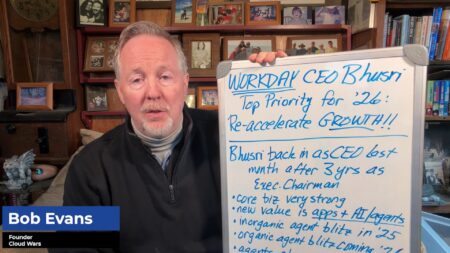

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Doubling Data-Center Capacity This Year

To accommodate that surging customer demand, Ellison said, Oracle plans to “double our data center capacity this calendar year.” said Oracle Chairman and CTO Larry Ellison in the company’s Q3-earnings press release.

“Our Database MultiCloud revenue from Microsoft, Google, and Amazon is up 92% in the last three months alone, and GPU consumption for AI training grew 244% in the last 12 months,” Ellison said in the release. “And we are seeing enormous demand for AI inferencing on our customers’ private data.”

Before posting this article, I was not able to determine from Oracle just how Ellison’s comment re: doubling data-center capacity by Dec. 31 correlates with the build-out of cloud regions. My guess — and I hope that it’s an educated guess, and not a completely uneducated bozo guess — is that Oracle will add about 15 new regions this year, and that the doubling in data-center capacity will be powered by the completion of a one or two of the massive “AI data centers” Ellison has been touting for the past few quarters.

Those facilities, he has said, will become the largest data centers on Earth and will, I believe, be the primary factors behind that doubling of capacity.

Final Thought

But back to the subject of cloud regions: Oracle’s commitment to not only maintaining but greatly expanding its lead in this wildly complex category was summed up forcefully by CEO Catz on the Q3 earnings call when she said this:

“We marked a milestone this quarter as we crossed into triple digits with our 101st cloud region coming online. It’s just a matter of time before we have more cloud regions than all of our competitors combined, reflecting the strategic advantage of our Gen 2 architecture, which offers our customers the most flexibility from a delivery standpoint.”

Safra Catz is not someone who tosses around prodigious claims like that lightly or unseriously —and while Oracle’s cloud-infrastructure business is without question much smaller than those of Microsoft, Google Cloud, and AWS, it is also growing much more rapidly and winning lots of customers that have chosen Oracle over those three powerhouses.

So clearly Catz and Ellison believe that distinct superiority in cloud regions is one of the ways for Oracle to maintain that hypergrowth here in the early days of the AI Revolution.

And to give you one more nugget in closing, consider this perspective offered by Catz on the earnings call about Oracle’s future plans for power consumption to handle all that growth.

“The growth of our power capacity under contract is even higher than the growth in the number of data centers, and we expect that our available power capacity will double this calendar year.

“And triple by the end of next fiscal year.”

Buckle up tight — the Cloud Wars are starting to get really serious!