Despite excellent Q1 cloud-revenue achievements from both Google Cloud and Amazon’s AWS, Microsoft’s first-quarter cloud revenue once again exceeded the comparable totals for Google Cloud and AWS.

Those 3 companies sit atop by weekly Cloud Wars Top 10 rankings, with Microsoft the longtime #1, Amazon and its AWS cloud unit the longtime #2, and Google Cloud jumping to the #3 spot at the beginning of this year, leapfrogging Salesforce, which is now #4.

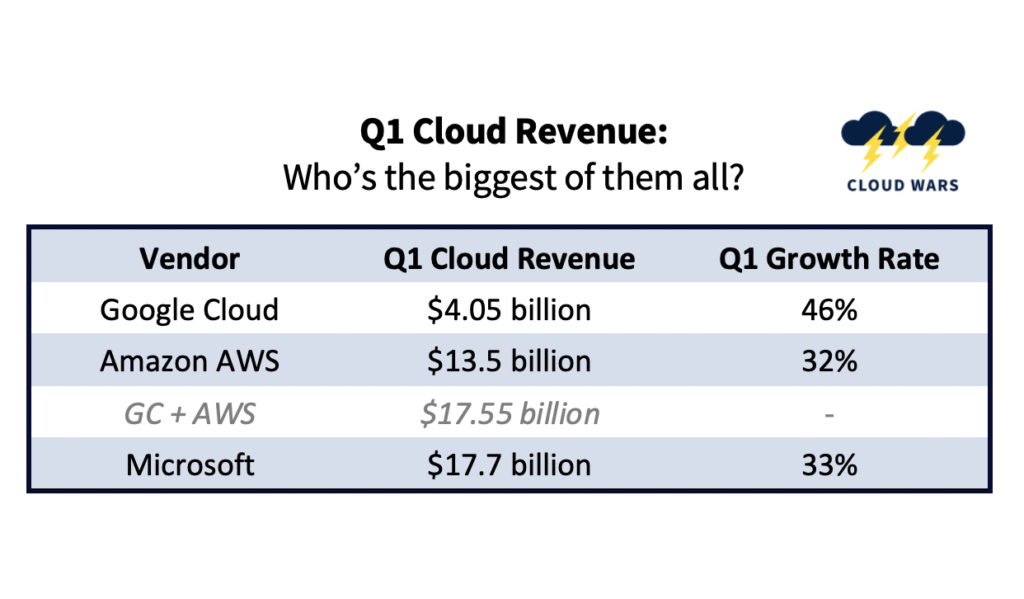

Google Cloud posted Q1 revenue of $4 billion, up a whopping 46%, while Amazon said AWS revenue jumped to $13.5 billion, up 32%.

Those are extremely impressive numbers for both companies, and it’s particularly noteworthy that in the first quarter, both Amazon and Google Cloud saw their growth rates increase, thereby pulling off the very rare feat of being able to accelerate growth even while getting significantly larger.

But in spite of those impressive performances, Microsoft’s cloud business remains larger than the combined cloud businesses of Google and Amazon, which total $17.5 billion.

For its fiscal Q3 ended March 31, Microsoft posted commercial-cloud revenue of $17.7 billion, up 33%.

So do these quirky math games really matter? And if so, why?

So do these quirky math games really matter? And if so, why?

I obviously believe these different looks at the revenue numbers matter or I wouldn’t have asked you to spend some of your valuable time looking at them. And here are some of the reasons why I feel this analysis is important:

- For years, we have all been told by the media and various “experts” that Amazon rules the cloud, and that it’s the “runaway” cloud leader with Microsoft futilely trying to play catchup. And for at least the past 3 years, those claims have been dead wrong.

- For years, cloud terminology was dictated by the tech industry, and the inside-the-bubble terms of IaaS, PaaS and SaaS defined how we were to look at the world. But it is now the business customers who are defining the cloud and setting the rules about what the cloud is and what they want it to be, and this is a very refreshing, welcome, and valuable change. Here in mid-2021, it is simply *absurd* for anyone remotely involved in the tech industry to try to claim that cloud = IaaS and nothing else.

- In the early days, cloud vendors sold services and technologies. But today, customers are demanding solutions that meet their specific needs, and have lost all interest in conversations centered on the 4-letter acronyms some backward-thinking salespeople are still trying to peddle. Along those same lines, I was always baffled how some analysts and plenty of media people would try to frame what the cloud is or isn’t by relying on some old fuddy-duddy definitions put out in 2011 by the National Institute of Standards and Technology. I have no quarrel with the NIST—fine outfit—but its relevance in shaping how modern businesses select, deploy and advance modern cloud solutions is nonexistent. Yet many “influencers” clung to it, and that type of close-minded and dogmatic thinking is precisely why you’ll still see plenty of people today say, “Amazon is the runaway leader in the cloud, because a lot of the stuff that Microsoft calls “cloud” isn’t really cloud.”

- Each cloud provider certainly has to make its own way in the world, but Microsoft is showing that great success can be had by offering tightly integrated solutions across not just the cloud stack but the entire enterprise-IT stack. The business needs and requirements of 2021 are wildly different than they were just a few years ago, and will no doubt continue to evolve rapidly. For Microsoft and its customers, the ability to offer an enormously wide range of integrated solutions has been a huge factor in its ability to drive a cloud business that is not just bigger than Amazon’s—but that is also bigger than Amazon’s and Google’s combined.

Final thought

Bear in mind that these are three of the biggest, wealthiest and most-influential corporations on Earth. Where they go, others often follow, whether by choice or by necessity. Look at their almost unfathomable market caps—and to underscore that, I’ll start with the “runt” of the group, Google: a market cap of $1.6 trillion. Then there’s Amazon, with a market cap of $1.75 trillion. And then, knocking at the door of a $2-trillion valuation, a threshold that only Apple has reached, comes Microsoft with a market cap of $1.9 trillion.

At the rate Google Cloud is growing, this might be the last quarter in which Microsoft’s cloud business is bigger than that of Google’s and Amazon’s combined. That trivial point aside, I think we would all do well to learn a powerful but simple lesson that Microsoft CEO Satya Nadella and CFO Amy Hood have expressed passionately many times in one form or another but that was best expressed 3 months ago in late January on their fiscal-Q2 earnings call.

Asked repeatedly by a couple of analysts about this product or that product, Nadella finally told the analyst, gently but firmly, that he’s looking at the question from a perspective that’s far too narrow and fails to take in the big picture. Here’s how I highlighted the high-level views of Nadella and Hood in a Jan. 28 analysis called Why Microsoft Just Posted the Greatest Quarter the Tech Industry’s Ever Seen. First Nadella:

So it’s a pretty important area for us with our participation in business-process applications coming on the Azure side, on the data side, on the AI side, on the biz apps side, as well as on Power Apps.” And then Nadella evangelized the need for the entire industry—vendors, analysts, partners, everyone—to stop seeing the tech business as it used to be and instead view it as it is becoming.

So it’s not one narrow category, because I think the way you measure business applications and the categories of business applications is pretty narrow. The business process is much broader than that.

And here is the equally compelling counterpoint from Hood:

And even the terms and categorization today that I find that define biz apps, I think, we’ll see are quite large and will be addressed not just with our Dynamics product portfolio, but partially with our LinkedIn portfolio, with our Power Platform portfolio, with Microsoft 365 as well as Azure.

Thinking about it holistically is why it’s so important for us and why we keep coming back to the commercial cloud as our frame. It’s how customers see the solution.

That’s the power and the promise of thinking about the cloud like customers do, rather than as the early tech industry and its assorted punditry would have us think: “It’s how customers see the solution.”

RECOMMENDED READING

The Industry Cloud Top 10: #1 Salesforce, #2 Google, #3 Oracle, #4 SAP

Oracle Vs. SAP: Like King Kong Vs. Godzilla, the ERP Battle Rages On

Has Oracle Climbed to #3 in Booming New Cloud Category?

IBM Cloud Bounces Back with Q1 Cloud Revenue up 18% to $6.5 Billion

Cloud Vendors Confront ‘Highest Risk’ Projects: Database Migration

Cloud Wars Top 10 2021 Revenue to Hit $241 Billion: Microsoft $75B, Amazon $60B, IBM $28B

Infor Leapfrogs Microsoft, Oracle, SAP: $1 Billion in Vertical Apps

Microsoft Versus Amazon: Who Will Be King of the Cloud for Q1?

Disclosure: at the time of this writing, Google Cloud was a client of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!