In announcing a stunning new partnership that conjures up “not until hell freezes over,” #1 cloud vendor Microsoft strengthens and extends its leadership position while #6 Oracle wins big new customer opportunities by setting aside its fierce independence.

This landmark agreement goes far beyond the standard tech-industry pair-ups of convenience precisely because of the companies involved. By aligning with a longtime competitor that almost never gives any quarter of any kind to any rival, Microsoft heightens the value it can offer to customers and the influence it wields as the world’s largest cloud vendor.

And lone-wolf Oracle gains not only a powerful partner but also a dramatically enhanced cloud-migration story to offer customers, one that includes tangible evidence that Oracle’s willing to adapt to the new realities of the multi-cloud marketplace.

Here are some thoughts on why this partnership is so striking, why it will likely trigger other cloud alliances, and why customers—as always—are the biggest winners in the Cloud Wars.

Microsoft-Oracle Partnership? Not Until Hell Freezes Over.

While Microsoft, the longtime #1 company in my Cloud Wars Top 10 rankings, is more than willing to compete savagely for business, it’s also shown under CEO Satya Nadella a great willingness to form partnerships that offer big benefits to customers. Look at its recent alignment with SAP that will include the opportunity for the Microsoft sales team to sell SAP’s crown-jewel cloud applications. Or consider its willingness to partner with Adobe in various situations. Or even its openness to connecting with arch-rival Amazon for Alexa-to-Cortana collaboration.

And then there’s Oracle, which, to my knowledge, has until now never been willing to enter into any type of significant partnership with any cloud vendor that might be a competitor. Since Oracle—like Microsoft—plays in all three layers of the cloud, that range of zero-collaboration candidates covers pretty much everyone.

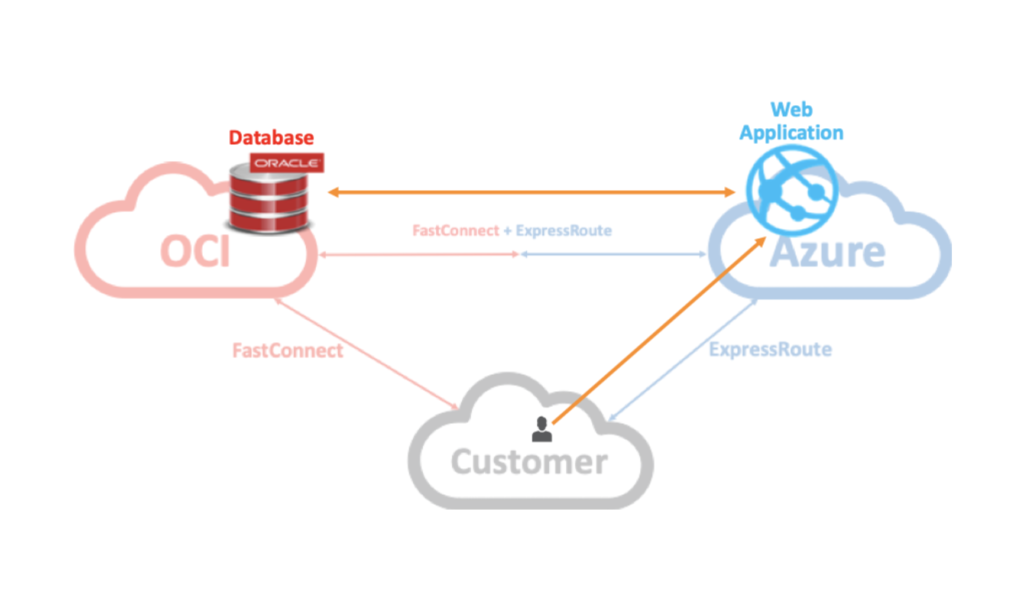

In the case of Microsoft, it’s clear that Nadella and team believe an alliance with Oracle will give them the opportunity to showcase the Oracle Database as a new part of what they can, in partnership, offer to customers. Recall that in a Bloomberg interview in September 2017, when asked what non-Microsoft product or technology he wished his company had, Nadella immediately named Oracle Database.

On top of that, of course, are the many essential multi-cloud technology components that each company is willing to support. But I believe the overwhelming attraction for Microsoft was the ability to pair up around the world’s leading data-management product and technology and its related pieces.

So what was the attraction, then for Oracle? Here are my theories:

- A desire and a need to accelerate the growth of its cloud business, where its performance has been solid, but has also begun falling behind rivals such as Microsoft, Amazon, Salesforce, SAP, Workday and possibly Google Cloud as well.

- The unstated but clear need to be perceived among customers as willing to put their needs and desires above its own go-it-alone mentality.

- The opportunity to be seen as a partner—and perhaps by some even as a peer?—with the world’s leading cloud provider, whose commercial-cloud business will blow past $40 billion this calendar year.

- The acknowledgement that customers are demanding multi-cloud capabilities from any and all cloud vendors wanting to continue to earn revenue from those businesses.

- And perhaps as well, the 2×4-across-the-face realization that what got Oracle here won’t necessarily get the company to where it needs to be in this wildly different world of customer-led, customer-centric digital business.

More Cloud Partnerships Will Follow Because Customers Are In Charge.

The Microsoft-SAP partnership to date has been the most striking, but we’ve also got to consider the “Embrace” program launched recently by SAP to optimize the ways customers can work with the sometimes-dizzying array of vendors they have to deal with. In the case of SAP Embrace, that could include not only SAP (#4 on the Cloud Wars Top 10) but also the various sales teams within SAP; the hyperscaler partners for IaaS such as Amazon, Microsoft and Google; integrator partners helping to pull it all together; and competing SaaS vendors whose apps have to be made to work with SAP’s.

SAP’s goal was to simplify that process for customers by having that ensemble of vendors work together *beforehand* to hammer out and present to the customer some optimal approaches, rather than behaving in silos and leaving the customer to tie it all together.

Google Cloud, #7 on the Cloud Wars Top 10, has also expressed, under new CEO Thomas Kurian, a strong desire to work in concert with other cloud vendors for the ultimate benefit of customers.

And #9 Accenture makes its living by creating and enhancing partnerships that ultimately drive greater benefit for customers, so I’d expect to see Accenture continue to be an innovator in this emerging multi-cloud environment.

Why Customers Are the Big Winners in this Microsoft-Oracle deal.

One of the IT nightmares that the cloud was expected to overcome was this: business customers would buy IT components from dozens or hundreds (thousands?) of vendors, and then be fully responsible for somehow making that mismatched stuff work together—something all those pieces were never intended to do. But customers are insisting that they want to run multi-cloud environments because that reflects the nature of their business and operations, as well as their desire to retain leverage and exert some control over their cloud suppliers.

Any vendor that chooses to fight that trend—and soon that will shift to any vendor that does not eagerly and actively support multi-cloud estates—will be consigned to the “Do Not Do Business With” list.

For customers, then, this high-profile alignment between two of the world’s most-successful and ubiquitous tech providers should be seen as a huge victory. And while that victory will initially be centered on what’s going on between Microsoft and Oracle—and for a high-level overview of that, I recommend this excellent overview by Oracle VP of product management Vinay Kumar—it will soon become the norm.

As cloud vendors mature, they’ll come to understand that customers care much more about the problems they’re trying to solve and the growth opportunities they’re trying to create than they do about what product or service any particular cloud vendor happens to have.

And as Microsoft and Oracle are showing with this partnership, the cloud vendors that take that new reality to heart will be—along with their customers—the biggest winners in the Cloud Wars.

Disclosure: at the time of this writing, Microsoft and Oracle were clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!