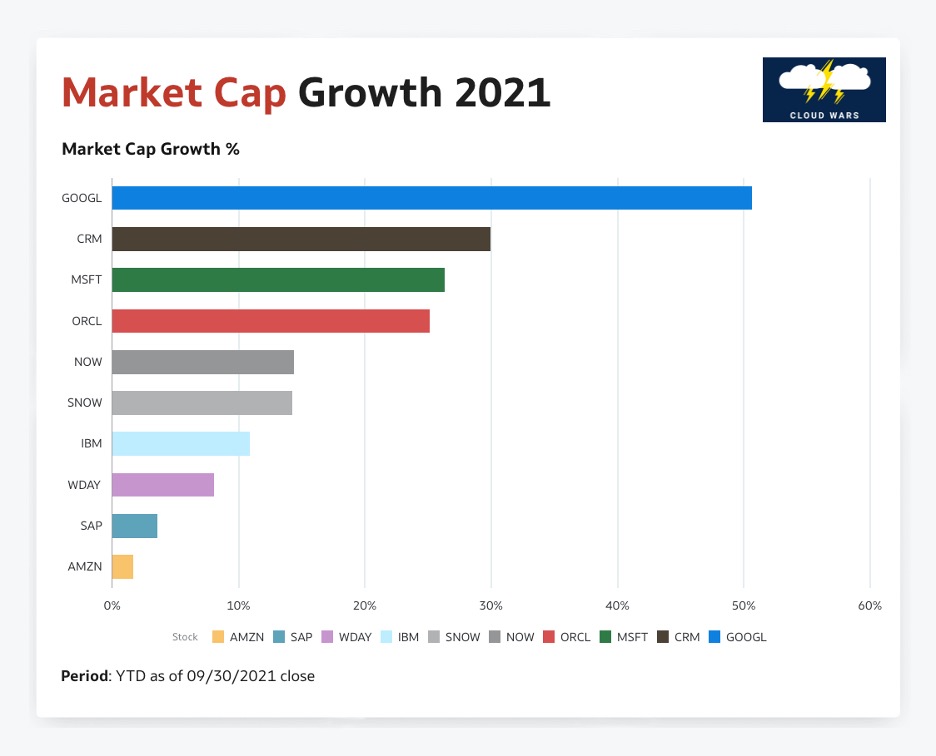

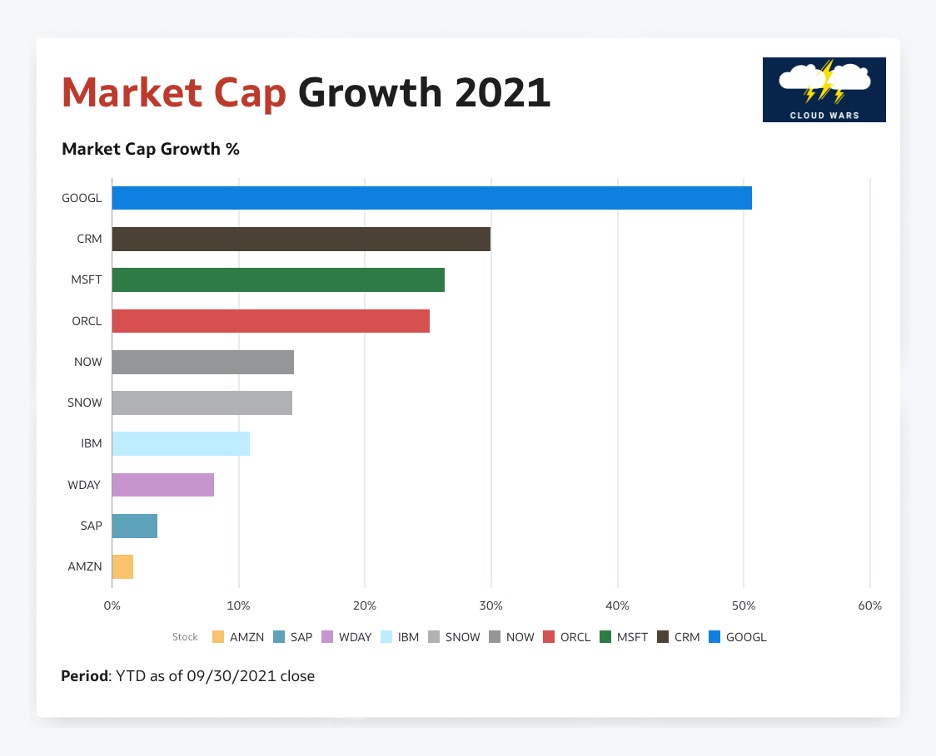

If tech-sector market caps are indications of future growth opportunities, then for the first 9 months of 2021 the investment community has been particularly bullish on Google, Salesforce, Microsoft and Oracle.

On my weekly Cloud Wars Top 10 rankings, Google is #3, Salesforce is #4, Microsoft is #1 and Oracle is #6.

As the nearby graphic indicates, the market cap for Google Cloud parent Alphabet has risen 52% YTD in 2021; Salesforce up 30%; Microsoft up 27%; and Oracle up 26%. (And I’d like to offer a big thank-you to Benjamin Arnulf, senior director of analytics product strategy at Oracle, whose excellent package of related graphics on LinkedIn inspired my idea for this article. Based on that work on LinkedIn, Benjamin at my request created this graphic on market-cap growth YTD 2021 for the Cloud Wars Top 10.)

So, why do these numbers matter to anyone other than investors? And since we don’t get into anything like giving stock advice on Cloud Wars, why am I covering this?

Well, it goes back to my catch-all line for the cloud industry: “the greatest growth market the world has ever known.” To us, the growth that matters is the revenue side for the cloud providers—current and potentially into the future—because that reveals at least some indication of where business buyers are looking.

It also gives us an idea about the purchasing power of the various cloud vendors, and which ones would have the big-time assets on hand to make an acquisition or two or three to fully exploit this opportunity in “the greatest growth market the world has ever known.”

In that context, here’s a quick recap of the market cap numbers for the Cloud Wars Top 10, and I’ll roll out the companies in the order in which they appear on my weekly rankings, not on their market cap since it is only one of the factors I use in setting those rankings.

- #1 Microsoft: $2.173 trillion

- #2 Amazon: $1.663 trillion

- #3 Google (Alphabet): $1.82 trillion

- #4 Salesforce: $269.5 billion

- #5 SAP: $160.4 billion

- #6 Oracle: $245.3 billion

- #7 ServiceNow: $125.4 billion

- #8 Workday: $63.13 billion

- #9 IBM: $128.5 billion

- #10 Snowflake: $91.39 billion

Of course, with Amazon and Google, these very large numbers cover vast corporations involved in much more than cloud computing. But the leaders of Google and Amazon have made it very clear that their high-growth cloud businesses are at the core of their strategies and are receiving significant investment dollars quarter after quarter.

To me, the surprising entrant in this YTD calibration of market-cap growth is Oracle. Google Cloud has had surging cloud revenue throughout 2021, with that growth rate actually rising even as the revenue base gets larger. Salesforce has been riding new highs in the wake of a great Q2 and the completion of its Slack acquisition. And Microsoft is, well, Microsoft.

But Oracle has quietly been building some momentum of its own, with cloud revenue now reaching an annualized run rate of $10 billion and high growth in both its infrastructure business with Autonomous Database and OCI Gen2, and in its SaaS business led by Fusion ERP.

With all of that going on, I expect that the revenue trajectory of the Cloud Wars Top 10 will continue to reflect “the greatest growth market the world has ever known.”

RECOMMENDED READING

Will Google Cloud and Tesla Torpedo the Insurance Industry?

Oracle Calls Out Salesforce Yet Again—Can Larry Ellison Succeed This Time?

Google Cloud President Rob Enslin: Touching Billions of People’s Lives

Google Cloud Just Introduced the Most Important Product of the Year

Database Wars: Oracle Attacks Amazon with High-Speed Upgrade

Microsoft Crushes Antiquated Business Model: Bravo!

RECENT PODCAST EPISODES

Oh My: Supply Chains Have Become Sexy! | Uphoff on Industry

Google Cloud’s Rob Enslin: Touching Billions of People

What CIOs Should Say to Boards of Directors | Sadin on Digital

The Fog of War: Data and Leadership | Anschuetz on Leadership

Disclosure: at the time of this writing, Microsoft, Google Cloud, Salesforce, SAP, Oracle, Workday and IBM were among the many clients of Cloud Wars Media and/or Evans Strategic Communications LLC.

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.