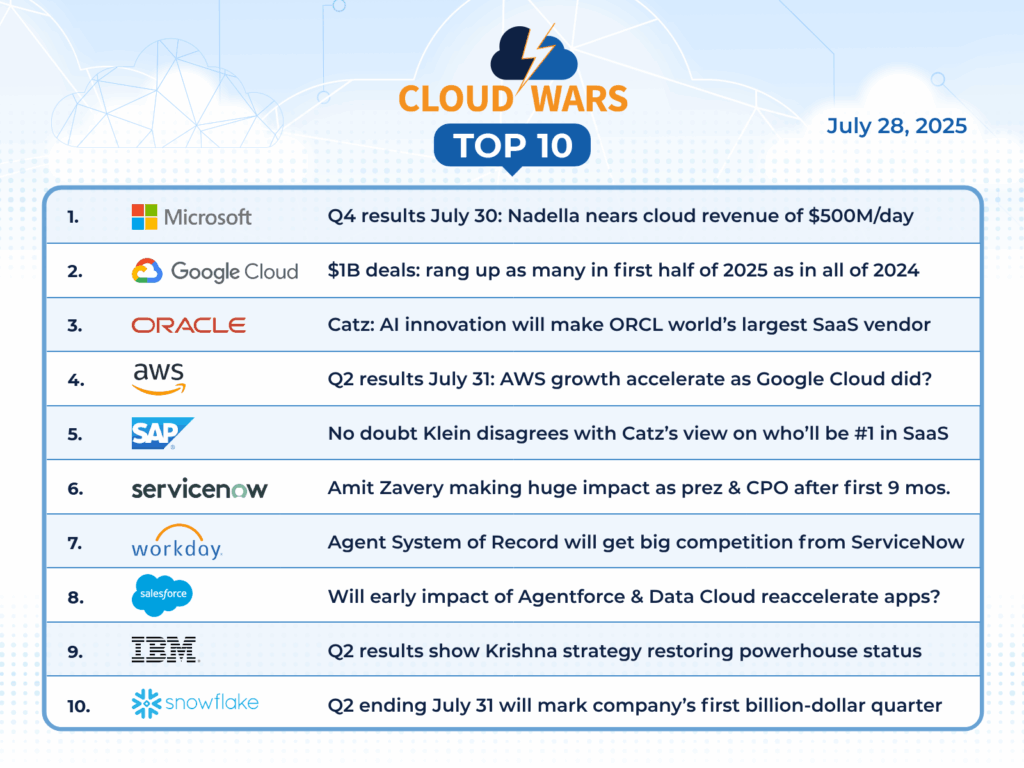

While Microsoft will no doubt post some impressive quarterly cloud and AI numbers later this week, Google Cloud’s booming Q2 growth surge in both revenue and backlog is surely triggering some restless nights for the company that’s been #1 on the Cloud Wars Top 10 for four years.

Before we get into my reasons for making that prediction, let’s deal with the issue of the significantly different sizes of the two cloud businesses. Yes, I’m fully aware that Microsoft’s cloud revenue is about 3.25X larger than Google Cloud’s — if Microsoft Cloud revenue reaches its expected growth rate of 20% for its fiscal Q4 ended June 30, then it will total $44.2 billion for the quarter. For the same three months, Google Cloud last week reported revenue of $13.6 billion.

However, with the AI Revolution in full swing, the dynamics within the Cloud Wars Top 10 are being dramatically expanded to include not only the traditional cloud segments and market opportunities but also the unprecedented economic boom that AI has triggered.

And while Microsoft has done a very credible job of weaving AI throughout its massive cloud portfolio, Google Cloud and its parent company have been AI-first from the day they were born. That pedigree, I believe, began to fully reveal itself for the first time in Google Cloud’s Q2 numbers — and I think we have every reason to believe that the enormous momentum Google Cloud harnessed for Q2 will continue for many, many quarters to come.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Let’s take a look at some of the key numbers that have generated that momentum for Google Cloud:

- Q2 revenue up a sparkling 32% to $13.6 billion

- Q2 backlog of $106 billion, up 38% year over year

- Relative to Q1, Q2 backlog was up 18%, showing very current momentum

- In the first half of 2025, signed as many billion-dollar deals as in all of 2024

- Doubled the number of $250 million-plus deals versus Q2 of 2024

- Added 28% more new customers in Q2, as it did in Q1

- 85,000 enterprise customers are now building with Gemini, up 35X versus Q2 a year ago

- Alphabet is pouring an additional $10 billion of CapEx into Google Cloud — pushing the total for 2025 to $85 billion — to build data-center capacity to meet explosive future and current customer demand

Final Thought

As I mentioned at the top, Microsoft will very likely post some impressive numbers later this week (July 30), and the always-eloquent Satya Nadella will no doubt gracefully articulate how his company is “taking share” everywhere.

But Nadella also no doubt remembers that there was a time when Microsoft’s cloud business was not nearly as large as that of AWS, and when AWS was assumed by many to be the once and future and permanent king of the cloud. And as Microsoft ultimately blew past AWS in innovation and then influence and ultimately in size — a phenomenon that I called pretty much before anyone else and hammered home relentlessly here at Cloud Wars — the old Latin saw about “sic transit gloria mundi” made the rounds more than once.

And my friends, that very same eternal reality — “thus passes the glory of the world” — that Microsoft not so long ago embraced warmly on the way up might very well today be the stuff of nightmares.

Because, to paraphrase that old bromide, “Sic transit gloria Cloud Wars.”