Setting a torrid pace in the greatest growth market the world has ever known, the Cloud Wars Top 10 vendors generated $60 billion in Q2 cloud revenue with #1 Microsoft, #2 Amazon, and #3 Google combining for $39 billion.

Of course, the big driver behind these very big numbers is the worldwide transition to digital business, which requires companies in every industry to reimagine not just their IT environments—heck, that might be the easy part—but also and more importantly their business models, revenue models, customer-engagement models, talent models, product development models, org structures, and much more.

Let me offer a colorful metaphor for the global cloud boom. Way back when I was in college and worked evenings in the sports department of the Pittsburgh Post-Gazette, a mischievous desk editor described a local athlete as “a hog on ice.” Puzzled, I asked him what he meant by that and he grinned and said, “Once a hog on ice gets moving, what in the hell’s gonna stop it?”

So the hog-on-ice phenomenon is in full swing, and other than a worldwide economic collapse, I can’t fathom anything that can slow it down. The cloud has clearly demonstrated that it:

- is the engine of digital transformation for every industry;

- allows businesses to shorten their time to value;

- accelerates the pace of innovation;

- enables companies to move at the speed of the markets around them; and

- most important of all, unleashes the power of imagination among business leaders who need to be willing to change anything and everything to meet the needs of the wildly fluid digital economy.

Against that backdrop, here’s how the individual companies within the Cloud Wars Top 10 contributed to that stunning total revenue figure of $60 billion. And please note that for the 4 companies whose fiscal quarters do not coincide with the calendar quarters, I have had to plug in estimates based on most-recent results.

- #1 Microsoft: $19.5 billion

- #2 Amazon: $14.8 billion

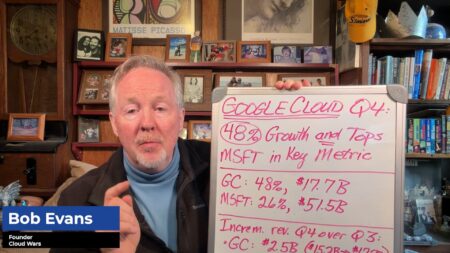

- #3 Google: $4.63 billion

- #4 Salesforce: $6.1 billion (estimated)

- #5 SAP: $2.7 billion

- #6 Oracle: $2.1 billion (estimated)

- #7 ServiceNow: $1.33 billion

- #8 Workday: $1.1 billion (estimated)

- #9 IBM: $7 billion

- #10 Snowflake: $250 million

- TOTAL: $59.5 billion

Final thoughts

In a recent issue of our weekly Cloud Wars Newsletter, we shared another intriguing perspective on the remarkable economic impact of the Cloud Wars Top 10 by digging into their overall valuations. And we found that the combined market cap of the Cloud Wars Top 10 companies as of about a week ago was $6.76 trillion.

And recall that in April, Amazon CEO Andy Jassy—who at the time was still CEO of AWS—said this: “Less than 5% of the global IT spend is in the cloud at this point. That’s going to substantially change in the coming years.”

Hog on ice, indeed!

RECOMMENDED READING

Infor and AWS: CloudSuite Vendor Bets the Company on Amazon R&D

ServiceNow CEO Bill McDermott Playing Dangerous Game w/ SAP, Oracle

Amazon-Workday Kerfuffle: Big Winners Are Workday and Google Cloud

SAP Slaps Back at Larry Ellison: ‘Hundreds’ of Q2 Wins Over Oracle

Microsoft Thumps Amazon by 31% in Q2 Cloud Revenue; Bigger than AWS + Google Cloud

Google Cloud Takes on AWS, Microsoft, Oracle, Snowflake in Databases: 5 Keys to Its Success

Google Becomes World’s Hottest Cloud Vendor with Q2 Blowout

How Google Cloud Is Deutsche Bank’s Innovation Engine: 15 Examples

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.