Not long after four of the world’s largest and most influential cloud providers announced layoffs totaling about 48,000 people, public confidence in the cloud as measured by market caps indicates a great deal of ongoing confidence in the future growth prospects.

I’ve created a simple “Cloud Confidence Index” outlining the numbers behind that premise, and I’ll share those in a moment in a handy-dandy table. But first, let’s think for a moment about what those layoffs represent and why it’s very likely that they can’t be viewed in the same light in which we’ve evaluated big layoffs in the past.

Those layoffs — Microsoft 10,000, Google 12,000, Amazon 18,000, and Salesforce about 8,000 —have triggered a lot of discussions based on the reasoning that those companies simply hired too many people during the pandemic to meet surging demand.

While that might be a contributing factor, I think that simply chalking up the loss of almost 50,000 jobs to overhiring during the pandemic is a gross oversimplification and masks deeper and more essential drivers that offer some vital clues about the fundamental nature of the digital-business world we’ve entered.

- Huge companies will need to reconstitute themselves rapidly and frequently. While layoffs have been around ever since a couple of hairy dudes swapped a bolt of wooly-mammoth hide for a couple of brontosaurus eggs — well, okay, maybe not quite that long — the business world has never witnessed the pace at which companies today must adapt, evolve, and transform to meet the new needs and demands of customers racing to keep pace with their fast-moving and fickle customers. That’s why we’re seeing all four of those companies mentioned above continuing to hire in strategic areas even as they eliminate jobs in other areas deemed to be too distant from dazzling customers or aligned with opportunities of the past.

- I think we’ll see big companies in every field — not just tech — go through these fairly frequent rebalancing of their workforces. It isn’t so much the number of people — although that certainly matters — as it is how closely and intimately those workers are aligned with customers: customer success, customer service, and customer engagement. As new products and services come into being more quickly than ever before, businesses will need to morph and reshape themselves almost on the fly — and unfortunately, a consequence will be more-frequent layoffs. But this new cycle will, at the same time, also mean lots of new hiring to meet new needs, new demands, and new opportunities.

- HR and HCM and culture and onboarding will become more strategic and more impactful than ever before. And this trend cuts both ways: an old-fashioned HR team, equipped with 5-year-old software, will be steamrolled by this new reality, while those focused on helping to build workforces connected to external market demand more intimately than ever before will thrive.

As we enter this new phase, I’ve decided to do a little morphing myself by transforming my long-running occasional series called “Market Cap Madness” to “Cloud Confidence Index.” The metrics I’ll offer will be similar, but I’m trying to evolve it to represent more of an outside-in view to reflect the stunning changes I’ve outlined above.

As I’ve said before, these pieces have nothing to do with stock picking or investment advice — rather, they’re simply an analysis of how the public’s behavior can be viewed as a very specific measure of its confidence in the growth potential of the cloud industry.

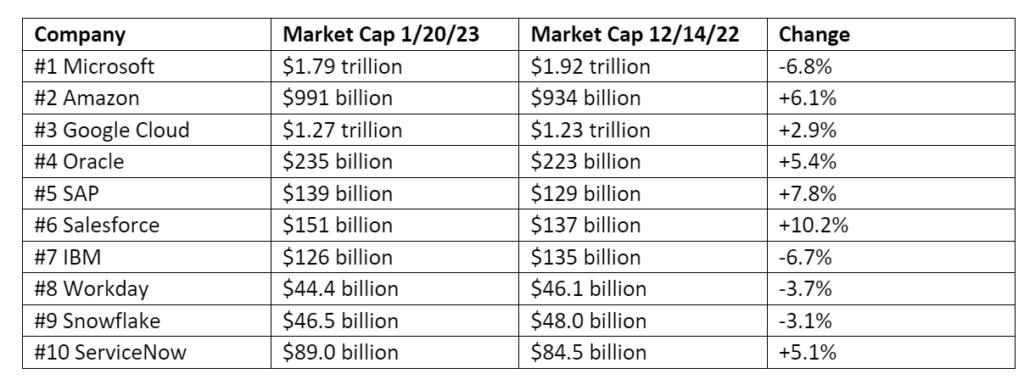

In the table below, you’ll see the market caps of the Cloud Wars Top 10 from late last week and also from about 5 weeks earlier, back in an era we could (but won’t) call The B.L. Era: “Before Layoffs.” You’ll also see that six of the 10 companies have seen their market caps go up over that period, including a very solid 10.1% jump from the company that kicked off this latest round of layoffs: Salesforce.

As will become very plain, I lay no claim to being a data scientist or a quant — two torturous bouts with calculus in college knocked my spine out of place — but I do think that amid the hysteria raised by the media about how these layoffs represent the demise of modern civilization and the free market, my simple little home-brew “Cloud Confidence Index” can help all of us get a better sense of what is in fact going on with the world-shaping companies of the Cloud Wars Top 10 and with the business customers who are the lifeblood of those tech firms.

In combination with my ongoing and thorough analyses of earnings results, and via special reports such as Cloud Wars Top 10 CEO Outlook 2023, our goal here at Acceleration Economy is to give you unique insights into the direction of the cloud industry, the health of its top players, and the shifting demands and requirements of the most important companies of all in this ongoing drama: the business customers deploying the cloud to become the digital enterprises of the future.

Over the next 10 days, we’ll all be getting lots more insights into this multifaceted situation as quarterly results are released for six of the Cloud Wars Top 10 companies: Microsoft, Amazon, Google, SAP, IBM, and ServiceNow.

I hope you enjoy the Cloud Confidence Index and our related work here at Cloud Wars, and I’d love to hear your feedback on LinkedIn via @bobevansIT.

CLOUD CONFIDENCE INDEX

For timely insights from Cloud Wars Founder Bob Evans and a roster of leading CXOs on the hows and whys of sustainability’s impact on business processes and profits, please join us for the Acceleration Economy Sustainability Impact Digital Summit on January 26, 2023. Register today for your free streaming pass here.