With its industry clouds growing significantly faster than its LOB clouds, Salesforce is making “huge” investments in its vertical-market solutions as it looks to put even more distance between itself at the top of the Industry Cloud Top 10 and #2 Oracle and #3 Google Cloud.

Saying that Salesforce’s customers “are increasingly focused on time to value and reducing their implementation costs,” co-CEO Bret Taylor said Salesforce’s 12 industry clouds deliver on both of those customer requirements and were “another bright spot” in the quarter ended July 31.

“The out-of-the-box industry processes we’ve built into our industry clouds are a compelling value proposition in this more measured by environment and I’m excited about the new processes we brought to market in the first half of the year, including trade-promotion management for Consumer Goods, and our virtual assistant for our Financial Services Cloud.”

Those new solutions give an indication of the deep and specific functionality being delivered in this red-hot part of the market, and Taylor said that Salesforce will continue to invest aggressively to meet the surging demand from customers for these purpose-built industry applications and solutions.

“You can think of our Industry Cloud as essentially taking the Customer 360 clouds — Sales, Service, Marketing, E-commerce, Tableau, MuleSoft, Slack — and building industry-specific processes and workflows that work right out of the box,” Taylor said on Salesforce’s FY23 Q2 earnings call late last month.

“There’s a lot of value for our customers. Number one is they don’t need to pay us or a professional-services firm to implement the table stakes for their digital transformation — it just works out of the box, which means they can focus their investment resources in the areas of their business that are differentiated,” Taylor said.

“It means they get faster time to value and it means that these processes are stickier, which is why our industry clouds have lower attrition rates than our line of business clouds.”

Lower attrition rates — very interesting. Given Salesforce’s ongoing success in a wickedly competitive market, I suspect its LOB attrition rates are pretty low, to begin with — and Taylor is saying that the industry clouds have been even more successful among customers.

With all those arrows pointing up, Salesforce is cranking up its investments in this dynamic new area, which I think will be, over the next 2 years, the hottest category within the greatest growth market the world has ever known.

Industry clouds have been “a huge area of growth for us,” Taylor said on the earnings call, highlighting Salesforce’s acquisition of Vlocity a couple of years ago. Continuing with the “huge” theme, Taylor said industry clouds are “a huge area of investment for us.”

Taylor also called out Salesforce chief product officer David Schmaier, who founded Vlocity and whose rapid rise to the head of product development indicates how strategic Salesforce believes industry clouds to be.

“It’s a huge part of our go-forward strategy,” Taylor said before asking a hypothetical question that powerfully underscores the company’s confidence in this vibrant new category: “If you have an option to buy one of our industry clouds, why wouldn’t you? They work right out of the box, and you’ll get faster time to value.”

He also addressed what business customers tell me are their biggest concerns about industry clouds: that the big cloud vendors need to make it absolutely seamless for customers to work across these purpose-built industry apps and the traditional horizontal apps those vendors have been offering for years.

“I think the thing that we do really uniquely though — and Marc [Benioff] alluded to it earlier — is it’s really all in one integrated platform. If you buy our Financial Services Cloud, you get all the capabilities of our Salesforce Cloud or our Service Cloud or our Customer Data Platform all in one integrated technology platform.”

That seamless integration and the resulting benefit it offers to businesses in these difficult economic times make the industry clouds even more appealing, Taylor said.

“That’s very unique in the industry and I think in this more measured buying environment, it will become even more important, although actually, it was important prior to this as well,” he said, referencing again Salesforce’s new-found “focus on delivering faster time to value to our customers.”

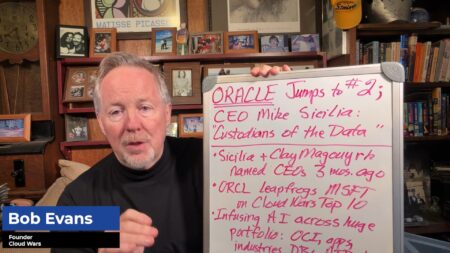

Later today, as Oracle releases its fiscal Q1 results, we’re likely to hear more about its aggressive industry strategies, and no doubt the intense rivalry Oracle and Salesforce have had over the past decade or more will only intensify.

As is always the case in the Cloud Wars, the big winners will be you — the customers.

Want to gain more insights from Bob Evans and view cloud-focused content from Cloud Wars Expo? On-demand video from the event is rolling out now, with more than 40 hours of cloud education content — featuring 100-plus speakers — to be made available in the coming days. All content is free to Acceleration Economy subscribers with an on-demand pass.