Welcome to the Cloud Wars Minute — your daily cloud news and commentary show. Each episode provides insights and perspectives around the “reimagination machine” that is the cloud.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

In today’s Cloud Wars Minute, I share the latest Cloud Wars Growth Chart.

Highlights

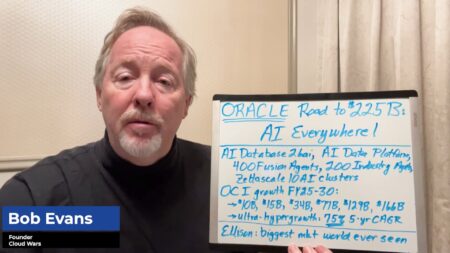

00:13 — Periodically, we do the Cloud Wars Top 10 Growth Chart. Again, this time, we see that Google Cloud is, without question, the fastest-growing major cloud vendor. We’ve got SAP coming in second, and ServiceNow in third. This is interesting because if you look at Google Cloud, SAP, and ServiceNow, they all serve very different parts of the market.

01:24 — Google Cloud’s again at the top, with a 35% growth rate in Q3 to $11.4 billion. If you go to the previous quarter, Q2, Google Cloud’s growth rate was 28.8%. So, from Q2 to Q3, it accelerated by a massive 6.2 points. SAP grew 25%, with cloud revenue of $4.8 billion. This has been very consistent for SAP. ServiceNow is now at 23%, with $2.7 billion.

02:38 —Fourth spot, Microsoft: 22%, again, a staggering quarterly revenue of almost $39 billion—much bigger than anybody else right now and carrying an impressive growth rate. Oracle is in the number five spot, with a 21% growth rate and $5.6 billion in revenue. The numbers are the numbers. There’s no way around that. 21% is fine. It’s not up near the top.

Ask Cloud Wars AI Agent about this analysis

03:40 — Number six, AWS, at 19%, with $27.5 billion — big, big numbers there. AWS retained that 19% growth rate that it had in Q2. So, it kept that very nice growth rate for a company that size. Workday is up 17% to $1.9 billion, and it is in a challenging market here against bigger competitors, but they continue to do very well.

04:16 — Now, IBM — it hasn’t broken out their cloud revenue for a while. So, I’m going by its Red Hat numbers: 14% growth. Arvind Krishna said that Red Hat now has an annualized run rate of $6.5 billion. So, I divided that by four, and you get about $1.63 billion. And in the sort of low spot, Salesforce, 8% growth on very large revenue, $9.33 billion.

05:00 — As I’ve said since I put together the growth charts, probably two and a half years ago, three years ago, until Snowflake’s revenue reaches a billion dollars a quarter, I’m going to keep it isolated at the bottom. Until it gets closer to a minimal size parity with the others, I’m going to keep it isolated. That 30% growth pushed its fiscal Q2 revenue to $829 million.