As the cloud becomes the most influential enterprise-technology platform in 2019, the mix among the top five cloud vendors of “cloud-native” hotshots and “legacy” veterans underscores not only the rapid rise of the hybrid cloud but also the end of any reasonable claim that the big traditional tech companies are not cloud companies.

In today’s digital-business world, there’s just no place for any tech vendor that can’t aggressively and effectively tie together the cloud and the vast estates of on-premises technology that continue to run the processes and operations of huge chunks of the global economy.

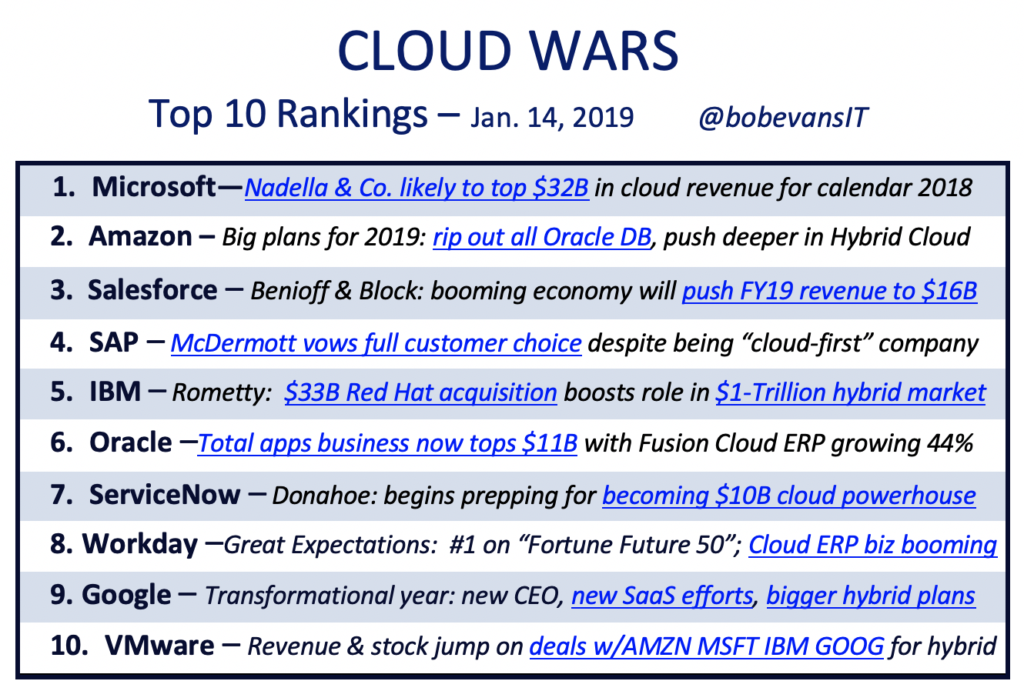

As a result, we can see that the tech veterans among the Top 5 vendors—Microsoft, SAP and IBM—all have wide-ranging and fast-growing cloud businesses to meet the emerging demands of business customers eager to exploit the cloud’s ability to accelerate innovation, enhance customer experience, and shift more tech spending toward growth initiatives.

And the born-in-the-cloud companies in the Top 5—Amazon and Salesforce—have each been aggressively expanding not only their cloud portfolios and capabilities but also the hybrid solutions to help customers balance their unique tech environments as needed.

1. Microsoft.

At the top of this list of five superb cloud vendors—and also atop my broader list of the Cloud Wars Top 10 rankings—is Microsoft, which is likely to top $32 billion in cloud revenue for calendar 2018 (it will announce quarterly earnings within the next 2 or 3 weeks). And here’s why I feel so strongly that it is Microsoft and not Amazon that rules the roost in the cloud:

- The sheer volume of its business and the fact that Microsoft’s commercial-cloud business is continuing to grow at more than 40%, with the Azure business’s growth rate topping 70%.

- The innovative and extensive set of solutions for “intelligent cloud” and “intelligent edge” that CEO Satya Nadella has driven.

- Its ability to deliver broad and deep cloud solutions across not only IaaS but also PaaS and SaaS.

- Its longtime and unwavering commitment to the hybrid cloud as the cornerstone of its cloud strategy.

- The ability to leverage the massive base of Office 365 users across the globe as an “on ramp” to Microsoft’s broader cloud services.

- A broad and deep commitment to cybersecurity from the edge to the core.

- Its incredibly deep, long-lasting and highly trusted relationships with and knowledge of the world’s largest corporations and how they work.

2. Amazon.

Maybe the best #2 competitor in any category, Amazon and its AWS cloud unit have become one of the world’s most innovative and influential tech companies. The undisputed category king in the cloud, Amazon has become a global phenomenon in the tech world and has made itself a highly trusted and valued partner to developers and the broader category of what it calls “builders.” In addition:

- Even as its annual revenue approaches $30 billion, Amazon’s AWS unit continues to grow at more than 40% per year.

- Amazon has boosted its hybrid capabilities with its new Outposts services that put AWS hardware inside customer data centers.

- In one of the most significant developments in the cloud in all of 2018, Amazon said that it is ripping all of its Oracle databases and replacing them with home-grown technology. If Amazon can demonstrate that its own databases can run its business without a hitch, that will open up a potentially huge new business opportunity for AWS.

- CEO Andy Jassy continues to make all the right moves as he’s got AWS near the top of mind among customers, dynamic new products and services coming out constantly, happy and in some cases fanatical customers, and an ability to generate huge profits in a business that some claim is a race to the bottom.

3. Salesforce.

No tech company has done more to evangelize the cloud, and no CEO has done more to make the cloud a global phenomenon than co-CEO Marc Benioff. Salesforce has been extraordinarily successful at helping global corporations embrace the cloud, allowing Benioff and company to create tens of thousands of customer-side advocates eager to tout the cloud’s capabilities. Here’s why I believe Salesforce richly deserves the #3 spot:

- Continuing to grow at 25% or better even as its revenue base has become huge, Salesforce expects to report revenue of $16 billion for its fiscal year beginning Feb. 1.

- From its acquisition of MuleSoft to its early and strong advocacy for AI via its Einstein technology to its creation of the compelling Customer Success Platform, Salesforce relentlessly innovates with new technology and new approaches for customers eager to become end-to-end digital businesses.

- Benioff has been leading the charge at Salesforce since launching the company 20 years ago, and with his bold move last year to promote Keith Block to co-CEO, the company now has additional strength and depth at the top help it keep pace with not only the demands of its customers but also the increasingly challenging requirements of being one of the world’s top technology companies.

- Its unquestionable success in key customer-facing categories: Sales Cloud, Marketing Cloud, Service Cloud, Commerce Cloud and more.

4. SAP.

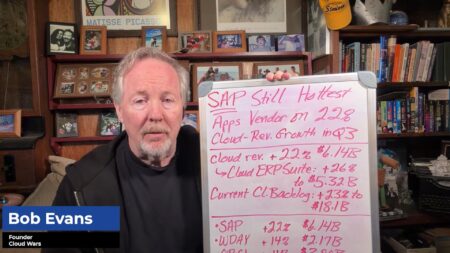

The world’s longtime leader in enterprise applications has big aspirations to parlay all that success in the cloud and beyond and has earned its lofty spot on this list by its aggressive strategy, strong cloud revenue growth rates, and innovative approaches to a fast-changing market including last year’s acquisition of Qualtrics. SAP is the #4 vendor on my list thanks to:

- Its unique power of incumbency: with its ERP applications helping run the operations of big global corporations in almost every industry, Bill McDermott’s company has huge opportunities to help big companies around the globe strike the right hybrid balance between the cloud and their entrenched on-premises apps.

- Growing at close to 40% last quarter, SAP’s cloud business continues to win favor among not only its existing customers but small and mid-sized businesses that have purchased any of SAP’s traditional products.

- SAP’s eager efforts to radically overhaul its iconic ERP products to meet the new demands of the digital economy that values killer algorithms as much or more than killer applications.

- In jumping aggressively into the CRM space 10 months ago in a very direct challenge to Salesforce, SAP is looking to redefine the way businesses perceive and use enterprise applications. SAP’s vision of CRM incorporates a sweeping view of ERP data and insights as well, allowing businesses for the first time to interconnect the previously fragmented realms of supply chain and demand chain.

- The Qualtrics acquisition is a further extension of that new view of the digital-business world, and also serves to validate the idea that SAP here in 2019 is a wildly different company than it was just 5 years ago.

5. IBM.

When IBM reports Q4 and full-year numbers on Thursday of this week, there’s a good chance its cloud revenue for the full year will come in at about $20 billion and make up almost a quarter of the company’s total revenue. IBM’s approach to the cloud is quite different than those of its competitors at the top of the cloud world, and it’s making some moves to further differentiate the value it generates for customers in 2019:

- The $33 billion acquisition of Red Hat will give IBM—a longtime advocate for the hybrid cloud—enhanced capabilities and credibility in that space, which CEO Ginni Rometty has called a “trillion-dollar opportunity.”

- IBM looks like it will be the first tech vendor to offer commercially available quantum-computing services, which it will do via the cloud in limited ways later in 2019.

- Leveraging its long and proud tradition of deep partnerships with the world’s largest corporations, IBM has created a unique set of cloud offerings—what I call its “cloud conversion business”—that help those large firms convert big chunks of their legacy systems into private clouds. That portion of its huge cloud portfolio should generate close to $7.5 billion in revenue for calendar 2018.

- While IBM lacks the “cool” factor of some other players in the Cloud Wars Top 10, IBM’s strengths in AI, cybersecurity, data management, integration, and multi-cloud management—not to mention its 90,000 cloud architects—give it the same type of “power of incumbency” that SAP and Microsoft can exploit in this wickedly competitive marketplace.

In conclusion.

The primary reason I launched the Cloud Wars series 2 years ago was the opportunity it afforded to track the profound ways in which the digital-business revolution is changing—and, I believe, enriching—every facet of our lives in extraordinary ways.

And while there are many tech companies making big contributions to that progress and innovation, these five clearly stand apart. We’ll keep a close eye on each—and on their competitors as well—to see if they can hold on to these hard-earned spots throughout what is sure to be a most interesting 2019.

Disclosure: At the time of this writing, SAP, IBM, and Oracle are clients of Evans Strategic Communications Inc.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!