(Latest in our series on the top challenges facing the Cloud Wars Top 10 in 2020.)

With Workday’s quarterly revenue getting awfully close to $1 billion, its demonstrated ability to win big HR deals within the world’s largest corporations has set it apart from primary rivals SAP and Oracle.

But the big challenge for Workday in 2020 will be this: can it hold and perhaps even extend that lead?

A few months ago, in a piece called Workday CEO: Oracle and SAP Can’t Match Us in Fortune 100, I offered this observation:

With half of the Fortune 100 having bought Workday HCM and 35 of those 50 customers in production, Workday CEO Aneel Bhusri said last week that Oracle and SAP just can’t cut it in competition for the world’s largest corporations.

These highly successful incursions into some of the world’s largest and most-influential corporations are enormously important for Workday as its competition with Oracle and SAP extends beyond HCM into financials, analytics, planning and more.

If Workday is able to establish secure beachheads within those global giants with its flagship HCM product line, it greatly increases the likelihood that it can convince those business customers to also take a look at its other product lines: Workday Financials, Prism Analytics, and Adaptive Insights Planning and Workday Cloud Platform.

In March, Workday will celebrate its 15th birthday. For much of its lifetime the company tried to glide along quietly under the radar of much-larger rivals Oracle and SAP.

But here in 2020, Workday’s clearly established itself as one of the premiere enterprise-software companies in the world, with customers whose loyalty to and affection for the company are legendary.

RECOMMENDED READING

Workday Says High-Flying Financials Business Will Surpass Flagship HCM

Machine Learning More Disruptive than Cloud, Says Workday CEO Aneel Bhusri

Workday CEO: Oracle and SAP Can’t Match Us in Fortune 100

As SAP, Oracle and ServiceNow Lose Leaders, Who Wins CEO Shuffle?

Archrivals Oracle and Workday Agree on One Thing: SaaS Market Booming

Workday Faces 3 Key Questions as $4-Billion Run Rate Looms

Workday’s Secret Weapon Has “Phenomenal” First Year

Oracle Will Dethrone SAP as World’s #1 ERP Vendor, Vows Larry Ellison

So can Workday hold or extend its leadership position in HCM in 2020? Its well-heeled rivals will strive mightily to prevent that, but Workday has some key factors in its favor:

- the customer loyalty noted above is priceless;

- the company’s broad and deep product set (also noted above) will appeal to big customers whose appetite for point-solutions is waning rapidly; and

- CEO Bhusri has become absolutely fanatical about ensuring Workday’s a world-class player in Machine Learning, a powerful capability that will be indispensable in the onrushing world of digital business.

In a recent exclusive interview I had with Bhusri, he explained the power of Workday’s intense focus on ML to drive new types of business value for customers. From that piece, headlined Exclusive 1:1 with Aneel Bhusri: Machine Learning Changes Everything:

In his own understated but high-impact way, Workday cofounder and CEO Aneel Bhusri has become one of the world’s most-bullish evangelists for the extraordinary power and potential of machine learning.

“We’ve always talked about predictive analytics but they’re now a reality—and it’s really a reality,” Bhusri said.

“It’s what we’ve dreamed about for a long time. But we never actually got there because the technologies weren’t there—but now they’re here.”

And Bhusri is making sure that Workday—which is on the verge of posting its first billion-dollar quarter—is at the forefront in giving corporate customers the full benefits of ML’s transformative capabilities.

Machine learning is just so profound, right? It’s impacting all of our lives in so many ways,” Bhusri said when I brought up his comment that ML will be even more disruptive than the cloud.

“Internally I described my role to the company as ‘the pied piper of machine learning,’” he said with a chuckle. “And I asked every employee in the company to buy the book Prediction Machines and charge it back to Workday because we all have to get comfortable with this new world and be able to succeed in it and be able to talk to our customers about it.”

Those customers and their loyalty could well be Workday’s most-valuable asset. So if Bhusri and company can maintain that loyalty as it continues to build out its product line and infuse it with customer-centric advanced technologies, Workday’s own “Pied Piper of ML” has a very good chance of keeping those Fortune 100 companies following Workday’s tune for some time to come.

Cloud Wars: Outlook 2020

The Top 10’s Biggest Challenges

| 1. Microsoft — Can it sustain a reputation for reliability for the Azure cloud? |

| 2. Amazon — Can it win vs. Oracle Autonomous DB? AND vs. Microsoft Azure? |

| 3. Salesforce — Can Marc Benioff win the battle to redefine CRM? |

| 4. SAP — Can it sell the marketplace on Experience Management / HXM? |

| 5. Oracle — Larry Ellison is talking a big talk—can Oracle back it up? |

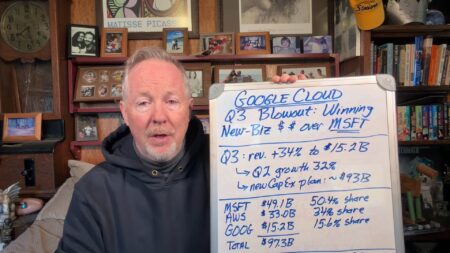

| 6. Google — Can it outflank Amazon through software skills and $$$? |

| 7. IBM — Can it catch up with the rest of the Top 10 in growth rate? |

| 8. Workday — Can it hold or expand its lead among Fortune 100? |

| 9. ServiceNow — coming soon |

| 10. TBD |

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!