Yes, Amazon’s AWS $10 billion in Q1 cloud revenue is probably 20X and perhaps 40X larger than Oracle’s.

Yes, AWS has been and remains the undisputed category king and reigning champ in public-cloud infrastructure, while Oracle only recently has pulled together a credible IaaS business after a series of rumblin’, bumblin’ and fumblin’ missteps.

Cloud Wars

Top 10 Rankings — May 11, 2020

| 1. Microsoft — Cloud revenue up 40% to $13.3 billion |

| 2. Amazon — As world surges to cloud, Jassy & team reach $10B in Q1 cloud rev |

| 3. Salesforce — Check out Marc Benioff: Extraordinary Ascendancy of a Global Leader |

| 4. Google — Remains growth leader as Q1 cloud revenue jumps 52% to $2.8 billion |

| 5. SAP — As co-CEO Morgan leaves, SAP, Oracle, Salesforce agree: co-CEO model dead |

| 6. Oracle — Ellison uses Zoom deal and Autonomous DB to position ‘next-gen’ IaaS |

| 7. IBM — New CEO Krishna lays out strategy to beat Microsoft, Amazon, Google |

| 8. Workday — Bhusri doubles down on commitment to employees as crisis intensifies |

| 9. ServiceNow — How the company is turning digital workflow into strategic enterprise apps |

| 10. Adobe — Digital Experience business up 24% to $859M in Q4 |

But now Oracle’s got Autonomous Database and has made it the centerpiece of its cloud-infrastructure strategy.

And now Oracle’s got a number of referenceable cloud-infrastructure customers. Customers that came on board in spite of what was surely intense competition from all three massive hyperscalers: Microsoft, Amazon, and Google.

And then last month, as video-conferencing high-flyer Zoom was facing a stupendous increase in daily meeting attendees, Zoom overlooked incumbent IaaS provider AWS as well as Microsoft and Google and picked Oracle to help it handle that extraordinary surge.

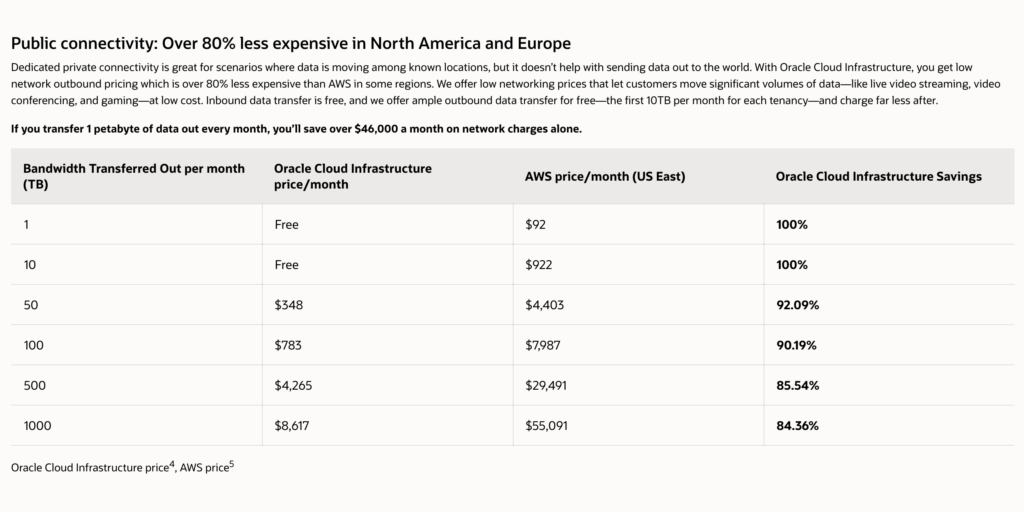

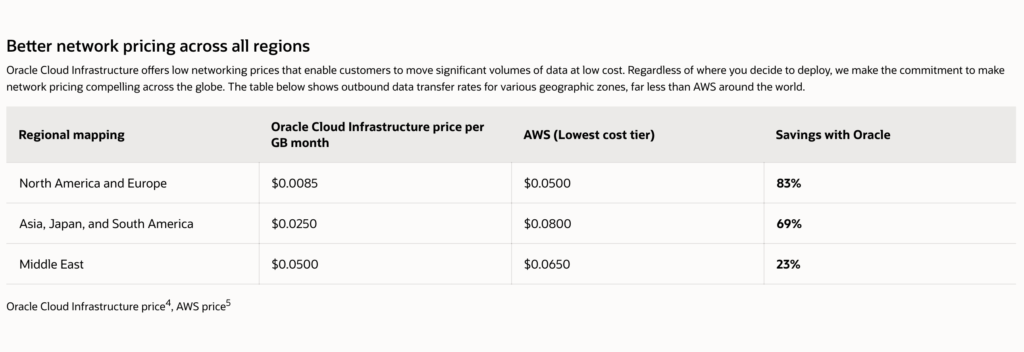

And this week comes word that another video-conferencing company—8×8—experiencing a hockey-stick spike in demand also bypassed incumbent AWS and the other two giants and picked Oracle to handle its video workloads as monthly users boomed by 100X. Oracle’s website says it simply offered 8×8 a combination of performance and price that AWS could not possibly match. From the site: “8×8 migrated its video meetings services from AWS to Oracle Cloud Infrastructure for a savings of more than 80 percent in network outbound costs, global reach, and substantial performance enhancements—experiencing more than a 25 percent increase in performance per node.”

I also want to note that an 8×8 executive said that while his company was heavily influenced by Oracle’s superiority in pricing and performance, he was also “blown away” by how easy it was to do business with Oracle and how quickly 8×8’s video workloads were up and running on OCI.

Mehdi Salour, 8×8’s senior VP of Global Networks and DevOps, said Oracle offered “incredible support” throughout their discussions and was “extremely engaged.”

Speaking on a conference call with analysts earlier this week, Salour said he had production video workloads up and running 4 days after the deal was signed.

And while 8×8 remains an AWS customer—as is the case with Zoom—Oracle’s cloud infrastructure is handling the huge and complex video workloads resulting from 8×8’s growth during the pandemic from 200,000 average monthly users to 20 million average monthly users.

Here are a couple of graphics that Oracle posted on its “Cloud Economics” page to demonstrate the stark differences between its prices and those of AWS. The first compares connectivity pricing, and the second network pricing.

Again, I fully understand that it will take many more such wins before anyone can credibly claim that the Oracle Cloud Infrastructure business belongs in the same class as those of the Big 3.

But in the Cloud Wars, the competitive dynamics are unlike other businesses. Because:

- the demand is so great,

- the opportunities are so vast,

- the technology is evolving at a staggering pace, and

- business customers know they are in a buyers’ market fed by savage competition.

And then there’s the Larry Ellison factor—and it would be a terrible mistake for anyone in the market to underestimate the significance of that element. For more than 50 years, the Oracle founder has been confronting existing and supposedly impregnable power structures, typically with great success.

Ellison has said that in the early days of his tech career, the prevailing wisdom was that IBM was the technology environment in which you competed, rather than against which you competed.

That “know your place” outlook clashed directly with Ellison’s outlook and personality. He set out to defy that rock-headed conventional wisdom and find a better way to deliver innovation and business value to corporate IT customers.

The result was the Oracle Database, a relational technology Ellison had read about in an IBM research paper describing a relational database as conceptually exciting but practically not feasible.

As a result, IBM’s once “untouchable” market share in the database segment is now a distant second or third to Oracle’s.

There are other examples—from enterprise applications to sailboat racing—and it’s clear that Ellison relishes the role of plucky but clearly outclassed underdog.

Two months ago, in Oracle’s most-recent quarterly earnings call, Ellison eagerly recited a list of big global companies that had chosen Oracle Cloud Infrastructure that quarter, with most having been heavily influenced by their desire to get the Oracle Autonomous Database. (You can read all about that in Larry Ellison Redefines Cloud as Oracle Autonomous Database Surges.)

Ellison then laid out what he believes is not only his vision—“it literally is the promise of the cloud”—but also the worst nightmare for his big cloud competitors. From that article:

And as Ellison described a couple unique features of his Gen 2 cloud infrastructure with the cloud-native Autonomous Database, it became harder and harder to separate where the database part ends and the infrastructure part begins. That is, no doubt, precisely what Ellison is intending.

“But another thing that people may not know about Autonomous Database is that it’s both serverless and elastic,” Ellison said on the call.

“When your application isn’t running on the Oracle Public Cloud, you don’t pay for any CPUs—you’ve got no CPUs dedicated to you and you’re not paying for servers. That is not true of Amazon databases. If you have Redshift, you pay for the right Redshift processors. If you have their MySQL implementation, you pay for those processors.

“But we’re not only serverless, we’re instantaneously elastic,” Ellison said. “So if you suddenly need to go from two servers or two cores to 20 cores, we do that instantaneously, while the database is still running. And then when you no longer need the 20 cores, we automatically go back to the two.

“So it literally is the promise of the cloud.”

Can Oracle keep this cloud momentum going, now that its OCI business is gaining visibility and will surely draw much more competitive attention from AWS, Microsoft and Google?

We’ll get our first clear indication in about a month when Oracle reports its fiscal-Q4 earnings in early June. Until then, who knows—maybe Larry Ellison will have cause to make another YouTube video or two.

RECOMMENDED READING

Larry Ellison Accelerates Zoom’s Boom with Huge Endorsement on YouTube

Can Larry Ellison Turn Zoom & Autonomous DB into Big-Time Oracle Cloud Revenue?

Larry Ellison Redefines Cloud as Oracle Autonomous Database Surges

Zoom Picks Oracle for Cloud Infrastructure; Larry Ellison’s First YouTube Video

Larry Ellison’s View: Oracle Whipping Workday, Kicking AWS, Sacking SAP

SAP Has Twice as Many Cloud ERP Customers as Oracle: Exclusive Co-CEO Interview

Disclosure: at the time of this writing, Oracle was among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!