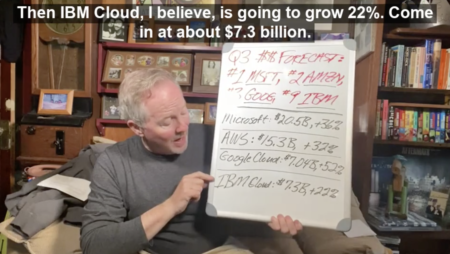

Bob Evans predicts that we’ll see $50 billion in Q3 cloud revenue from just 4 vendors, Microsoft, Amazon AWS, Google Cloud & IBM.

Cloud Revenue

My reaction to “Cloud’s trillion-dollar prize is up for grabs,” a McKinsey article from this year w/ some fascinating cloud research.

SAP CEO Christian Klein on the company’s Q2 earnings call claimed to have whipped longtime rival Oracle for hundreds of competitive wins.

Delivering an astonishing Q2, Google Cloud spiked its revenue by 54% and slashed its losses by 59%. Could it be the world’s #2 cloud vendor?

While SAP is rightfully proud that its S/4HANA Cloud ERP business jumped 39% in Q2, the competing product from Oracle grew at 46%.

With solid if unspectacular Q2 cloud revenue up 13% to $7 billion, IBM has pushed past Salesforce as the third-highest earner.

Google Cloud lost $5.61B in calendar 2020, but through revenue hypergrowth it is rapidly narrowing its losses and building momentum.

10 months ago, Salesforce had a market cap 40% higher than that of Oracle. Now, it’s 10% lower. What happened to impact these numbers?

Late this month we’ll find out if Google Cloud and Amazon (together) are finally able to best Microsoft in cloud revenue for Q2.

Calling Q4 “fantastic” and “incredible”, Oracle chief executive Safra Catz made a statement on the company’s recent earnings call.

Reveling in a blowout fiscal Q4, Oracle chairman Larry Ellison said Fusion ERP could ultimately hit $20B & NetSuite ERP $10B in revenue.

For Q1, Google + Amazon’s cloud revenues totaled $17.5 billion. Meanwhile, Microsoft posted Q1 cloud revenue of $17.7 billion, up 33%.

Microsoft will release Q1 (its fiscal-Q3) numbers later today, and I see no indications that its rising rate of cloud growth will taper off.

SAP CEO Christian Klein and Oracle chairman Larry Ellison have very different views of which company is winning the cloud ERP battle.

I expect that next week’s Q1 earnings results will provide additional support for the clear winner of the Microsoft versus Amazon battle.

Good news for IBM, which rebounds nicely from last quarter’s measly 8% growth in cloud revenue with strong Q1 results.

With every Top 10 company—particularly Google, Microsoft, SAP—declaring that industry clouds are a top priority, Salesforce has competition.

With Microsoft, Amazon and IBM generating $163 billion in 2021 cloud revenue together, the Cloud Wars leaders are raking in cash.

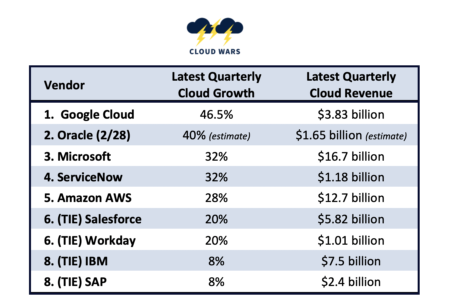

Assessing the world’s 9 most-influential cloud vendors’ growth rates, with Google Cloud’s 46.6% leading #2 Oracle and the rest.

On Oracle’s March 10 earnings call, CEO Safra Catz quietly offered 6 numbers indicating the best is yet to come for Oracle Cloud.