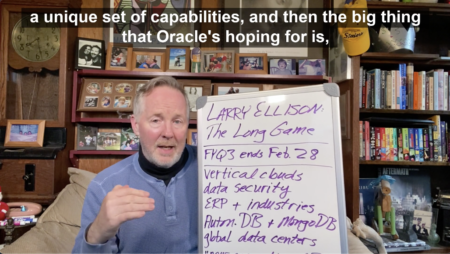

After Oracle delivered a blowout Q1, its founder Larry Ellison announced further plans to snatch customers from the infrastructure category.

Cloud Revenue

As Bob explains, Microsoft’s remarkable level of growth indicates that it is highly likely to reach $100 billion in cloud revenue by the end of the calendar year.

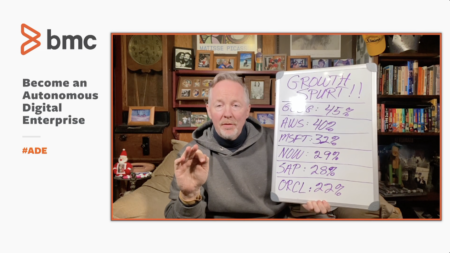

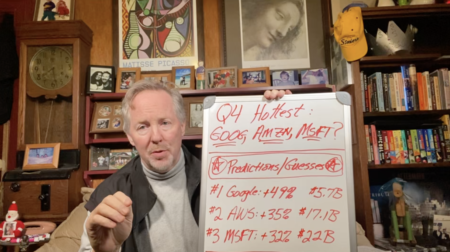

Bob shares his projections for the cloud revenue of leading providers on the Cloud Wars Top 10 for the quarter ending June 30.

Bob shares insights on data cloud juggernaut Snowflake FY22 Q4 earnings of $1.2 billion and what this means for Microsoft and Google

Industry clouds are creating tangible customer value for Salesforce, and have become a secret weapon indispensable to its future success.

The story of why Snowflake CEO Frank Slootman offered the unusual comment of, “This is not philanthropy.” on a recent earnings call.

Here’s why I expect Salesforce to reach $1 billion in industry-cloud revenue for fiscal Q4 to underscore its position

When Oracle announces Q3 earnings in March 2022, Bob expects we’ll hear some very surprising points of emphasis. Watch for his full preview.

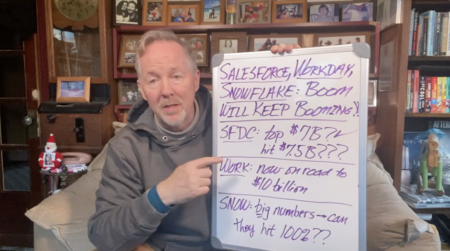

Bob shares some predictions and ideas about the forthcoming Q4 earnings results from Salesforce, Workday, and Snowflake.

Why I believe Salesforce, Snowflake & Workday will report powerful ongoing cloud growth numbers for their fiscal Q4 ended Jan. 31

Cloud revenue growth exploded across the Top 10 vendors in Q4, which conveys important truths about the present & future business world.

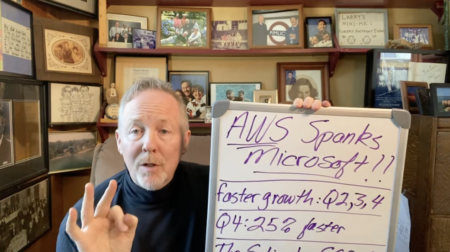

For the last 3 quarters, the growth rate for AWS jumped, and the company is now in hypergrowth range at 40%. How might Microsoft respond?

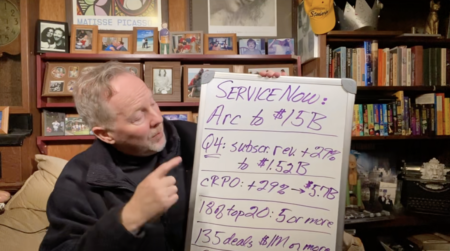

ServiceNow had a great quarter, as market forces are starting to support the company’s arc towards $15 billion in revenue.

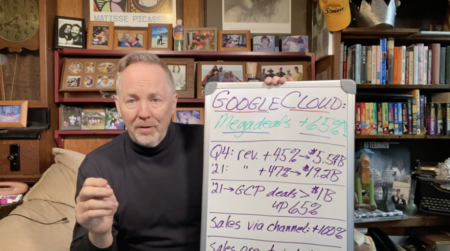

On the recent Alphabet earnings call, CEO Sundar Pichai said that Google Cloud’s $1-billion deals increased 65% year over year.

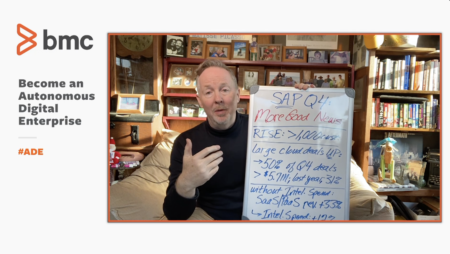

The good news from SAP continues! We learned on its Q4 earnings call that the game-changing RISE with SAP program now has 1,000+ customers.

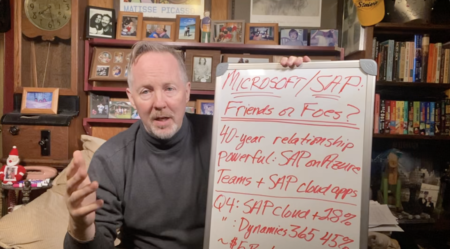

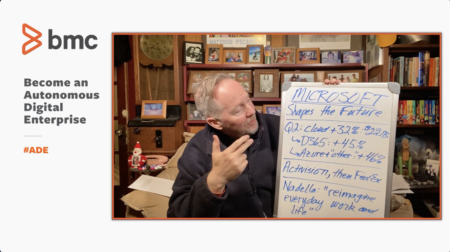

Microsoft D365 is the fastest growing set of enterprise apps. What does this mean for MSFT’s long-standing & productive partnership with SAP?

A set of eye-popping Q2 numbers that reveal the scale, depth and astonishing scope of growth for Microsoft under CEO Satya Nadella.

As Microsoft releases fiscal-Q2 earnings, CEO Satya Nadella declares intention to “help people reimagine everyday work and life.”

Microsoft is closing out 2021 with cloud revenue that should reach $22 billion for Q4 and $80 billion for the calendar year.

In Q4, who’s the hottest cloud vendor of them all? Can AWS best Microsoft in growth for another quarter? Let’s peer into the crystal ball.