Bob Evans offers cloud growth guidance for several of the Cloud Wars Top 10 companies, with Oracle, ServiceNow, and SAP being “most bullish.”

Cloud Revenue

Oracle’s CEO Safra Catz suggests that Oracle’s booming cloud business will grow 50% in the next quarter, after seeing 45% growth in Q3.

Oracle CEO Safra Catz projects 50% growth in cloud revenue in the next quarter, enabling the company to continue down the path of being the fastest-growing cloud provider.

Oracle’s cloud revenue for Q3 grew by 45%, making it the only company in the Cloud Wars Top 10 to achieve that upward trajectory during economic uncertainty.

Oracle continues to be the fastest-growing major cloud provider, with a recent Q3 growth rate of 45%, Bob Evans explains in this Cloud Wars Minute.

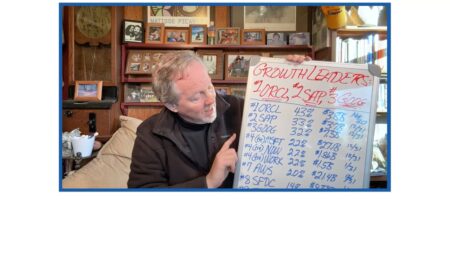

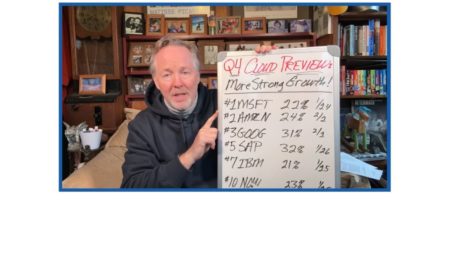

Oracle, SAP, and Google Cloud are the fastest-growing major cloud vendors in the world, explains Bob Evans, who reports Q4 earnings for the Top 10 companies.

Oracle, SAP, and Google Cloud have proven to be the fastest-growing major cloud providers in the world, explains Bob Evans in reviewing Q4 results.

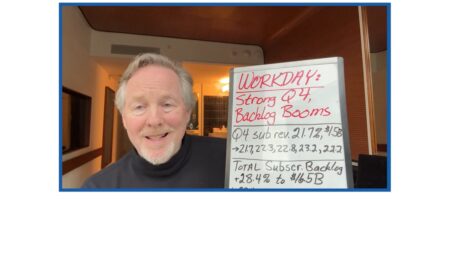

Bob Evans reviews the latest earnings results for Workday in Q4. The company saw a 25% jump in its total subscription backlog.

Bob Evans reviews Workday’s Q4 earnings results which highlight the company’s strong subscription growth rate and total subscription backlog.

Bob Evans details how Oracle is boosting its CapEx investment to about $10 billion to meet the surging demand for its cloud infrastructure services.

Bob Evans shares the Cloud Wars Top 10 growth chart and the related changes, after six of the Cloud Wars companies released their Q4 numbers.

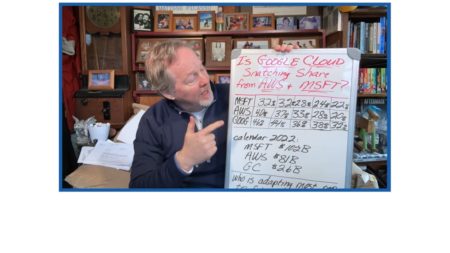

Bob Evans compares the growth rates for the last five quarters of Google Cloud, Microsoft, and AWS.

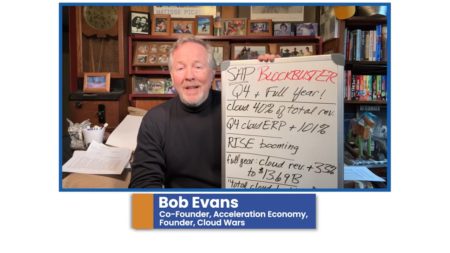

Bob Evans reviews SAP’s Q4 earnings, which indicates that cloud revenue accounts for 40% of the company’s total revenue.

SAP’s Q4 results show that the company’s cloud business now accounts for 40% of total revenue, writes Bob Evans.

Bob Evans reviews the fiscal earnings for Microsoft’s second quarter. The company is the first cloud vendor to top $100 billion in annual revenue.

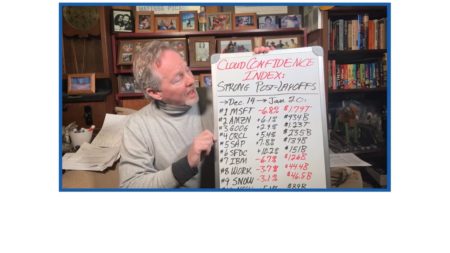

Bob Evans reviews the new Cloud Confidence Index, which replaces his Market Cap Madness series.

In his new Cloud Confidence Index, Bob Evans adds “a bit of analysis and perspective” into recent news around tech company layoffs.

Bob Evans offers his projections for the Q4 growth rates of the Cloud Wars Top 10 companies, which he expects will show strong, though reduced, growth.

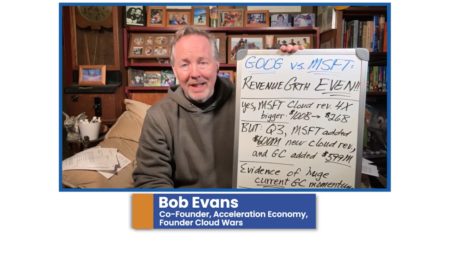

Bob Evans explores the potential Q4 revenue of both Google Cloud and Microsoft and wonders if the former, based on its impressive Q3 results, will come out ahead on the Cloud Wars Top 10.

Bob Evans looks at the reasons why he thinks Google Cloud’s soon-to-be-announced annual revenue growth will surpass that of Microsoft.