Larry Ellison also disclosed that the Oracle Gen2 Cloud Infrastructure (OCI) biz grew 100%+ in revenue on a recent earnings call.

Cloud Revenue

Look for Larry Ellison to come out swinging against major rivals during the March 10 Oracle Q3 earnings call.

Snowflake continued on its high-growth trajectory in Q4, with cloud revenue jumping 116% to $178M and overall revenue soaring 117% to $190M.

I’m puzzled by 3 comments Marc Benioff made on Salesforce’s recent Q4 earnings call. Read more from Cloud Wars.

Microsoft has reported that that its “remaining performance obligation” (RPO) for cloud reached a total of $112 billion, up 24%.

Gartner: 75% of all databases will be deployed or migrated to a cloud platform by 2022. Subscribe to the new Cloud Database Report.

When fiscal Q4 earnings come out on February 25, we’ll be watching to see if the Salesforce growth rate gets back up above 20%.

On the Jan. 27 earnings call, Satya Nadella casually mention that Microsoft’s security business did more than $10 billion in revenue in 2020.

A deeper look into the numbers and marketplace dynamics shows that the $5.6 billion Google Cloud lost actually reflects a strong performance.

Amazon’s AWS cloud unit had an excellent year with revenue of $45.4B, but Microsoft blew past that w/ 2020 commercial cloud revenue of $59.5B.

Google Cloud Q4 growth happened far more rapidly than any other cloud provider, but that’s not because the others were slacking.

Extending its year-long run as the world’s fastest-growing major cloud vendor, Google Cloud Q4 revenue soared to $3.83 billion.

During the Microsoft fiscal Q2 earnings call, Satya Nadella and Amy Hood revealed how Microsoft has become the world’s #1 cloud provider.

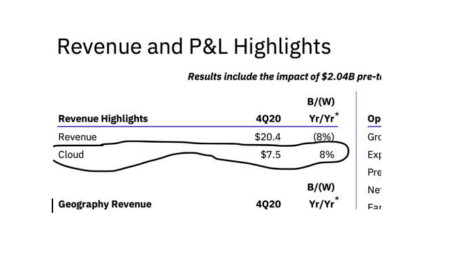

Q4 financials from IBM show a cloud growth rate of 8%. In the competitive cloud industry, this means they are rapidly falling behind the leaders.

The cloud database market is being upended by a new breed of providers, led by Snowflake but there are many others.

The true indicator of the full potential of Snowflake is its 240% growth rate for contracted future commitments from customers.

For cloud vendors, the battle for supremacy in industry-specific clouds will be the most intense due to the massive future revenue potential.

Despite being the core of the greatest growth market the tech industry has ever known, cloud vendors face significant challenges.

Walmart, Accenture, UPS and GE all went live on Workday HCM in Q3, with those 4 companies representing almost 3 million new users.

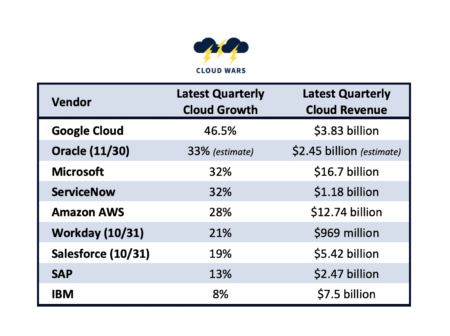

The three vendors whose cloud revenue is growing most rapidly are Google at 44.8%, Oracle 33% (estimated), and Microsoft 31%.