I believe that the SAP challenge to Salesforce for CRM leadership prompted Marc Benioff to develop and/or accelerate his customer-experience vision.

Search Results: sales (2354)

The vibrancy of the dynamic SaaS segment is on full display in new customer-centric initiatives from Cloud Wars leaders Salesforce and Workday.

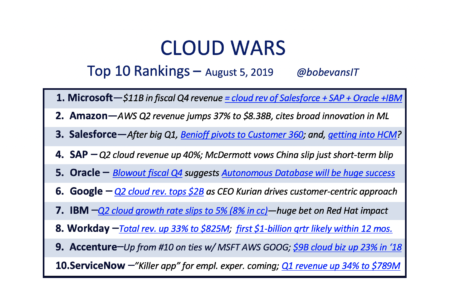

Sparked by CEO Thomas Kurian’s customer-centric leadership, Google Cloud has moved up to #6 in the Cloud Wars Top 10 on the strength of its recent $2B Q.

Microsoft just announced $11 billion quarterly cloud revenue, besting the combined totals of Salesforce, SAP, Oracle and IBM.

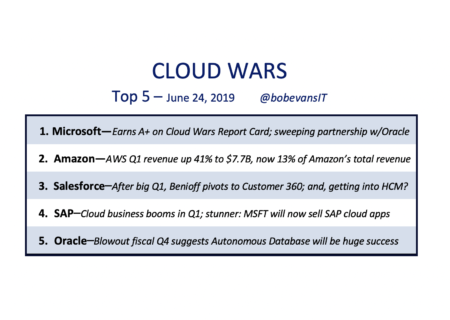

Five vendors stand out in today’s Cloud Wars: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, and a new addition to list: #5 Oracle.

As business customers demand easy-to-use and modern data solutions, a new arms race is developing among the Cloud Wars Top 10 to answer those demands.

According to Gartner data, Salesforce racked up 2018 CRM market share of 19.5% in 2018—while the combined share for SAP, Oracle and Adobe was 18.9%.

At the recent Bank of America Merril Lynch Global Technology Conference, IBM sales exec Martin Schroeter said of cloud: “everyone is thinking about it.”

Google Cloud and Salesforce each announced multi-billion dollar acquisitions about 72 hours apart. Here’s what’s behind the Looker and Tableau deals.

There’s little chance that Salesforce is getting into HCM, but after a week of stunning announcements in Cloud Wars, it’s probably best to never say never.

As the digital-transformation phenomenon shifts from boardroom theory to full-blown execution, Salesforce is doubling down on its Customer 360 strategy.

SAP on its own and Microsoft and Adobe together look to turn the CRM marketplace upside-down and position Salesforce as a behind-the-times “legacy” vendor.

It’s interesting to speculate about how three of the world’s top enterprise SaaS companies will respond to SAP and what I’m calling The Qualtrics Effect.

The Salesforce Q4 2018 earnings call revealed that the company is somehow managing to scale up an scale out in multiple dimensions simultaneously.

At the recent Goldman Sachs conference, Marc Benioff used his time to focus on CEO responsibility for social and cultural issues. Read my reaction.

The Cloud Wars CEO priorities offer an intriguing picture of where those companies’ customers—the world’s leading businesses—are headed.

My list of the world’s top 5 cloud vendors, including both cloud-natives and “legacy” veterans, and what they’ve done to earn the lofty spots.

Salesforce, SAP, and Oracle’s CRM battle will continue to escalate in 2019. Read why Salesforce is in a great position to dominate the race.

Predictions for how the Cloud Wars 2018 revenue leaders will finish the year, with a focus on the revenue of leaders Microsoft, Amazon, IBM, and Salesforce.

The cloud’s ability to completely revolutionize customer engagement & experience is the dominant topic for CEOs of many leading vendors in the Cloud Wars.