On this episode: Tony Uphoff says we’re in “a whole new era,” a high-tech industrial revolution, in the world of products.

Delivering an astonishing Q2, Google Cloud spiked its revenue by 54% and slashed its losses by 59%. Could it be the world’s #2 cloud vendor?

“We certainly play an advisory role but also… a challenging role.” – Seidor MENA managing director Ignacio Ruiz de Eguilaz

Accelerating Supply Chain Transformation with Microsoft Dynamics 365 and Logan Consulting

Founded in 1992, Logan Consulting focuses serving clients through consultations. Supporting clients in North America and availability to serve worldwide,…

In this Acceleration Economy News Desk interview, Bridget Courneya has a discussion with Romi Mahajan. He is the Chief Marketing Officer…

In this podcast episode, Christopher Lochhead introduces us to the concept of “native digitals” and how they’re overhauling the U.S. economy.

When governments began imposing lockdowns to stop the spread of Covid-19, millions of people found themselves behind closed doors. Sometimes,…

Business Challenge – Digital Transformation Founded in 1989, Sovereign is one of the most significant housing associations in the United…

Morgan Jonsson shares the evolution of SignUp Software and the benefits of selecting an ERP inclusive AP Automation solution vs. an ERP agnostic solution.

Seidor MENA managing dir. Ignacio Ruiz de Eguilaz & sales dir. Tariq Laham talk speed, Seidor’s value to customers and more. [Sponsored]

Elevated digital expectations to persist well beyond the pandemic Throughout the pandemic, people became more reliant on digital experiences than…

Based in the United States, Pattern Energy is an independent renewable energy business. The company aims to find new possibilities…

Search engine optimization (SEO) continues to be a daily challenge for many companies. Having a diversified approach to SEO creates stability when faced with disruptions in various markets and industries.

Today’s modern workplace is heavily data-driven. All of this information is at the core of most business strategies. Data makes…

Business Challenge – Staying Ahead of Demand As a leading global online marketplace, Etsy has more than 2.8 million sellers…

While SAP is rightfully proud that its S/4HANA Cloud ERP business jumped 39% in Q2, the competing product from Oracle grew at 46%.

Tom Mescall and Lori Colvin share about DataVue: Armanino’s unique approach to helping customers scale business and improve operational efficiency.

Creating a positive customer experience is critical in boosting your sales. Many customers are willing to pay more for a…

Business Challenge – Staying Efficient Plymouth Inc. is a third-generation company supplying customers with high-quality meat products at affordable prices…

Podcast: Industry Impacts – Are New Tech Innovations Serving the Food and Beverage Industry?

We all impact the Food and Beverage industry in our own way as consumers or directly working in the industry. But, how did tech impact the industry?

With ransomware, cybersecurity and digital transformation in the news, I talk with Wayne Sadin about the current CIO agenda and more.

Technology is ever advancing and so are the cyber threats. Therefore, security is so important to your business and its…

Business Challenge – Security Development As a publicly-traded company, Pattern Energy Group focuses on serving clients, protecting the environment, and…

Stream a new podcast episode from Cloud Wars Live, for a conversation about the strategic adoption of the customer’s point of view.

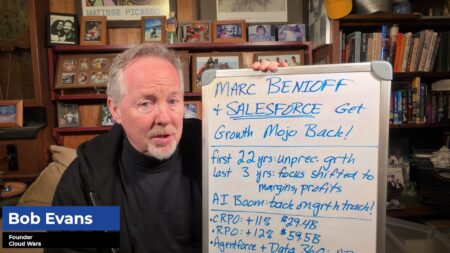

With solid if unspectacular Q2 cloud revenue up 13% to $7 billion, IBM has pushed past Salesforce as the third-highest earner.

Explore the benefits of embracing Machine Learning and Artificial Intelligence to gain a competitive edge over other businesses.

AI Copilot Podcast

AI Agent & Copilot Podcast: Avanade Exec on Security Data Storage, Integration Advances in Microsoft Sentinel

Sentinel Data Lake provides important data storage and management improvements; universal connectors facilitate integration of third-party data such as SAP, Jason Revill says.