Ensuring that its stunning growth and surging relevance has only just begun, the cloud industry is warmly embracing hybrid computing—the fusion of traditional on-premises technology with the cloud—with Microsoft, IBM and Amazon leading the way in recognizing that business reality outranks whiz-bang new technologies.

Because as impressive and disruptive as public-cloud infrastructure undoubtedly is, the simple truth is that most large businesses will continue to depend heavily on their on-premises technology for at least 5 more years and more likely the next decade because it’s the best option for their requirements.

And the leading cloud vendors are all recognizing that reality and rapidly rolling out a wide range of hybrid services and technologies designed to match the business reality mandating that cloud and on-premises solutions work together seamlessly and productively.

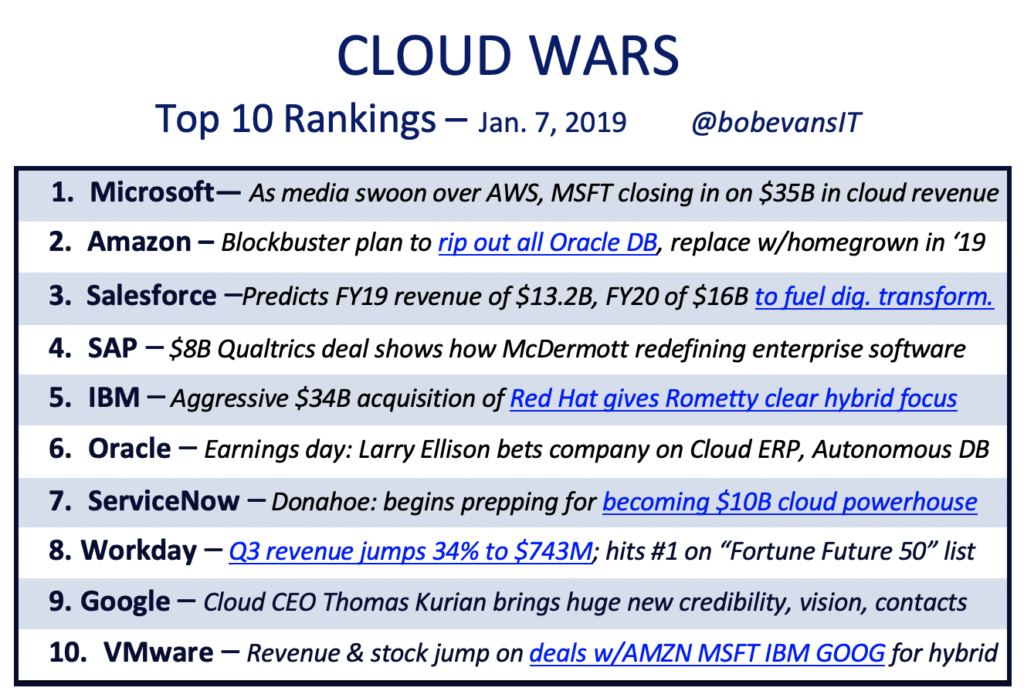

As I see it, the three vendors in my Cloud Wars Top 10 rankings that have had the biggest influence in triggering the coming hybrid wave are #1 Microsoft, #5 IBM and #2 Amazon. In addition, Oracle, SAP and Google Cloud have also been major factors in this vital paradigm shift, so this 2-part series will take a look at how each of those six vendors is making hybrid the new standard in enterprise computing.

Today in Part 1, we’ll look at where Microsoft, IBM and Amazon stand on hybrid; and tomorrow, we’ll examine the hybrid strategies of Oracle, SAP and Google Cloud.

And as you look at those six companies, it’s striking to see the blend of traditional tech giants (Microsoft, IBM, SAP and Oracle) with younger cloud-natives Amazon and Google Cloud, with that mix being a clear indicator that this hybrid surge is not a fad or a sign of retreat, but is instead the best way forward for this rapidly evolving industry.

1. Microsoft.

More than a year ago, CEO Satya Nadella was unmistakably evangelizing hybrid as a primary differentiator in Microsoft’s strategy precisely because it maps to the real-world needs of customers. On a quarterly earnings call with analysts late in 2017, here’s how Nadella framed his company’s approach to the future of computing—and notice that he put hybrid at the very top of his list of issues impacting the sweeping “digital estates” of businesses today.

“We have been focused on addressing the real-world needs of customers with our differentiated approach to the cloud – architecting for hybrid consistency, developer productivity, AI capabilities, and trusted security and compliance,” Nadella said in his opening remarks on that earnings call.

“Moreover, customers are choosing the Microsoft Cloud for its operational consistency, productivity and security that spans the entire digital estate, including Windows 10 cloud security and management, Dynamics 365, Enterprise Mobility & Security, and Azure.”

Nadella has also framed the cloud/on-premises continuum as being indispensable in modern business. In the Q&A portion of that same earnings call, Nadella said, “We don’t think of our servers as distinct from our cloud. In other words, this intelligent cloud and the intelligent edge is the architectural pattern for which we are building. Whether it’s SQL Server 2017 or it’s Windows Server, or the container service, everything that we do assumes the distributed computing will actually remain distributed.”

In comments to analysts and investors about Microsoft’s strategy and approach, CFO Amy Hood has also repeatedly underscored Microsoft’s commitment to being agnostic about customer choices of on-premises or cloud, and to ensuring that both approaches can work together harmoniously.

Speaking at an investors conference about a year ago, Hood said, “A really important thing for us is continuing to focus on creating customer value. The concept of adding a lot of value by giving comfort to the customers that as they make a commitment to the Microsoft platform they can move between a commitment to on-prem to the cloud in a high value way—I believe that’s a unique thing that we offer at this time.”

Executive VP Scott Guthrie underscored those hybrid-centric themes in a blog post about 16 months ago that contained these comments:

“While the vast majority of organizations have moved to a cloud-first technology strategy, most are still early on realizing this strategy due to a number of aspects from technology complexity to evolving regulations,” Guthrie wrote. “Over the past year, the Microsoft Azure team has explicitly focused on removing all barriers for enterprise customers, so that even the most complex technology and policy requirements are uniquely met with Azure.”

He later added, “We uniquely understand that a distributed hybrid cloud model is the durable cloud model. And, we uniquely understand that hybrid cloud is more than just infrastructure – it must address your entire environment.”

2. IBM

No company on Earth understands deep corporate technology or has more experience working with it than IBM, and CEO Ginni Rometty is taking steps to ensure that expertise—both old and new—is leveraged aggressively in the emergent world of the hybrid cloud.

On the “old” side, part of IBM’s huge cloud business (it will probably total close to $20 billion for calendar 2018 when IBM releases its earnings later this month) is what I call its “cloud conversion business” that helps clients transform legacy technologies into private-cloud environments. That business, which IBM rarely talks about publicly, will probably generate revenue of more than $7 billion in 2018 and is predicated squarely on the hybrid strategy.

And on the “new” side, there’s IBM’s blockbuster $33-billion acquisition of Red Hat a few months ago. When the deal was announced, Rometty called hybrid cloud “an emerging $1-trillion market” and said IBM plus Red Hat would be uniquely qualified to deliver to customers the flexibility and continuity that hybrid promises.

At the time, here’s how I described the significance of the deal for IBM’s future and its aspirations in the cloud:

IBM’s blockbuster acquisition of Red Hat for $33.4 billion to create a hybrid-cloud powerhouse signals a massive shift in the cloud-computing industry away from vendor-driven technology-first approaches and toward a customer-centric model that offers C-level execs strategic and high-value digital-business capabilities.

Just as Henry Ford is rumored to have said more than 100 years ago that car-buyers can have any color they want as long as it’s black, too many cloud providers in today’s world have boxed corporate customers into closed and proprietary cloud systems that also are unable to offer simple connections into traditional on-premises technology.

That’s because most first-generation cloud services were quite intentionally set up in isolation from not only those on-premises systems but also from other cloud services, partly in a land-grab effort and partly because the nature of first-gen solutions are by nature narrow, specific and fragmented.

But at some point, all those Balkanized clouds, and all that “old” on-premises stuff (that still runs most of the world’s business processes and manages most of its data), and all the competing new cloud technologies, and all that fragmentation exposed an underlying disaster for corporate customers: too much complexity, too much cost, too many limited views of their operations, and too much time wasted in trying to make all that incompatible stuff work together. [End of excerpt.]

Along with the deep software expertise and technology that both IBM and Red Hat offer, IBM’s massive Global Services business gives the company additional opportunities to help customers embrace hybrid technology in ways that optimize their business strategy.

3. Amazon.

So what’s the new kid on the block doing to help customers integrate their legacy technology with modern cloud technology? Amazon’s cloud unit, AWS, is adapting elegantly to customers’ demand for hybrid solutions by offering to place its hardware—and thereby its cloud services—inside customers’ data centers.

Interesting—remember your Trojan Horse history?

In a very good overview of Amazon’s intentions with its new Outpost (you gotta love that name!) initiative, DataCenterKnowledge.com offers this perspective from analyst Patrick Moorhead, president of Moor Insights & Strategy:

“The biggest differentiator [for the new on-prem solution] is that customers can write to the same exact APIs to get access to AWS public cloud as they do with Outposts,” he said. “The same goes for VMware cloud. Outposts definitely raises the stakes on Azure Stack and on-prem OpenStack deployments.” (OpenStack is a family of open source software widely used by companies to build on-premises private clouds.)

The DataCenterKnowledge.com piece also offers this viewpoint from Forrester Research analyst Dave Bartoletti:

“Microsoft was the first one to jump into this, and it’s doing well,” he said. “They have happy customers. I think both [Azure Stack and AWS Outposts] have value for customers who are aligned with one of those two clouds. If you already made a choice and committed to using Azure and Azure Stack, it makes sense for you, even if you have to run your own hardware. Same thing with customers who have a commitment with AWS or VMware Cloud on AWS. This is a nice logical way for them to modernize their data centers.”

It’s impossible to overstate the importance of this move by Amazon—the ultimate cloud-is-everything vendor—in adding further momentum to the hybrid wave among not only customers eager to maintain as much flexibility and consistency across environments as possible, but also among cloud-industry players who will see Amazon’s acknowledgement of hybrid’s ascendancy as the ultimate proof that hybrid is the primary path to the future.

Coming tomorrow in part 2 of this 2-part series: what Google Cloud, Oracle and SAP are doing in hybrid.

Disclosure: at the time of this writing, IBM is a client of Evans Strategic Communications.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************