With the AI Revolution gaining steam and the outcome of the U.S. presidential election boosting confidence in economic growth, I’m forecasting that the three Cloud Wars Top 10 companies releasing fiscal-Q3 results in the next couple of weeks — Salesforce, Workday, and Snowflake —will all report accelerating growth for the quarter ended Oct. 31.

I realize this bullish outlook flies in the face of the cautionary statements issued earlier this year by Salesforce CEO Marc Benioff and Workday CEO Carl Eschenbach, both of whom used prior earnings calls to warn of softening customer demand for enterprise applications, stretched-out purchasing decisions, and shifts to smaller-scale purchases. For more on that, please see:

- As Salesforce Growth Rate Flatlines, 7 Questions for CEO Marc Benioff (June 10)

- As Workday Customers Slow-Walk Purchases, CEO Eschenbach Remains Bullish (May 30)

Meanwhile, Snowflake has maintained a growth rate of 30% or more in its first two quarters under CEO Sridhar Ramaswamy, who took over in February for and was hand-picked by the legendary Frank Slootman.

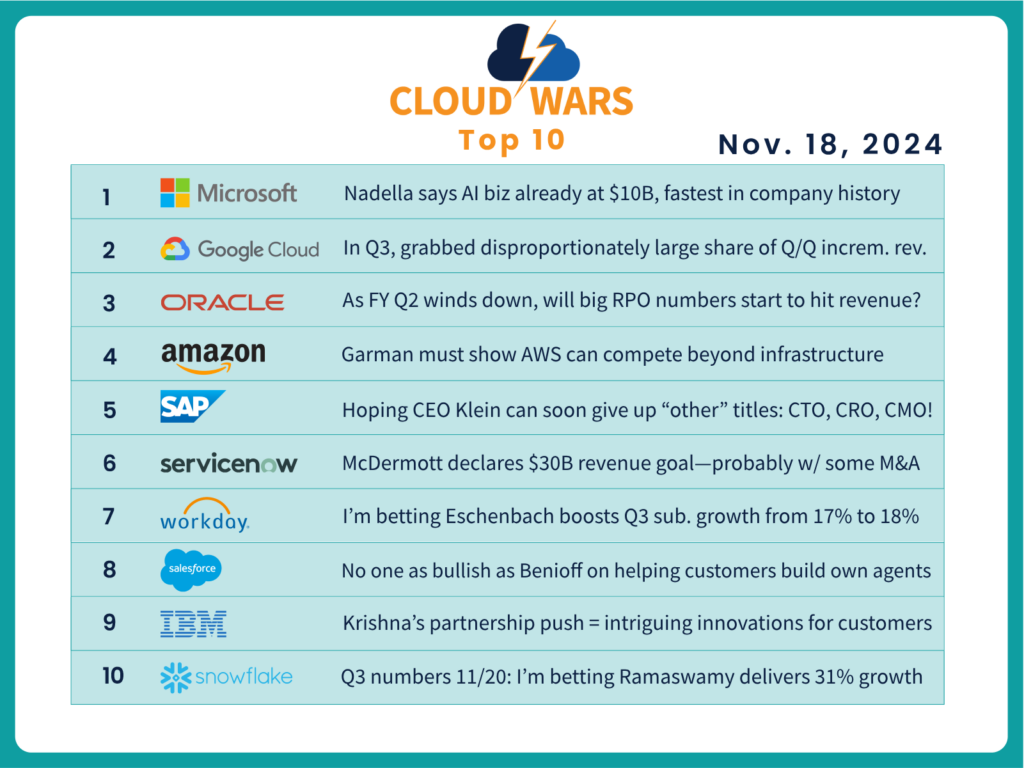

Here are my projections for what we’ll be seeing from Snowflake on Nov. 20, from Workday on Nov. 26, and from Salesforce on Dec. 3:

| Q3 Projected Growth | Q3 Projected Revenue | Q2 Actual Growth | Q2 Actual Revenue | |

| Salesforce | 10% | $9.59B | 8% | $9.33B |

| Workday | 18% | $1.99B | 17% | $1.9B |

| Snowflake | 31% | $915.0 | 30% | $829M |

I have three primary reasons for believing that these three companies from three fairly distinct segments of the market will all show accelerated growth rates for their fiscal Q3’s ended Oct. 31.

1. The massive interest in and desire for AI-powered transformation from CEOs and boards of directors, a demand that cuts across all industries and all regions.

2. The fundamental strengths of all three companies and the belief among customers that each is a best-in-class player.

3. The renewed sense of business vitality and opportunity that has been evident since the presidential election, which not only triggered a huge run-up on Wall St. but also pushed the combined market cap of the Cloud Wars Top 10 companies above $9 trillion for the first time ever.