C3 AI, a powerful player in the enterprise AI market, disclosed a ramped-up focus on partners, a new selling structure, and a new consumption-based pricing model in its recent earnings report.

“These measures, in aggregate, will allow us to accelerate sales cycles, accelerate product adoption, increase market share, increase revenue growth and increase profitability,” said Chairman and CEO Tom Siebel.

Siebel gave a lengthy overview of his company’s go-forward plans during its quarterly earnings call on August 31.

New AI Software, New Pricing Model

Siebel said the company has been planning a transition from the current subscription-based model to consumption- or usage-based pricing for years, and that the transition is facilitated by the latest release of its flagship software, C3 AI Version 8.

The company’s subscription model required protracted negotiations for all the different components that make up the C3 AI suite, generally involved 3-year contracts, and deal values were typically $1 million and above – a practice he referred to as “elephant hunting.”

Siebel noted such practices — and price points — aren’t well suited to the current macro environment, even though they’ve served the company well until now. This is even despite posting 25% revenue growth, to $65.3 million, in its most recent quarter.

“The downside has been more lumpiness than we would like to see in bookings, lengthy sales cycles and higher levels of uncertainty associated with individual deal closure in period,” Siebel said, adding the existing model “is not well suited to the deliberate decision and approval processes inherent in the current economic environment.”

Case in point: the company noted that in the most recent quarter, 66 forecasted deals moved out, many of which C3 AI officials would have expected to close under normal market conditions. The company has 228 customers and it closed 31 deals during the quarter.

Siebel: ‘That Game Is Over’

“In this market environment, I’m telling you closing a $50 million deal with any multibillion-dollar corporation, it has to go to the board, okay? So you could play in this game in the last decade, we played it very well, but that game is over. So, now we have a pricing model that we think meets the market needs quite well,” he said.

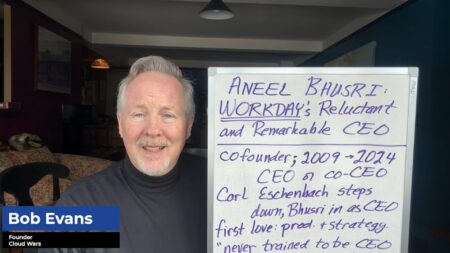

The existing subscription-based model “is not well suited to the deliberate decision and approval processes inherent in the current economic environment.”

Tom Siebel, C3 AI chairman and CEO

Under the new model, a customer gets a six month pilot subscription that includes:

- One AI Enterprise application

- Unlimited use of the C# Ai Platform

- Unlimited developer licensing

- Unlimited runtime licensing

- Concierge technical support and training

Note: Pricing post-pilot is 55 cents per vCPU hour.

The company acknowledged that this shift will have a negative effect on revenue and Remaining Performance Obligations (RPO) in the near term.

This approach will result in a higher number of smaller deals. But that trend had already begun under the subscription model: C3 AI’s 31 deals in the quarter had an average contract value of $1.4 million in the most recent quarter, as compared to 24 contracts with an average value of $1.9 million.

Officials said the consumption model aligns with customer expectations and experiences with major cloud providers and SaaS vendors.

Partner, Selling Models Revamped

Other elements of the company’s new focus include increased emphasis on work with strategic partners. Its partners represent an impressive cast that includes: Microsoft, Amazon AWS, Google Cloud, and Baker Hughes.

C3 AI and Baker Hughes, one of the largest petrochemical companies in Latin America, are collaborating with Microsoft and Accenture to develop and market an industrial asset management system for clients in the energy and industrial sectors.

Microsoft and C3 AI participated in 16 joint selling agreements in the quarter, while AWS customers are the largest installed base of C3 AI installations with 56%. Google Cloud has committed to co-sell and co-fund over 100 new deployments over the next three years.

The company has also remade its salesforce to align with the other changes it has made. Traditionally, its salespeople brought enterprise software (think SAP, Oracle) backgrounds but now the focus has shifted to technical domain experts with an average age of 35 and one or more advanced degrees, Siebel said.

Finally, Siebel said the company is targeting budget reductions in several areas:

- Marketing, reduced from 29% to 11% of revenue

- R&D, 44% to 29%

- G&A, 15% to 12%

Sales will increase from 23% to 26% of revenue.

Late last week, the company’s stock was trading near its 52-week low of $13.87; its 52-week high is $53.82.

For more exclusive coverage of innovative cloud companies, check out Cloud Wars Horizon here: