Microsoft’s commercial-cloud juggernaut now accounts for more than one-third of the company’s total revenue. This represents a stunning achievement for CEO Satya Nadella as he nears the end of his sixth year leading the world’s #1 cloud company.

Mighty Microsoft—the world’s most highly valued corporation, with a market cap of just over $1 trillion—yesterday reported $33.1 billion in total revenue for its fiscal first quarter. Its commercial-cloud revenue accounted for $11.6 billion of that, up 39%.

That computes to a 35.04% share of the company’s overall revenue, marking the first time that Microsoft’s wide-ranging and fast-growing cloud business has exceeded one-third of the company’s total revenue.

So why is that important? Why is it among the top reasons why Microsoft has a stranglehold on the #1 spot in my Cloud Wars Top 10 rankings? Let’s get into the many reasons.

Microsoft’s Cloud Evolution and Innovation

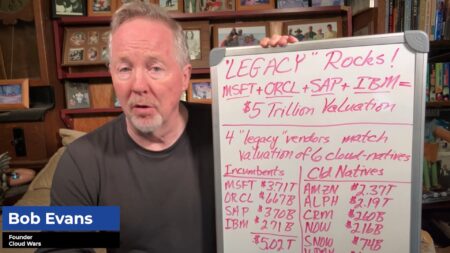

- All of the leading tech vendors aged 40 and up—Microsoft, SAP, Oracle, and IBM—have spent the past few years racing to build up their cloud businesses to align with market demand while also keeping their traditional on-premises solutions up to date. But by transforming itself to the point that 35% of its revenue now comes from the cloud, Microsoft has clearly outpaced all of the other seasoned citizens. (Among its competitors, cloud businesses account for about 20% to 25% of total revenue.)

- Just 6 years ago, the entire Microsoft organization was somewhere between sleepy and lost. Its cloud business was just one of the many internal camps battling for attention, budget, people and prominence. But from the moment Nadella took over as CEO on Feb. 4, 2014, he made it abundantly clear that the cloud would be the engine of Microsoft’s transformation, its reinvention, and its return to big-time growth and relevance.

- Nadella has made Microsoft extremely aggressive in using AI not only for internal purposes but also for infusing it into all of its products. And customers are clearly pleased with the results: “Azure AI now has more than 20,000 customers, and more than 85% of the Fortune 100 have begun using Azure AI in the last 12 months.”

Cloud as the Foundation for “Digital Estates”

- Some folks with either axes to grind or an inability to see where the world is headed have attempted to dismiss much of Microsoft’s cloud success by making the preposterous argument that only the Azure segment is “real” cloud. To these misguided observers, the other component parts of what Microsoft calls its “commercial cloud”—Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other properties—are somehow “phony cloud.”

But unlike those close-minded bubble-dwellers, business customers love the way Microsoft has turned Office 365 Commercial into an on-ramp for Azure and helped them connect via Azure all facets of what Nadella calls their “digital estates.” Here’s how Nadella framed his product strategy during yesterday’s earnings call: “Microsoft provides a differentiated technology stack spanning application infrastructure, data and AI, developer tools and services, security and compliance, business process productivity, and collaboration.” - No other cloud company has been able to engage with global customers on billion-dollar cloud deals. Not #2 AWS (the IaaS category king and the vendor those bubble-dwellers insist is the cloud leader, despite the fact that Microsoft’s cloud revenue is at least 25% greater than that of AWS). Not #3 Salesforce, and not #6 Google Cloud. But Microsoft has. And that’s precisely because it has, in addition to Azure, a very broad and sophisticated set of cloud services that span those massive digital estates—a trick no other cloud vendor can manage.

RECOMMENDED READING

#1 Microsoft Cloud Revenue Tops #3 Salesforce, #4 SAP, #5 Oracle and #6 Google Combined

Satya Nadella Admits: Microsoft Cloud Business Is Bigger than Amazon’s

Microsoft’s $50-Billion Moonshot: #1 Cloud Vendor Lays Out New Growth Plans

Inside Microsoft’s Billion-Dollar Cloud Deals: Driving ‘Innovation Agendas’

Why Microsoft’s Beating Amazon: Cloud Deals with SAP, Oracle and ServiceNow

Cloud Revenue Surging to $158 Billion for Top 10 Vendors in 2019

Relentless, Eye-Popping Revenue Growth

- There’s Azure itself, whose revenue grew 63% in constant currency in Microsoft’s fiscal Q1 ended Sept. 30.

- There’s Microsoft’s ongoing commitment to hybrid computing—one executive said “we’ve been doing hybrid since way before hybrid was cool”—that matches up with the reality of what customers want and need as they evaluate which of their on-premises systems to keep, and which to migrate to the cloud. And look at these revenue figures relating to Microsoft’s on-premises numbers per CFO Amy Hood on yesterday’s earnings call: “On-premises server business grew 12% and 14% in constant currency, driven by continued strength across our hybrid and premium offerings.”

Customer-Centric Strategic Alliances

- Of all the major cloud vendors, Microsoft has been the most open and eager to form innovative alliances with other big tech firms, notably SAP and Oracle. These unconventional alliances are hugely valuable to customers, who have little or no interest in getting caught up in the cloud industry’s competitive battles. Instead, customers want key vendors to collaborate to make life easier.

Here’s how CFO Hood framed it on yesterday’s call by specifically stating that Microsoft’s #1 goal is to be “customer-centric”: “And you actually see that in broader Microsoft Cloud results whether that’s helping through these partnerships to get closer to Tier 1 workloads and business-process changes. And so, I actually think these [partnerships] are quite important for us to continue to make sure the first goal is to be customer-centric, which is why we continue to move in this direction.”

The Indisputable Revenue Number

- And then there’s the fact that 9 months from now, when Microsoft reports full-year results for fiscal 2020, there’s an excellent chance that it will post $50 billion in commercial-cloud revenue for the 12 months. Think about that for a second: that $50-billion figure would make Microsoft’s cloud business—not the whole company, but just its cloud business—one of the two or three largest enterprise-technology companies in the world.

We’ll dig into Microsoft’s results over the next several days and post more analysis. For now, the big takeaway is that Microsoft’s driving 35% of its revenue from the cloud because of Nadella’s unflagging commitment to technological innovation plus slavish devotion to customer success.

Cloud Wars

Top 10 Rankings — Oct. 21, 2019

| 1. Microsoft — Q1 cloud revenue will top SFDC, SAP, Oracle & Google *combined* |

| 2. Amazon — AWS Q2 revenue jumps 37% to $8.38B, cites broad innovation in ML |

| 3. Salesforce —Is Benioff planning to switch more databases from Oracle to AWS? |

| 4. SAP — Rides Microsoft deal to first $2-billion cloud quarter |

| 5. Oracle — Ellison: Autonomous DB growth “so extraordinary, we’re not forecasting” |

| 6. Google — Q2 cloud rev. tops $2B; Kurian’s customer focus leads jump from #7 to #6 |

| 7. IBM — Q3 cloud rev. up 14% to $5B; Red Hat triggers sweeping internal changes |

| 8. Workday — CEO Aneel Bhusri says Oracle, SAP can’t match it in Fortune 100 mkt. |

| 9. Accenture — Up from #10 on ties w/ MSFT AWS GOOG; $9B cloud biz up 23% in ‘18 |

| 10. ServiceNow — Donahoe looks to Microsoft & mobile to drive next growth wave |

Disclosure: at the time of this writing, Microsoft was a client of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!