After 47 years of helping companies in every industry around the world run their internal operations with highly structured efficiency, SAP is in the midst of a stunning transformation to becoming the world leader in helping businesses understand what’s going on in the minds of consumers in today’s Experience Economy.

Proclaiming that newly acquired experience-management high-flyer Qualtrics has become “the crown jewel of the company,” SAP CEO Bill McDermott yesterday promised that Qualtrics will not only turn SAP into a very different type of company, but will radically alter how businesses around the world understand, engage with, and delight their customers.

“Qualtrics has the biggest leverage of any acquisition we’ve ever made,” McDermott said yesterday at SAP’s Capital Markets Day, noting that “supply and demand must go hand-in-hand and must be there in combination. When you take SAP’s long leadership in ERP and add in Qualtrics as the world leader in experience management, you have the front office and the back office connected in ways no one else can touch.”

And on SAP’s recent earnings call, McDermott called Qualtrics flat-out “the biggest growth opportunity I’ve ever seen.”

Now, by any measure, all of that is some high-powered talk about a highly specialized company that was not exactly a household name in spite of its excellent reputation within its market space.

And bear in mind that even before the Qualtrics acquisition late last year, SAP was cited as the world’s most-valuable brands, ranking at #21 on the annual Interbrand list.

So how can Qualtrics—with annual revenue that’s barely 1/50th of SAP’s—suddenly explode on the scene and convince McDermott and the executive board to radically overhaul the value proposition that SAP’s created and nurtured so carefully for almost half a century?

I have a few thoughts on that:

- It’s been a dream of McDermott for some time to seamlessly interconnect SAP’s decades of experience and expertise in the internal realms of operations, finance, logistics and supply chain with the external dynamics of demand, marketing, sales and customers. Early last year at the company’s Capital Markets Day, McDermott announced SAP’s intentions to redefine the CRM space by infusing SAP’s new C/4HANA customer-experience suite with ERP data to offer a better 360-degree view of the customer. That represented a big step forward, but pales in comparison to the new customer-centric capabilities Qualtrics can bring.

- McDermott has long talked about the need for SAP to help its customer become heroes for their customers—he’s had a vision of pushing SAP’s value beyond B2B and into B2C for years. And now with Qualtrics, he has the means with which to do that.

- SAP has promised to triple the size of its cloud business by 2023, the arrival of fast-growing Qualtrics will surely help SAP achieve that. Qualtrics’ revenue is said to be growing at 45%, and could top $800 million this year, McDermott recently indicated.

- And the Qualtrics leadership team seems to be as eager about being a part of SAP as McDermott and company are to have them. When the deal was announced less than 3 months ago, Qualtrics co-founder and CEO Ryan Smith appeared on camera with McDermott on CNBC’s “Squawk Box” and explained why, just days before one of the most highly anticipated IPOs in recent years, he decided to forego the IPO and agree to be acquired by SAP for $8 billion: “We had a chance to change the Experience Economy forever.”

- Rob Enslin, the president of SAP’s cloud business, said this during the Q&A session at yesterday’s Capital Markets Day event: “As good as the Qualtrics sales team is, they’ve now got 15,000 SAP sales professionals touching customer organizations, and that’s just a huge boost. Only 20% of their sales were outside the US, and we can help change that significantly. There’s no overlap in our product lines—none—and if you add ERP to CRM, and then add XM (experience management) to that—well, that’s something no one’s ever done, and the opportunity is really massive. And, they’re growing unbelievably fast.”

So I expect this deal will trigger some significant reactions across the industry because I believe that what SAP is doing here is fundamentally rewriting what enterprise software is all about—and this move into experience management is so big and so sweeping that it’s going to force competitors to react in ways large and small.

That’s a good thing for a dynamic business like enterprise software—and it will no doubt kick up the intensity in the Cloud Wars even higher.

Disclosure: At the time of this writing, SAP is a client of Evans Strategic Communications.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of SAP and all of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!

*******************

RECOMMENDED READING FROM CLOUD WARS:

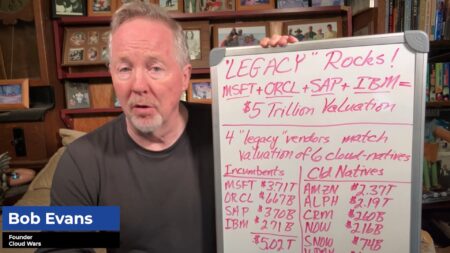

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************