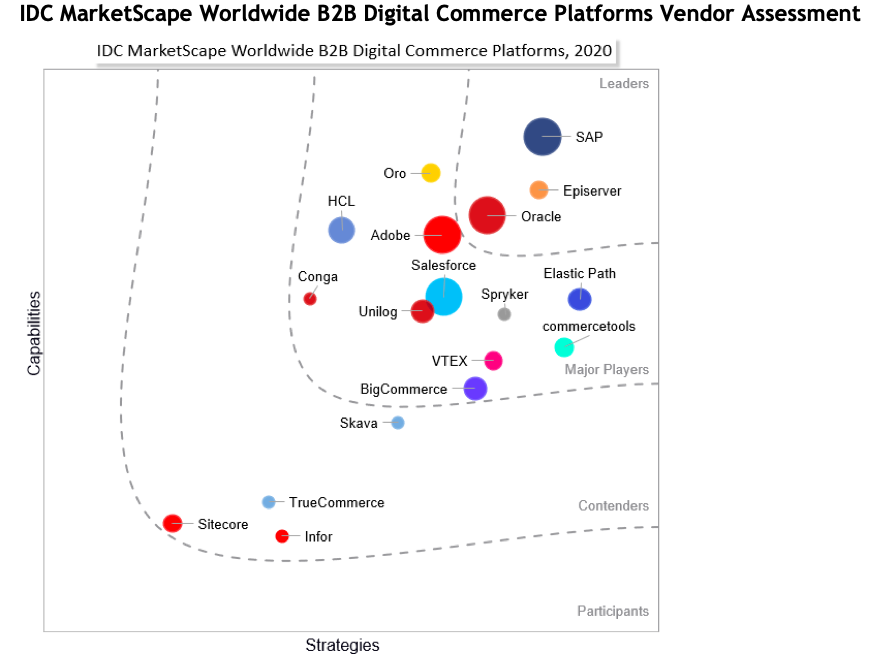

A week before SAP unveils its new CX strategy and intentions, IDC has released a market study showing that SAP has a significantly stronger presence in B2B Digital Commerce than competitors Salesforce, Oracle, and Adobe.

(On my Cloud Wars Top 10 weekly rankings, SAP is #5, Salesforce is #3, Oracle is #6, and Adobe is #10.)

Where does CRM end and CX begin?

While there’s a lot of fog, fuzziness and FUD in today’s market over where the new CX category begins and the traditional category of CRM ends, this is a big win for SAP and the SAP Commerce Cloud as the company seeks to counterbalance its powerful presence in the operations-oriented world of ERP with a formidable set of solutions in customer-facing CX.

As indicated in the graphic below from the IDC Marketscape report covering B2B Digital Commerce Platforms, SAP is positioned as #1 by a wide margin over its 3 highly capable competitors in both capabilities (horizontal axis) and strategies (vertical axis).

The clear win in the B2B Digital Commerce space also comes just a few weeks after SAP CFO Luka Mucic said that SAP would no longer attempt to slug it out with Salesforce across every facet of the CRM market. Instead, Mucic said at an investors conference, SAP would focus on some specific subsegments of the CX/CRM space. (You can read all about that in Salesforce-SAP Showdown: SAP Exits Mainstream CRM for ‘Focused’ Segments.)

SAP Commerce Cloud is the latest iteration of what had been known as the Hybris commerce solutions, acquired by SAP several years ago. It will certainly be one of the core foundations of the SAP CX product strategy to be unveiled in a big virtual event on Oct. 14, headlined by CEO Christian Klein.

The authors of the IDC study had this to say about SAP’s B2B digital commerce strengths and weaknesses:

Strengths

“SAP offers a broad and deep portfolio of customer experience [CX] applications, including CRM, marketing, CPQ, and service,” wrote IDC in its Marketscape report. “Customers we interviewed rated SAP above average when asked whether SAP Commerce Cloud is ‘built for the future.’ ”

In addition, IDC wrote, “SAP’s context-driven services provide deep personalization capabilities to tailor commerce experiences.”

Weaknesses

At SAP’s big CX event on Oct. 14, I’ll bet the CX team directly addresses some of the “challenges” for SAP Commerce Cloud as outlined by IDC: it’s not yet multitenant, it scores below average on ease of implementation, and it scores below average on value delivered relative to cost.

Final Thought

I’m hoping that SAP uses the Oct. 14 CX event to very clearly and precisely articulate what CX is versus what CRM is, and why SAP has chosen CX as the alternative by which it can deliver the greatest value to its present and future customers. I’m also hoping SAP dispels, once and for all, any lingering lack of clarity about what its CX strategy includes, what it does not include, and why SAP believes that approach will be best of its customers and for the company and its partners.

SAP does that with its vast fleet of ERP products and services—and unless it does the same for its CX portfolio and plans, that part of the SAP business will never reach its full potential.

RECOMMENDED READING

Larry Ellison’s Next Trick: Oracle Cloud and Nvidia Unleash Mainstream AI

Can Oracle Snatch Trillion-Dollar Hybrid Market from Microsoft and IBM?

Top 5 Cloud Vendors for Q4: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 Google Cloud, #5 SAP

SAP CFO Shoots Down Larry Ellison Claim of Oracle Snatching SAP Customers

The Audacious Larry Ellison Flips Oracle Cloud Strategy Upside-Down

Market-Cap Madness: ServiceNow at $90 Billion Halfway to Oracle and SAP at $180 Billion

Salesforce’s Marc Benioff Dishes Tough Love to Passive CEOs: ‘Get Out of Paralysis!’

Best Software Acquisition of All Time Was Salesforce Buying Tableau: Marc Benioff

What Did Oracle, Salesforce and SAP All Scrap But Workday Just Revived?

Snowflake CEO: Cloud Is ‘Biggest Thing Ever in the World of Computing’

Disclosure: at the time of this writing, SAP was among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!