Adding another powerful piece of evidence to its claim as the world’s pre-eminent provider of enterprise applications, SAP has overtaken Salesforce in market cap — $253.2 billion to $248.1 billion — as Christian Klein’s company is growing twice as fast as Marc Benioff’s here at the dawn of the GenAI Revolution.

Of course, market caps rise and fall and one’s superiority over another can be fleeting. But over time, market caps are a high-value manifestation of the public’s confidence — or lack thereof — in a company’s growth potential and its future prospects.

So, in the greatest growth market the world has ever known — and with the AI and GenAI party just getting started — the public’s steadily rising confidence in SAP’s growth prospects as expressed by its surging market cap stands in stark contrast to how that same public feels about Salesforce’s ability to sustain a leadership role in the fast-changing enterprise-apps space. (I dig into which company is better prepared for that future in “SAP vs. Salesforce: Battle for Supremacy Shifts from Apps and AI to Data.”

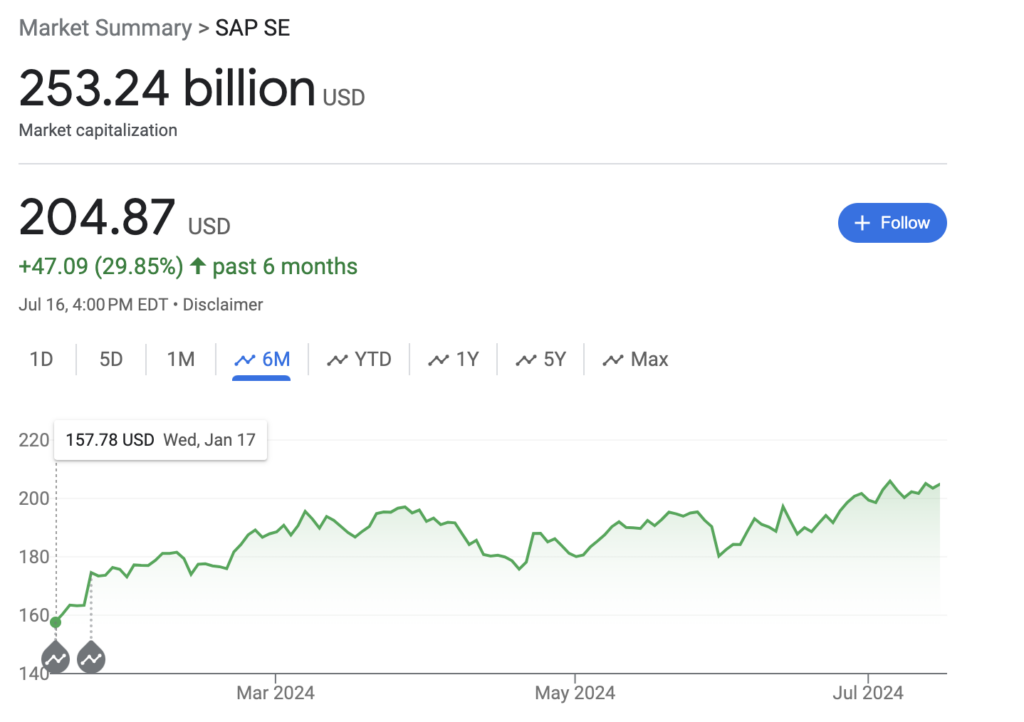

To see what I mean in graphic form, please have a look at the two charts below, which I captured yesterday morning on a Google search and that plot out the daily market caps for each company over the past six months.

SAP MARKET CAP OVER PAST 6 MONTHS

SALESFORCE MARKET CAP OVER PAST 6 MONTHS

Setting aside the particulars of the single-day market-cap numbers from July 17 — $253.2 billion for SAP, and $248.1 billion for Salesforce — the market-cap trendlines since mid-January clearly reflect profoundly different perceptions of what the future holds for SAP and for Salesforce.

And here are a couple of related data points that underscore the market momentum SAP holds today, both with customers and with investors:

- market caps one year ago: in mid-July of 2023, Salesforce’s market cap was $223 billion, and SAP’s was $166 billion.

- market caps on March 1, 2024: Salesforce’s had soared to $306.7 billion, while SAP’s had climbed to $220.5 billion.

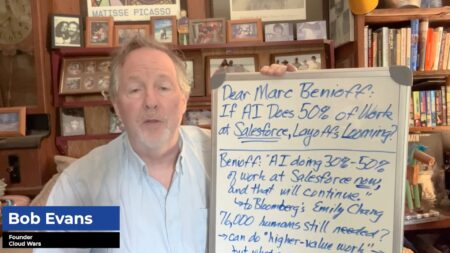

But in the four-and-a-half months since then, SAP’s valuation has continued its long and steady upward trajectory, while Salesforce’s has dropped precipitously, largely on the basis of its projection during its fiscal-Q1 earnings call in late May that revenue growth for the rest of the year would tumble into single digits and come in between 8% and 9%. I share my thoughts on key issues for Salesforce in my recent analysis headlined “As Salesforce Growth Rate Flatlines, 7 Questions for Marc Benioff.”

Meanwhile, SAP reported in mid-April that revenue growth for its Cloud ERP Suite was up 31% for the quarter ended March 31, marking the ninth consecutive quarter of 30% or higher growth for the heart and soul of its applications business.

Plus, relative to not just Salesforce but other enterprise-apps competitors, SAP is by far the fastest-growing major provider in the world (for more on that, please see my recent analysis headlined “SAP #1 Fastest-Growing Apps Vendor; #2 Microsoft, #3 Workday, #4 Salesforce, #5 Oracle.”

Final Thought

As noted above, market caps are but one measure of a company’s performance and potential. But over time, those valuations tell very important stories about what investors think about not just where a company is but where it is headed.

And in that context — and as the GenAI Revolution unfolds — SAP is making an extremely persuasive case that it is without question the world’s leading provider of enterprise apps, and will likely remain so for a long time.

The AI Ecosystem Q2 2024 Report compiles the innovations, funding, and products highlighted in AI Ecosystem Reports from the second quarter of 2024. Download now for perspectives on the companies, innovations, and solutions shaping the future of AI.