As the COVID-19 slowdown gutted traditional on-premises revenue for SAP in March, the world’s largest applications vendor reported that Q1 cloud revenue came in 4.5X higher than its traditional license revenue.

It’s a stunning statistic revealing how rapidly the enterprise cloud has become not just a solid contributor to the revenue of the major tech vendors but is now, at least for SAP, the dominant driver by far of new revenue. SAP is #5 on the Cloud Wars Top 10 rankings.

I will not be surprised if we see similar trends in the next few weeks from two other Top 10 vendors whose products span the worlds of cloud and traditional IT. The first is #1 Microsoft, whose earnings for its fiscal Q3 will be released on April 29. And the second is #7 IBM, expected to release Q1 numbers on April 20.

The other major player bridging cloud and on-premises technology, #6 Oracle, could present a slightly different case because its fiscal third quarter ended Feb. 29. That means that when Oracle released its fiscal-Q3 numbers in mid-March, COVID-19 had not yet delivered such a jarring financial impact.

While SAP’s final Q1 numbers will come out on April 21, here are the relevant figures referred to above from the company’s April 8 “pre-announcement”:

- cloud revenue was up 29% for Q1 to $2.2 billion; and

- software licenses revenue was down 31% to $490 million.

Those figures represent that 4.5X disparity between SAP’s cloud business, which in spite of the March COVID-19 impact still managed a very respectable 29% increase, and its traditional on-premises license business.

RECOMMENDED READING

SAP Has Twice as Many Cloud ERP Customers as Oracle: Exclusive Co-CEO Interview

Marc Benioff: The Extraordinary Ascendancy of a Global Leader

Will IBM’s New CEO Shake Up the Company or Simply Shuffle the Pieces?

7,600 Companies Pounce on Free SAP Solution to Help Employees Manage COVID-19 Stress

SAP Q1: COVID-19 Guts License Sales but Cloud Revenue Jumps 29%

To Combat COVID-19, a Retail App Becomes a ‘Smart Quarantine’ Solution

Google Cloud Unveils Massive, Wide-Ranging Global Response to COVID-19

In that press release disclosing its preliminary Q1 results, SAP said, “Business activity in the first two months of the quarter was healthy. As the impact of the COVID-19 crisis rapidly intensified towards the end of the quarter, a significant amount of new business was postponed. This is reflected, in particular, in the significant year-over-year decrease in software-licenses revenue.”

Of course, that factor of 4.5X must be taken in the proper context. It is specifically limited to new business signed in Q1. SAP continues to generate a large volume of its quarterly revenue from support or maintenance charges related to its license business.

The magnitude of that support revenue was not released in the preliminary Q1 numbers, but we can get a sense of its size by looking at one other number: SAP said that “cloud and software revenue grew 7% year over year” to $5.89 billion.

If we add the two numbers mentioned above—$2.2 billion in cloud revenue and $490 million for traditional license revenue—that comes to almost $2.69 billion.

If we subtract that $2.69 billion (cloud revenue and license revenue) from the $5.89 billion for “cloud and software revenue,” that leaves $3.2 billion. A very large portion of that is surely the support/maintenance revenue for on-premises licenses. Perhaps we’ll learn more details on that when SAP discloses full financials on April 21.

But for now, we have a very clear sense that the devastating impact in March of the COVID-19-induced economic slowdown has resulted in SAP’s Q1 cloud revenue absolutely dwarfing its license revenue by a factor of 4.5X.

As other big vendors report in coming weeks, we’ll keep a close eye on these unexpected and powerful trends.

Cloud Wars

Top 10 Rankings — Apr. 13, 2020

| 1. Microsoft — Bogus “775% surge” went from fake news to lame fix—very surprising |

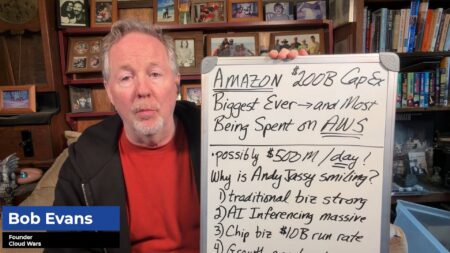

| 2. Amazon — Big donation of services to researchers for current and future crises |

| 3. Salesforce — Benioff was first tech CEO to speak forcefully about COVID-19 |

| 4. Google — Kurian shares a massive, wide-ranging global response to COVID-19 |

| 5. SAP — co-CEOs’ message to global community: ‘Together we will persevere’ |

| 6. Oracle — Giving Gen 2 IaaS GPU services to COVID-19 research teams |

| 7. IBM — Will new CEO shake things up or simply shuffle the pieces? |

| 8. Workday — Bhusri doubles down on commitment to employees as crisis intensifies |

| 9. ServiceNow — Its 4 free emergency-response apps now used by 1,000+ entities |

| 10. Adobe — Digital Experience business up 24% to $859M in Q4 |

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!