With fiscal-Q2 industry-cloud revenue up 58% to almost $800 million, Salesforce’s vertical-market solutions now account for 12.44% of Salesforce’s total revenue, underscoring their emergence as a mainstream part of the business.

On my Industry Cloud Top 10 rankings, Salesforce has been #1 since I established the rankings 6 months ago. On that list, Google Cloud is #2, Oracle is #3, Microsoft is #4, and SAP #5.

Salesforce did not disclose that $790 million figure in its fiscal-Q2 earnings call last week, but because of your humble correspondent’s deep love for his wonderful audience, I worked out that number this way:

- on Salesforce’s Investors Day almost a year ago, it revealed that its Industries business had achieved an annualized run rate of $2 billion for the its fiscal ’21 Q2, which ended July 31, 2020;

- to achieve a $2 billion annualized run rate, that would mean that the revenue for the 3 months ended July 31, 2020, was $500 million; and

- using that unpublished but decipherable revenue figure for Q2 2020, I multiplied $500 million by 1.58 to generate the 58% increase and came up with a figure of $790 million for Salesforce’s industry cloud business for FY22’s Q2.

So while Industries might not be up there with Service Cloud or Sales Cloud at the forefront of Salesforce’s revenue parade, that $790 million equates to about 12.44% of Salesforce’s total Q2 revenue of $6.35 billion. That in itself is a very healthy contribution to the cloud’s largest software company—and when you also factor in that Salesforce Industries grew at 58% last quarter, that clearly indicates that industry clouds are rapidly becoming more vital and strategic to the entire high-growth company.

After all, that $790 million for Q2 equates to an annual revenue run rate for Salesforce Industries of $3.16 billion.

Chief operating officer Bret Taylor underscored that point during the earnings call when he said this:

Our industry strategy is enabling our customers to get started with an end-to-end Customer 360 faster than ever before, tailored to the specific needs of every industry. Our industry cloud saw 58% year-over-year growth in annual recurring revenue. We had especially strong performance in the public sector, in our health cloud business, and financial services.

Congratulations to Salesforce for a fabulous Q2 overall and particularly for its industry-cloud momentum, and I hope other big vendors will start to release more financial details about their industry-cloud businesses.

RECOMMENDED READING

Salesforce Unleashes Slack and Rocks the Cloud

How Evan Goldberg and Larry Ellison Made Magic—Twice—with NetSuite and Oracle

The Remarkable Larry Ellison: Oracle’s Legendary Disruptor Turns 77

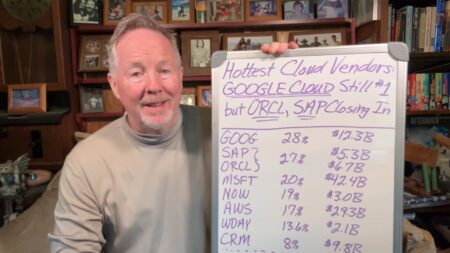

Cloud Wars Top 10 Crush Q2: $60 Billion Led by Microsoft, Amazon, Google

Infor and AWS: CloudSuite Vendor Bets the Company on Amazon R&D

ServiceNow CEO Bill McDermott Playing Dangerous Game w/ SAP, Oracle

Amazon-Workday Kerfuffle: Big Winners Are Workday and Google Cloud

SAP Slaps Back at Larry Ellison: ‘Hundreds’ of Q2 Wins Over Oracle

Microsoft Thumps Amazon by 31% in Q2 Cloud Revenue; Bigger than AWS + Google Cloud

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.