Not long after Larry Ellison revealed that Oracle is betting the company on two products—its new Autonomous Database and its Cloud ERP applications—CEO Mark Hurd has tripled down on that wager by claiming that Oracle is gunning to own 50% of the massive enterprise-apps market.

Now, while there’s no question that executives in the high-growth tech industry need to be bullish, the math behind Hurd’s claim is particularly intriguing.

A Bloomberg article about market share in highly competitive enterprise-applications sector set the stage:

“Today, there’s no one with more than 50 percent,” Hurd said Tuesday in an interview to air on Bloomberg Television. “In fact, the highest application percentage of any company in any segment is sort of mid-20s. This generation will see a leader that’s much more material than that, and I volunteer us to do it.”

The current and longtime leader in enterprise applications is SAP, which is facing furious competition from Salesforce, Oracle, Microsoft, Workday, ServiceNow and others as the generational shift to digital business is seeing companies in every region and across the globe looking to modernize their processes and operations with SaaS applications.

Hurd, reflecting Oracle’s aggressive outlook, said that over time he believes Oracle can be that breakout player that grabs about 50% of available share. And that’s where the math gets pretty wild, as played out in this excerpt from the related news article on Bloomberg.com:

Hurd said the market for apps in the transition to cloud computing would grow from $125 billion now to $400 billion “as it goes forward” by siphoning sales from more traditional information technology businesses.

Okay—a month ago on Oracle’s quarterly earnings call, Hurd said Oracle’s applications revenue for the 12 months ending Nov. 30, 2018, was $11 billion.

But in the Bloomberg interview, Hurd is claiming that the enterprise-apps category will at some point in the future balloon to $400 billion, and that in his view, some company is going to own 50% of that, which would equate to a $200-billion enterprise apps business.

And since Hurd is nominating Oracle to be that breakaway player, that means that for the company to meet the CEO’s expectations—or at least his publicly expressed hopes—Oracle needs to boost its apps revenue from its current annual rate of $11 billion to $200 billion.

That is, boost its apps revenue by 18X.

That means increasing its apps revenue by 1,700%.

Now, I guess it’s a good thing for the Oracle sales team that Hurd didn’t attach a specific timetable to that little challenge—as the article put it, “He declined to specify a timetable.”

But hey—as I said, you gotta be aggressive in the Cloud Wars because for calendar 2018, the Cloud Wars Top 10 are likely to exceed $110 billion in enterprise-cloud revenue, making it likely that for all of 2019 those 10 leaders will exceed $140 billion and perhaps even reach $150 billion. (That’s for all cloud services, not just enterprise apps.)

No matter how you slice it, Oracle betting that it will become a $200-billion player in enterprise apps takes “aggressive” to a whole new level.

Disclosure: At the time of this writing, Oracle is a client of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!

*******************

RECOMMENDED READING FROM CLOUD WARS:

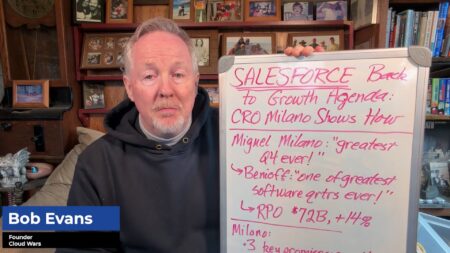

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************