Welcome to the Cloud Wars Minute — your daily cloud news and commentary show. Each episode provides insights and perspectives around the “reimagination machine” that is the cloud.

This episode is sponsored by Acceleration Economy’s “Cloud Wars Top 10 Course,” which explains how Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. The course is available today.

In today’s Cloud Wars Minute, I give my thoughts on Oracle’s Q1 report and its implications for the investor class and customers.

Highlights

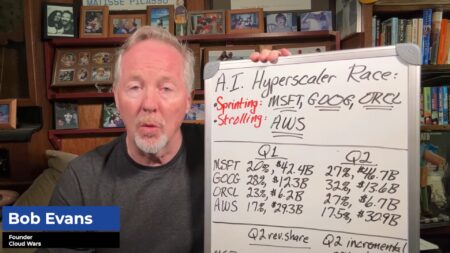

00:14 — Oracle released its Q1 numbers. Chairman and CTO Larry Ellison and CEO Safra Catz are very bullish about the company’s future, but the investor class was not pleased with the results and knocked about $35 billion, or more than 10%, of Oracle’s market cap down.

00:57 — But looking at it from the customer’s point of view, there’s a different story to be told. Oracle’s cloud business grew by 30% in the quarter. On the earnings call, CEO Safra Catz said the demand is stunning. She said Oracle is on target to hit all of its numbers for the fiscal year, as well as to meet its commitment to reach $65 billion in total revenue for the company by fiscal 2026.

01:57 — Ellison said that right now, Oracle has commitments from artificial intelligence (AI) development companies doing AI training for Oracle Cloud Infrastructure. It’s got commitments for $4 billion. Last quarter, that number was $2 billion. Ellison feels that with this type of growth, Oracle is very well positioned in the generative AI (Gen AI) category.

03:05 — Ellison said that the back office in the cloud is very different from what it was on-prem. There is so much more that can be done, he said, citing Oracle’s partnership with JP Morgan Chase to automate B2B commerce. He continues to be very bullish on that, even though for Q1, Oracle’s total cloud applications business revenue was up only 17%, well below where it’s been.

04:16 — The $35 billion reduction in Oracle’s market cap in one day was a clear signal from the investor class. From the customer’s point of view, however, if it was not good, there’s no way Oracle’s cloud business (and this is excluding Cerner) would have grown at 30%. That’s faster than any other Cloud Wars Top 10 company.

04:55 — In spite of what happened over on the investment side, Oracle continues to be the world’s fastest-growing major cloud provider. And that’s happening in spite of the fact that there’s an enormous range of options of different choices customers can have. The customers are where the ultimate truth comes through.