Regardless of what you might’ve seen or heard about Oracle’s Q2 results, the big takeaway should be that customer demand for Oracle cloud and AI services is not only very strong today but is set to surge in the next couple of years as Oracle becomes by far the world’s fastest-growing major cloud and AI vendor.

Amid the fog of AI-industry confusion that’s distorting the reality of where this world-shaping industry is headed, Oracle last week reported some of the most-impressive growth figures the tech sector has ever seen for its fiscal Q2 ended Nov. 30:

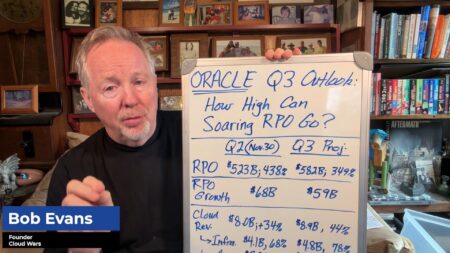

- RPO (remaining performance obligation) soared 433% to $523.3 billion;

- in Q2 alone, RPO increased by $68 billion (that’s almost $750 million every single day);

- RPO expected to be recognized as revenue in the next 12 months grew 40%, compared with 21% a year ago and 25% in the previous quarter;

- total cloud revenue grew 34% to $8 billion;

- cloud infrastructure revenue jumped 66% to $4.1 billion;

- total cloud database services revenue rose 30%;

- Autonomous Database revenue jumped 43%; and

- Multicloud consumption was up 817%.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Now, some Wall Street geniuses looked at all that and decided it wasn’t good enough. That’s fine, and of course they’re entitled to their opinions — and by the same token, I’m entitled to say that they’re so obsessed with their backward-oriented “models” framed around how things have worked in the past that they can’t see that we’re entering a very different future where their models simply don’t align with the new reality.

In addition, while those Oracle RPO numbers are stunning, they’re also so big that it’s difficult to see them in any sort of context. So let me add a little context to that analysis by comparing the Oracle RPO numbers with those of Microsoft, which is by far the world’s largest cloud vendor and has held the #1 spot on the Cloud Wars Top 10 for the past four years.

| Company | RPO | RPO Growth Rate |

|---|---|---|

| Microsoft | $392B | 51% |

| Oracle | $523B | 433% |

Those numbers show that while Microsoft’s quarterly cloud revenue is 6X larger than that of Oracle, when the arrow of time is flipped forward to measure future demand, Oracle is winning far more business than Microsoft.

And that’s happening even as Microsoft’s RPO numbers are outstanding — not only the size of that contracted business not yet recognized as revenue, but also the remarkable growth rate of 51%. Until the middle of this year, no other cloud vendor was anywhere close to Microsoft on RPO, although Oracle was rapidly gaining ground with quarterly RPO growth rates approaching 100%.

But on the strength of massive commitments for AI training and inferencing — led by but by no means confined to its $300-billion deal with OpenAI — Oracle closed that gap and overtook Microsoft in RPO a few months ago. And by boosting its RPO total by $68 billion in its fiscal Q2, Oracle is showing that demand is broad-based and rising.

“Remaining performance obligations, or RPO, ended the quarter at $523.3 billion, up 433% from last year and up $68 billion since the end of August, driven by contracts signed with Meta, NVIDIA and others, as we continue to diversify our customer backlog,” said Oracle principal financial officer and EVP Doug Kehring on last week’s earnings call.

Final Thought

My brother Harry, a world-renowned accounting professor, liked to say, “If you torture the data long enough, it will tell you anything you want to hear.” Along those lines, I suspect the stock-market crowd had to put the Oracle Q2 numbers on the rack for a long, long time before they yielded the verdict of “disappointing.”

But for us mere mortals, Oracle’s Q2 results — particularly the breathtaking RPO numbers — paint a picture of a company that is strong and getting stronger and whose best days are yet to come.