Reflecting the astonishing and growing influence OpenAI holds over the world’s largest and most-influential cloud and AI providers, Microsoft’s Q2 RPO surged 110% to $625 billion propelled by future commitments from OpenAI totalling about $281 billion.

Microsoft’s huge contract from OpenAI parallels the massive deal signed by Oracle and OpenAI last year for $300 billion. On a smaller but still vast scale, OpenAI also agreed late last year to spend $38 billion with AWS for cloud and AI infrastructure services. (Quick side note: only in the Cloud Wars can a $38-billion deal be dwarfed by not one but two competitors winning deals 10X as big!)

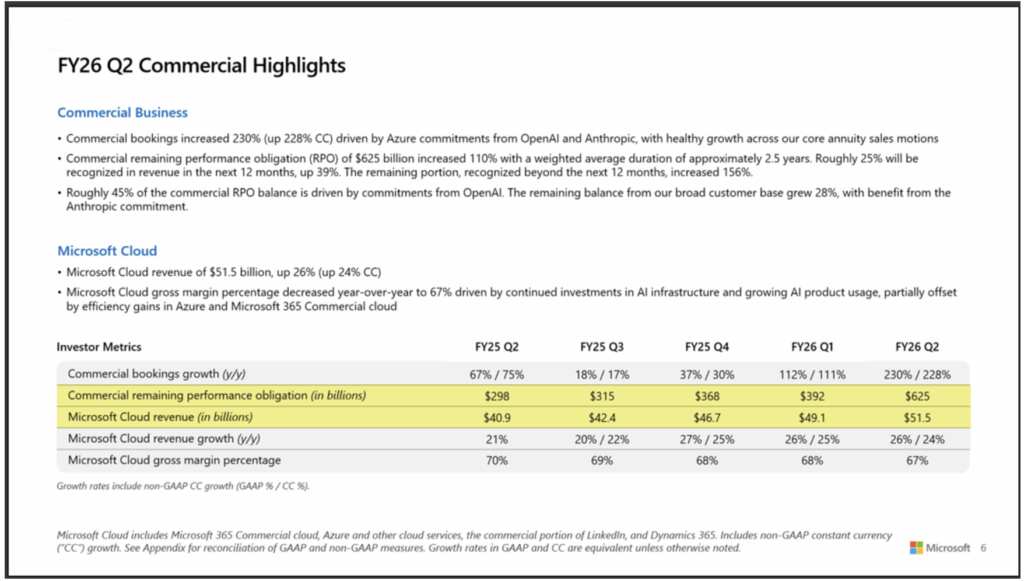

For its fiscal quarter ended Dec. 31, Microsoft said its cloud business — by far the world’s largest — grew 26% to $51.5 billion and pushed the annualized run rate for the Microsoft Cloud to a remarkable $206 billion.

The slide below from Microsoft’s Q2 earnings presentation shows the company’s ongoing powerful performance at a scale that few if any companies in any industry have ever reached:

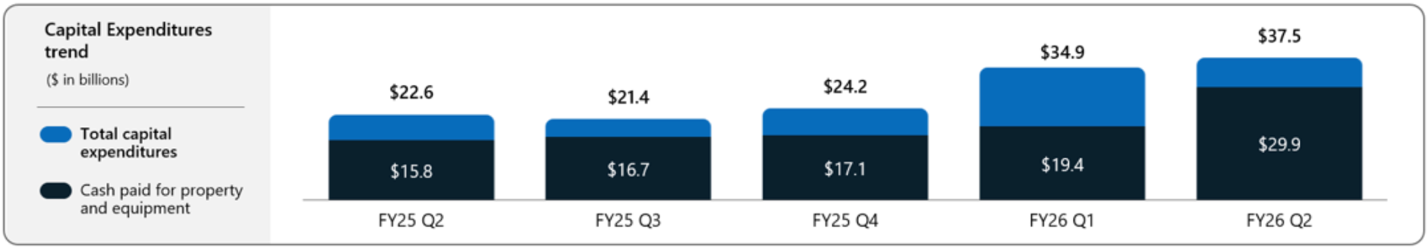

At the same time, Microsoft’s Q2 results also revealed the soaring cost of creating capacity for and fulfilling all of that unprecedented demand. The graphic below, taken from a slide in the Microsoft Q2 presentation, shows the enormous jump in CapEx that Microsoft must allocate to build out data-center capacity for not just the OpenAI deal but also for its other customers:

Speaking of those other customers not named OpenAI: Microsoft’s explosive RPO numbers come back down to Earthly levels when we set aside the huge OpenAI deal as well as a significant contract signed by Anthropic. Here’s how Microsoft itself described that breakout (slide 6):

“Roughly 45% of the commercial RPO balance is driven by commitments from OpenAI. The remaining balance from our broad customer base grew 28%, with benefit from the Anthropic commitment.”

Now, by mentioning that I’m certainly not taking anything away from Microsoft’s superb achievement in landing the colossal deal with OpenAI as well as its significant contract with Anthropic. Any way you slice it, RPO growth of 110% to $625 billion is remarkable.

At the same time, those numbers also show that with the exception of OpenAI and Anthropic, future demand for the Microsoft Cloud from that “broad customer base” is strong but not exactly booming. Let’s say the “benefit from the Anthropic commitment” made up two or three points of the 110% RPO jump — that would mean that future demand reflected in RPO for all of those other Microsoft customers was around 25% or 26% — again, strong but not booming.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Over the next week or two, as Google Cloud (#1 on the Cloud Wars Top 10) and AWS (#7) release Q4 numbers, I’ll be doing some broad comparative analyses of growth rates to offer some insight into how the world’s leading cloud and AI vendors are doing in their quests for customers’ hearts, minds, and wallets (Oracle is #2 on the Top 10, and Microsoft is #3).

Ask Cloud Wars AI Agent about this analysis