Nine months ago, Christian Klein was unexpectedly thrust into the role of co-CEO at SAP in the wake of Bill McDermott’s sudden departure.

Five months ago, the COVID-19 pandemic hit and wildly disrupted SAP’s business.

Three months ago, Klein become SAP’s sole CEO when Jennifer Morgan stepped down as co-CEO.

And this week, in the wake of all that upheaval and under the intense public scrutiny of quarterly earnings and a major announcement, Christian Klein made it unmistakably clear that he is fully in charge of one of the world’s most-influential tech companies not because of his title, but because of his willingness to set the direction for the company, make tough decisions and drive his will deeply into the marketplace.

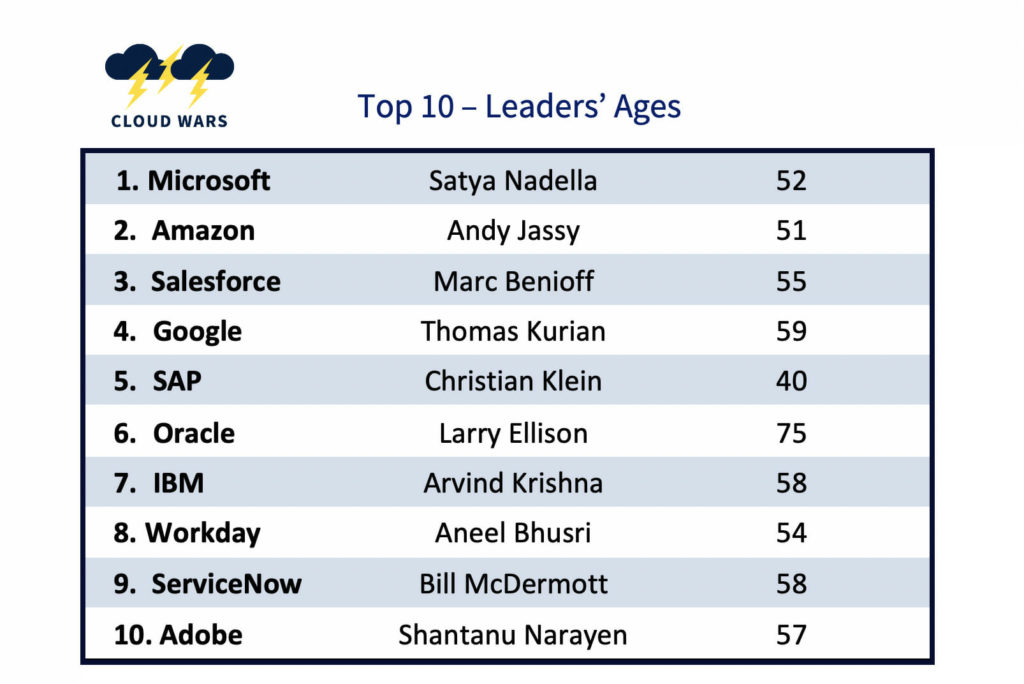

While I don’t want to overdo Klein’s age, it is certainly worth noting that he is all of 40 years old. In the hard-edged Cloud Wars, with billions of dollars in revenue and market cap at stake daily, the leaders of the other Top 10 companies range in age from 51 to 75.

I’m sure SAP and Klein would try to brush aside any discussion of age. And they’d have good reason to do so. But in spite of that, it is remarkable to see how naturally and almost easily Klein has managed the tumultuous ride he’s been on since McDermott’s departure in mid-October.

For Q2, SAP’s results beat analysts’ expectations and showed that the company’s traditional business as well as its fast-growing cloud business are vibrant and healthy. But it wasn’t just those numbers that demonstrated that Klein is in full control; rather, it was how he controlled the conversation with financial analysts on the earnings call and set a sharp, clear and aggressive tone for the company for the future.

That’s significant because any sign of uncertainty, hesitation or lack of complete clarity would have been taken as indications of weakness or indecisiveness or inexperience.

But in fact none of that happened; quite the opposite. Without thumping his chest or pounding a table or putting anyone down, Klein made it unmistakably clear that he knows the issues from every vantage point; he knows the customers and their unflinching expectations; he knows the voracious appetites of his competitors; and he knows that in a business of relentless innovation, he and SAP must create the future every single day.

Here are some examples of that.

SAP’s own lightning-fast transformation.

“This is our second quarterly earnings call during the pandemic, but our first full quarter under the COVID impact. And given the situation, it was a fantastic one. Of course, the crisis is far from over, but still our results reflect the progress we have made as a company since the pandemic hit hard in March.

“We have adapted to the situation by truly transforming into a virtual organization and allowing our customers to continue with their business. 17,000 customer go-lives in the past six months alone are showing SAP’s resilience in this crisis. Also, go-lives in the cloud are happening now in weeks rather than months. This shows how SAP enables our customer to react with agility and speed in this crisis.”

Be aware of the short term but play the long game.

“As we have said before, SAP is crucial to the business transformation of our customers and we are working to emerge stronger out of the crisis. If customers are in a difficult spot financially right now, we will provide commercial relief where needed, because we want to build partnerships for life.”

For the Intelligent Enterprise, delivering the numbers that support the vision.

“We have added over 500 S/4HANA customers in Q2, close to 40% of them net new. And we have seen a lot of competitive wins such as Carrefour, which also subscribed to a set of cloud solutions including Ariba. Other S/4HANA wins included Telefonica, Aon, BNP Paribas, Neptune Energy, Vedanta, Comix, and Deutsche Borse, taking the total S/4HANA customer count now to more than 14,600.

“We have also seen more than 700 customers go live on S/4HANA in Q2… Looking at sales performance in the second quarter, it is no surprise that we saw huge demand for solutions that increase resiliency while offering rapid return. Our portfolio is extremely relevant in the crisis. Commerce obviously had an absolute blow-out quarter, as did digital supply-chain management… Moderna, a U.S. biotechnology company, pioneering a vaccine candidate against COVID-19, just selected SAP to help with the distribution of the potential vaccine.”

Staking a claim to global leadership in HCM—and offering numbers to back that claim.

“At more than 8,000 customers, SuccessFactors continue to lead the global HCM market by a wide margin. They are also about to reach the 100 times 100k milestone, 100 global customers using SuccessFactors to manage more than 100,000 employees each. And we are very happy to report Google has gone live on Ariba.”

Delivering a compelling vision for optimizing SAP’s massive customer base.

“Moving beyond Q2, let me revisit a few key elements of our strategy. Number one, a clear focus in our existing markets, doubling down on categories where SAP has a right to win, differentiating via the broadest and deepest suite, end-to-end integration, real-time analytics, fully enabled artificial intelligence with concrete outcomes for our customers, a harmonized user experience, and very importantly, our leadership in Experience Management.

“Our PLM and intelligent-asset management partnership with Siemens is a prime example for this new focus, two market leaders coming together to take over the lead in Industry 4.0.”

Delivering new products and new technologies to meet emerging needs with a TAM of $200 billion.

“Number two, accelerate growth by expanding into new markets. Let me just give you two examples. The Industry Cloud: all industries are transforming and every new business model requires data and a strong integration into the backbone, which in many cases is in SAP’s core applications. This is our right to win.

“We will build modular industry apps helping our customers to stay competitive in their industry by adapting to new business models with fast time to value. We are co-innovating on our platform with our partners and customers the biggest plans in the world. This is a EUR170 billion market. Already this quarter, we closed a significant deal with a large utilities provider.”

Making hard decisions that will inevitably lead to second-guessing.

Before getting to Klein’s comments on the IPO spinout of Qualtrics, let me say I don’t really understand this one and don’t agree with the rationale—but at the same time, I applaud Klein’s decisiveness and his willingness to make a tough decision that will no doubt require him to defend it repeatedly. And I’ll go into why I don’t agree with this decision in a future piece.

“Finally, Qualtrics had yet another fantastic quarter with strong growth and is helping us to differentiate our core applications by adding Experience Management, especially the combination of with Success Factors, the Human Experience Management Suite resonates really well with our customers. By now, I’m confident you have all seen the news. Please allow me a couple of remarks before moving beyond Q2.

“Ryan and I are convinced that the proposed partial IPO marks a win-win situation and creates the best set-up for Qualtrics to fully tap the potential of a fast-growing Experience Management market. Under the leadership of Ryan and his outstanding team, Qualtrics will enjoy greater autonomy in expanding and leveraging its footprint, both within SAP’s customer base and beyond. We will remain Qualtrics’ majority shareholder. We will also remain its largest and most important go-to market and R&D partner, while giving Qualtrics the independence to broaden its base by partnering and building out the entire Experience Management ecosystem.”

Pushing back confidently on analysts who want more specifics in a time of great uncertainty.

At the end of a longer-than-normal earnings call, an analyst asked this question: “I mean, your unchanged guidance for 2020 essentially assumes no meaningful acceleration in the second half. Now, I know you had said that you anticipated the environment to sort of progressively improve. So, is it just you being conservative?”

I was very impressed by Klein’s reply and how it showed he has not only the confidence to push back, but also a complete and immediate grasp of all the relevant numbers and marketplace dynamics. So much so, in fact, that the analyst deserved what he got in Klein’s opening request to “get real.”

“But on the guidance, let’s be real here. I think we are very confident now based on how we have ended the first half year, but this is not yet the time to frolic or break any champagne bottles or anything like that. Let’s not forget, while the guidance assumes a continued improvement of further demand environment, we cannot take this for granted necessarily. There is still substantial uncertainty in the system. What about the development of infection rates? Is there a risk of a second lockdown? I think nobody can rule this out at this present time, even though everybody is hoping, of course, that it will not occur.

“And let’s also not forget that the seasonality for software licenses is becoming much larger in the second half year with the Q4, in particular, that has a much higher weight on software licenses. And given that uncertainty, I think it is absolutely understandable that we don’t want to get ahead of ourselves.

“We are glad that we did well in Q2, better than we expected ourselves. But that is not a guarantee for success in the second half year. We need to have our value story right for the customers.”

Concluding thought

Overall, Klein gave a performance of which a CEO of any age should be proud.

And for SAP, as it faces not only more competition but more-intense and more-capable competition than ever before, that ought to boost their already-high confidence to new levels.

Because Christian Klein has become a force to be reckoned with.

RECOMMENDED READING

SAP’s Secret Weapon: Month-Old Industry Cloud Already ‘Growth Driver’

SAP Will Battle Microsoft & Google for Customer Control, Says CEO Christian Klein

Microsoft Hypergrowth: Beyond Azure, Satya Nadella’s 5 Superstars

Why IBM CEO Arvind Krishna Earned an A+ for His Debut Quarter

Google Cloud Booms: Thomas Kurian’s Vision for World’s Fastest-Growing Cloud

Larry Ellison’s Miracle: Oracle Becomes Big-Time Cloud Infrastructure Player

Why Larry Ellison and Oracle Are Reinventing the Language of the Cloud

ServiceNow Will Triple Workforce in 5 Years, Says CEO Bill McDermott

Disclosure: at the time of this writing, SAP was among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!