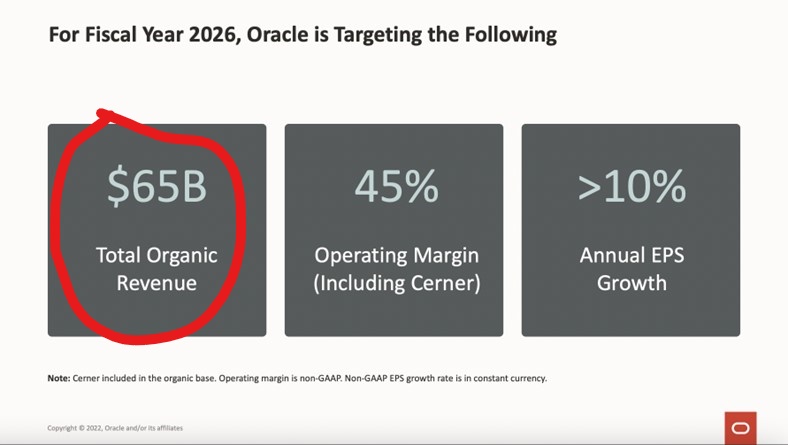

Leveraging its glitzy new status as the world’s hottest major cloud provider, Oracle is projecting it will reach $65 billion in total revenue for its fiscal 2026 powered by an uplift of 4-5X in infrastructure and 3-4X in applications over that time.

This is, I believe, the first time Oracle has offered such glimpses into its future performance, and the plan for achieving those ambitious cloud goals was laid out late last month during a financial analysts’ meeting at the Oracle CloudWorld event in Las Vegas. The charts shown below are from a presentation offered at that meeting by executive VP Doug Kehring, and those slides are available on the Oracle Investor Relations site.

Using several of those slides, I’ll offer an overview of that ambitious Oracle plan, which reveals the company’s belief that its massive product portfolio and huge installed base will inspire many of those customers to rely on Oracle to take their businesses deeply into the cloud over the next few years.

1. A Big From/To Challenge

For the current 2023 fiscal year ending May 31, Oracle is expected to generate total revenue of $50 billion. And as noted in the graphic at the top of this article, Oracle is projecting that it will grow to $65 billion within three years by the end of fiscal 2026.

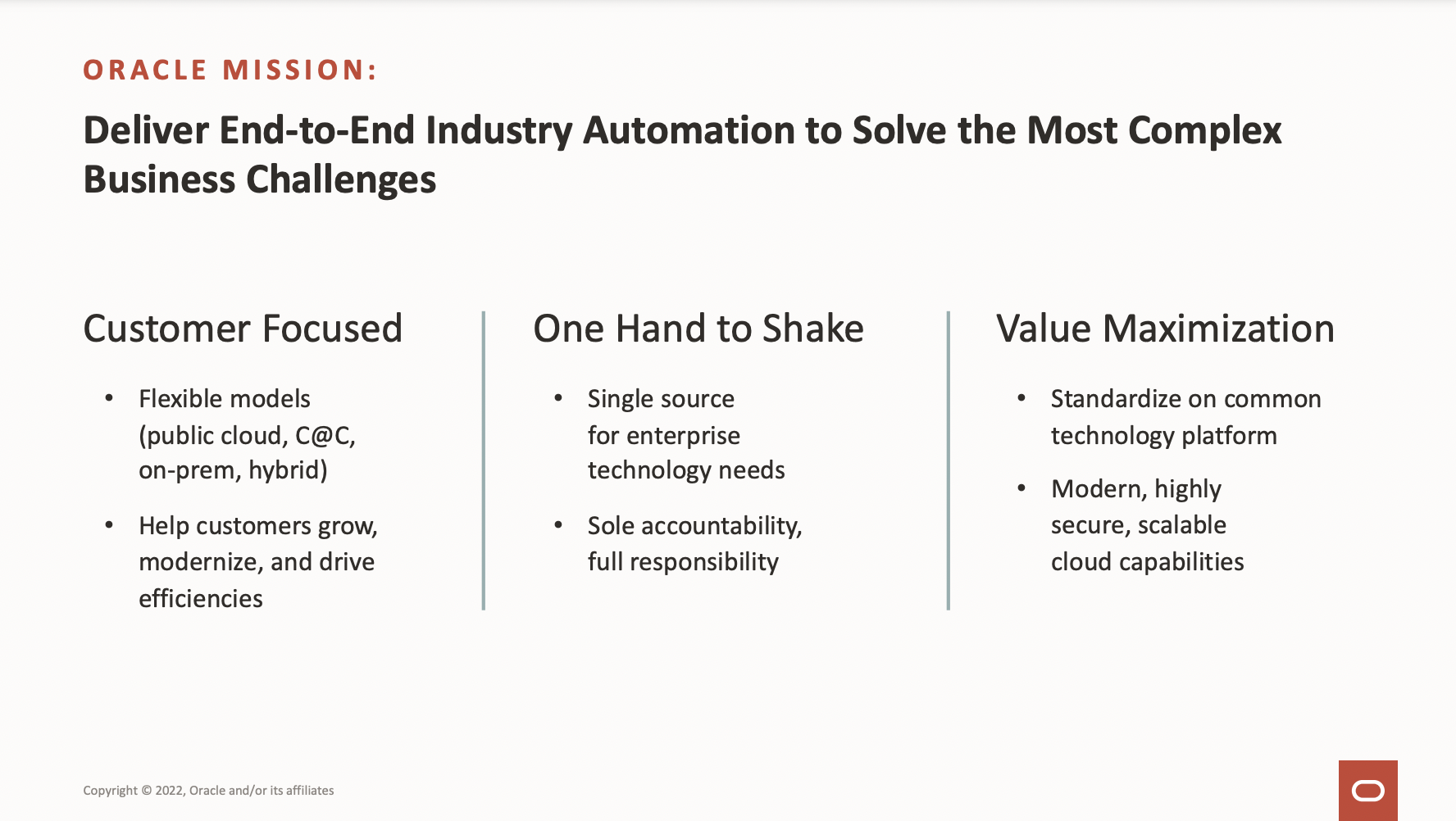

2. The Oracle Mission for that Adventure

“Deliver end-to-end industry automation to solve the most-complex business challenges.” I’m very impressed by Oracle’s willingness — indeed, its eagerness — to fuse industry-specific outcomes into its core mission during its next phase of cloud growth and evolution.

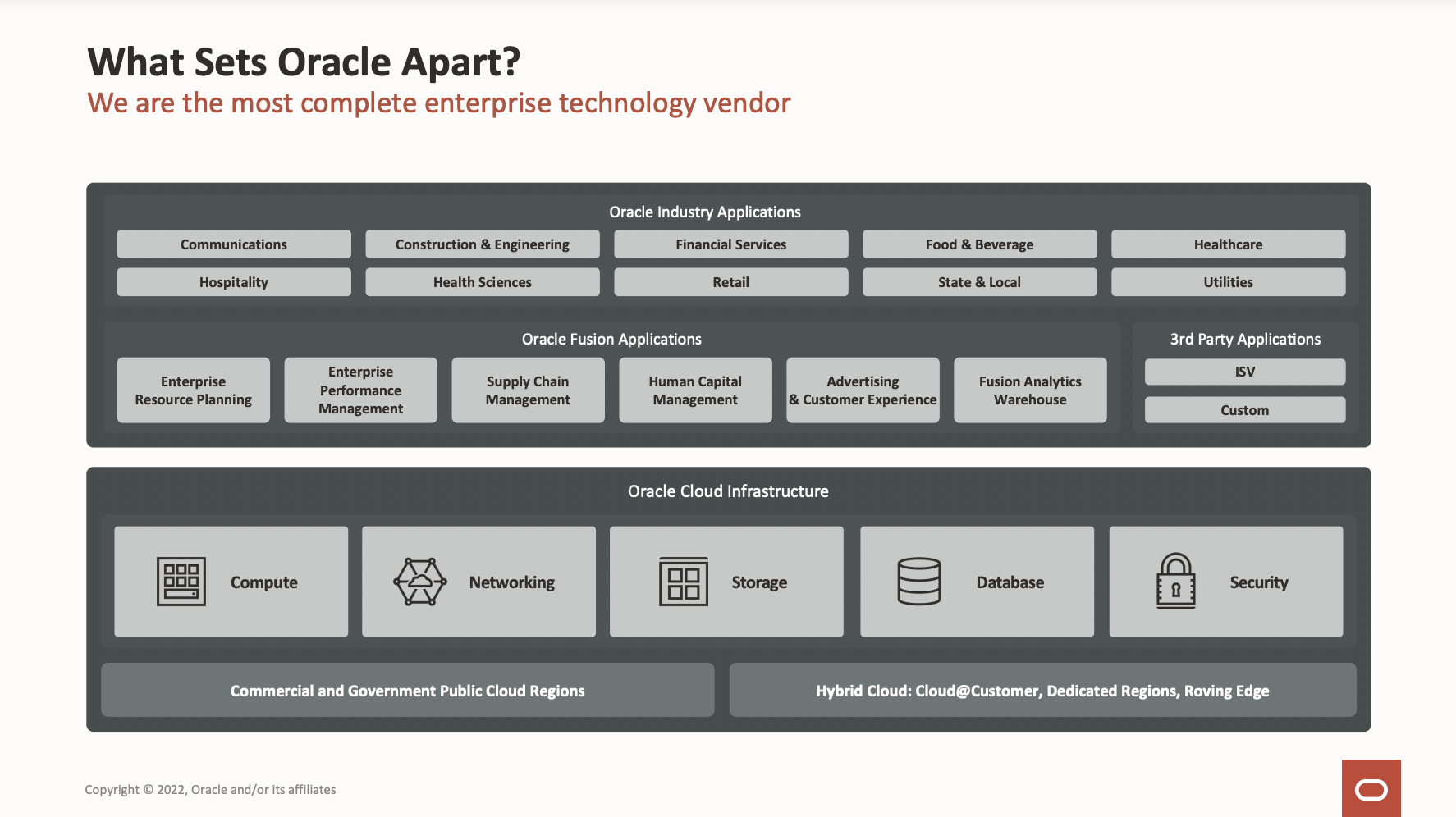

3. How Oracle Is Looking To Differentiate Itself From Some World-Class Competitors

I think it’s pretty bold of Oracle to bill itself as being “the most-complete enterprise technology vendor” and to use that position to convey the message of “why would anyone go anywhere else?” But it’s not just the breadth of Oracle’s portfolio — it’s also the performance of its new cloud products and technologies, which are an unbreakable link to the standard founder Larry Ellison set decades ago and has kept in place ever since.

4. Turning That Big Portfolio Into Big Customer-Driven Momentum

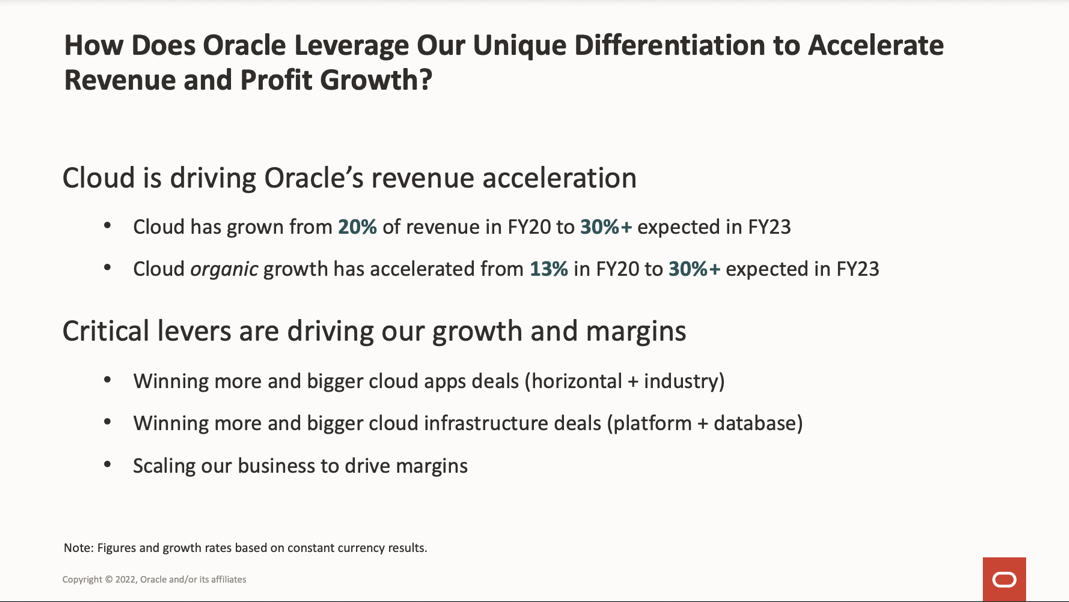

From the slide below, here’s a number that jumped out at me: In fiscal 2020, Oracle’s organic cloud growth rate was 13%. For fiscal 2023, Oracle is projecting that figure will climb to 30%.

5. Cloud Applications Will Show Massive Growth

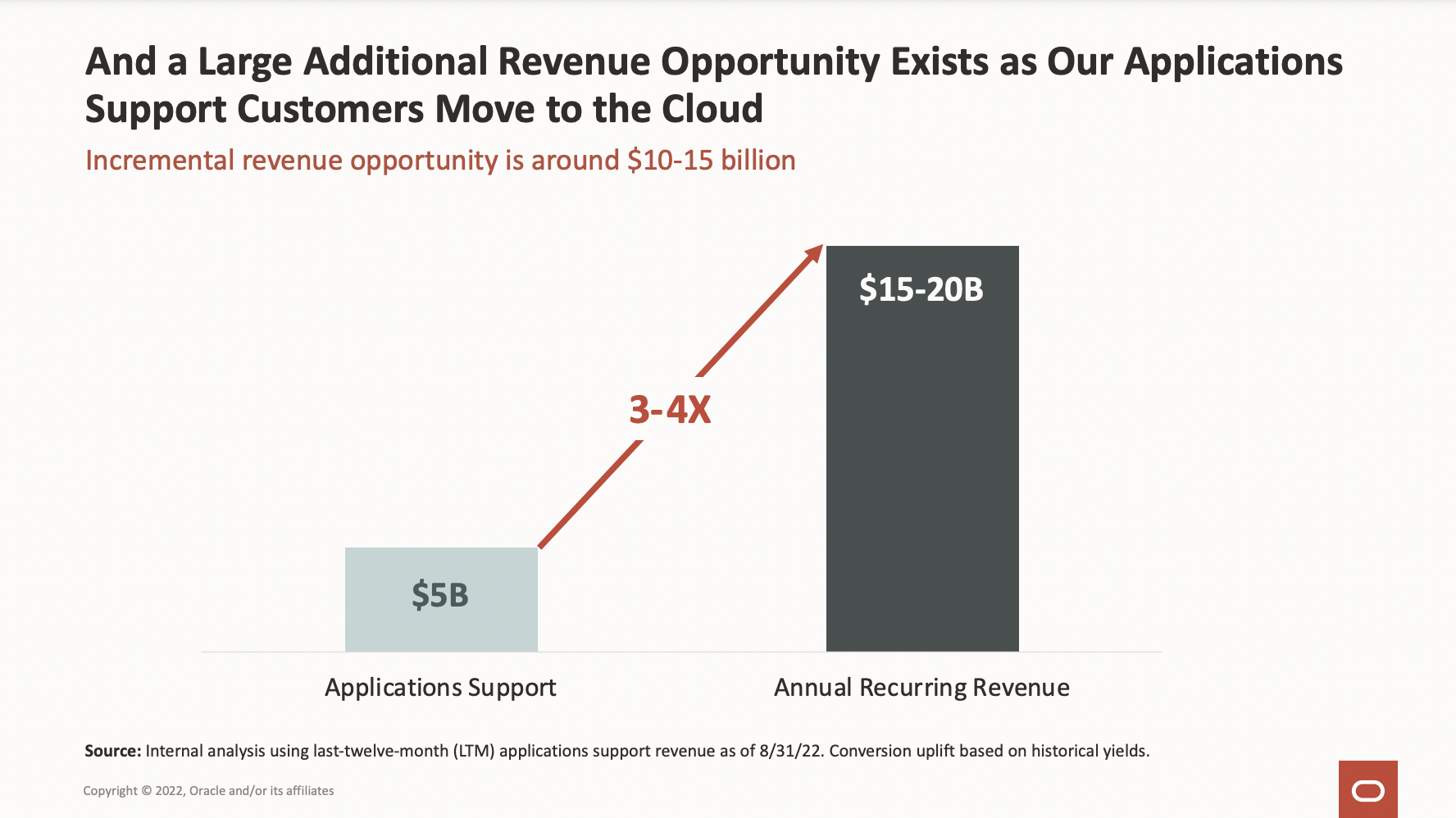

Using the current figure of $5 billion in applications support as a baseline, Oracle believes it can boost that number by 3X or 4X for 2026, which translates to an additional $15 billion to $20 billion.

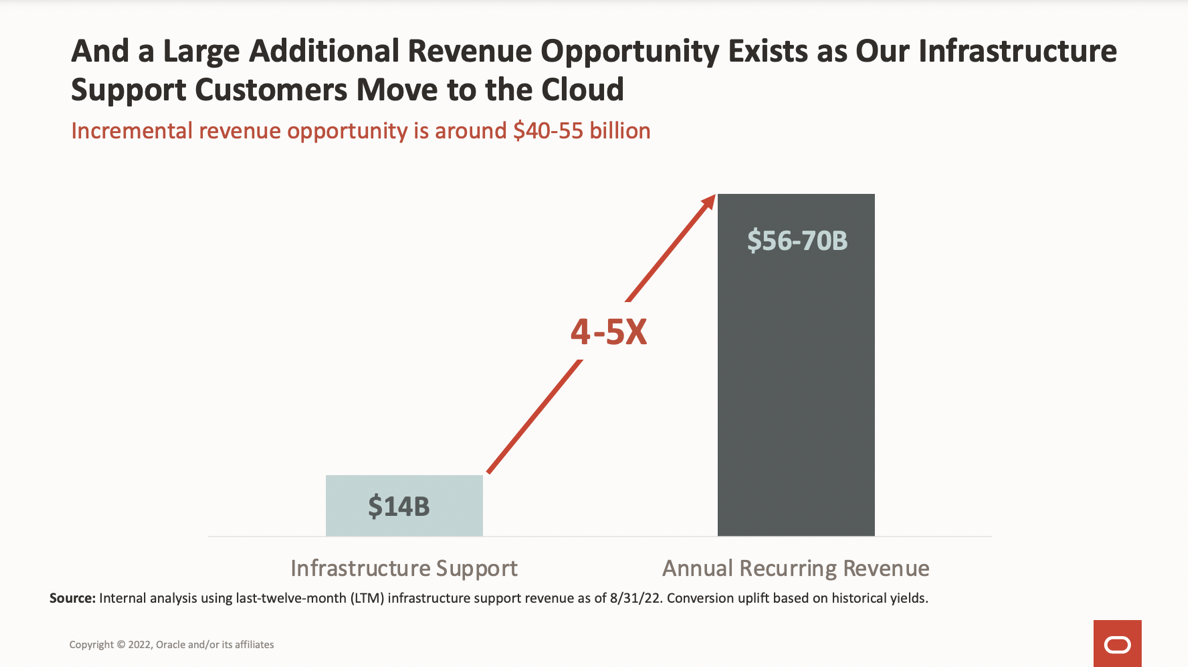

6. Even Bigger Growth Coming From Cloud Infrastructure

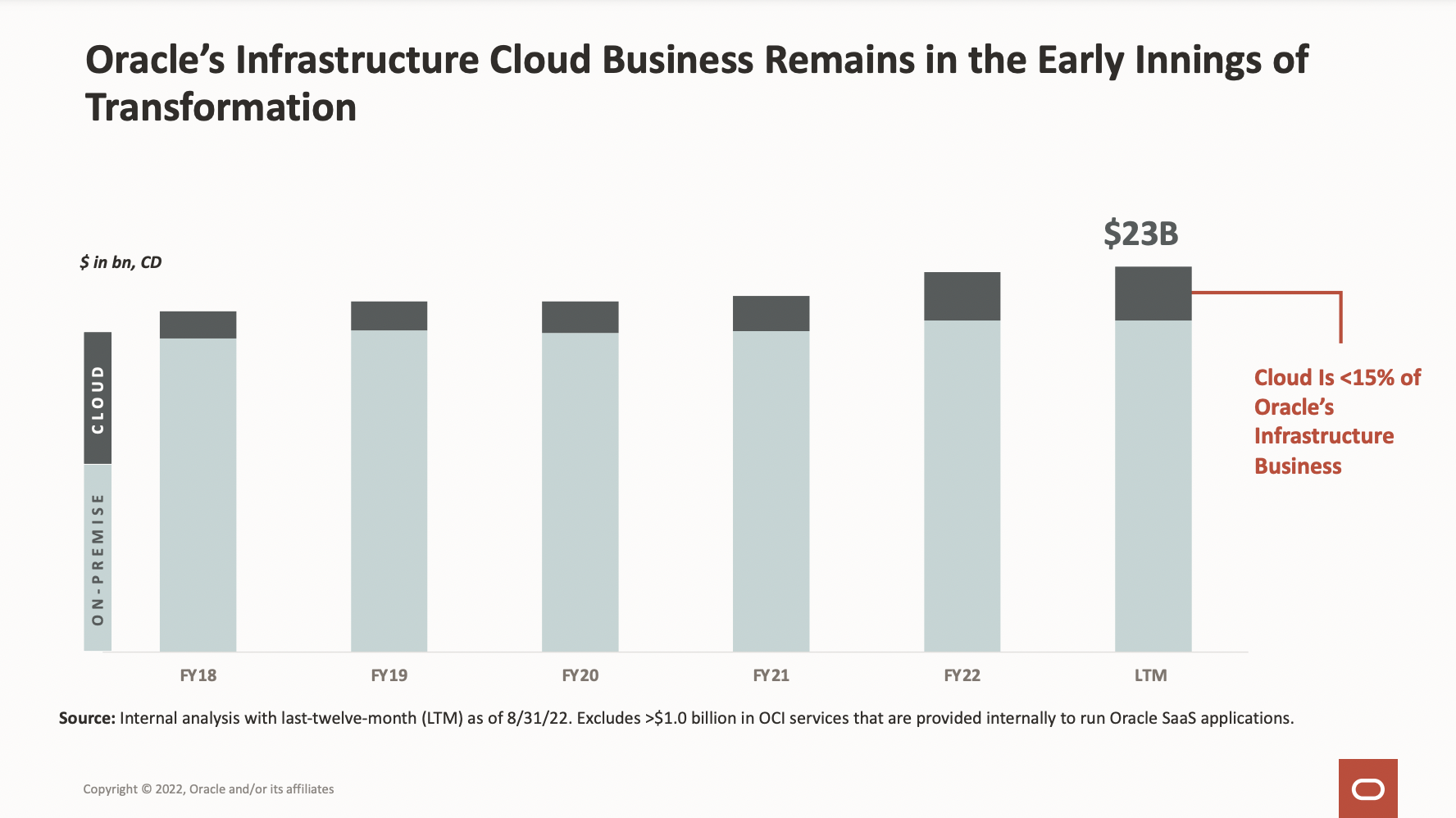

One slide from the presentation that I have not included here declared that Oracle has 18,000 cloud-infrastructure customers, and I would bet that number far exceeds what most people would have expected from Oracle. As you’ll see below, cloud infrastructure is still a relatively small portion of Oracle’s overall infrastructure business across both on-premises and cloud. But as you’ll see in the next slide, Oracle is projecting that this picture will change dramatically in the three years between the end of the current fiscal year in May of 2023 and May of 2026.

7. The Infrastructure Boom: Oracle as “The Hot Startup”

When Kehring reached this point of his presentation, he made a compelling point about how Oracle and Amazon have flipped personae in cloud infrastructure.

“As we like to talk about, we’re not the legacy vendor in the infrastructure space—we’re the hot startup. And why is that the case? Because we built the second generation of cloud infrastructure. And that makes AWS the legacy vendor,” Kehring said.

Do the numbers bear out those profiles? Well, Ellison has promised that some big customers are on the verge of jumping from AWS to Oracle and that he’ll have some details on that during Oracle’s quarterly earnings call in early December. But based on the uplift Kehring portrayed in his comments and on the numbers shown below, I’d say the hot startup shoe could fit Oracle very nicely.

Final Thoughts

Once again, what a great time to be a buyer in the greatest growth market the world has ever known! The competition among Microsoft, Amazon, and Google Cloud is already ferocious, and if Oracle’s able to scale up to meet the projections outlined above, then it will escalate that competition to extraordinary intensity.

And more than ever before, the big winners in the Cloud Wars will be the customers.

To see more Cloud Wars content, including all recorded sessions from June’s live Cloud Wars Expo, please register here for your Cloud Wars Expo on-demand pass. The on-demand pass, which is included with your Acceleration Economy subscription, gives you access to approximately 40 hours of invaluable educational content from last month’s event.