While Google Cloud Q3 revenue was only a third of Microsoft’s and half of AWS’s, its ongoing ability to grow faster than Microsoft and much more rapidly than AWS demonstrates that it is winning a sharply disproportionate share of new cloud and AI business relative to its larger competitors.

And while that sort of competitive dynamic has always been important, it takes on even greater significance here in the early days of the AI Revolution because what customers want today and into the future is very different from what they wanted in the past. And the companies harnessing the momentum of this new type of business are going to be leaders of the future.

I’m sure some people will not agree with that. Over the past few years, as I’ve highlighted Google Cloud’s consistent ability to outgrow Microsoft Cloud and AWS by significant margins, I’ve been lectured by commenters — often from Microsoft and AWS — who condescendingly point out that it is easier to generate high growth rates from a small base than from a large one. (No way!?!)

That is of course true — and it’s also utterly irrelevant. I doubt very much that Microsoft’s Satya Nadella and Amazon’s Andy Jassy have dismissed the high-growth numbers put up quarter after quarter after quarter by Google Cloud because, well, the laws of mathematics say it’s no big deal.

But in the real world of the Cloud Wars — the greatest growth market the world has ever known —the advances made by Google Cloud have no doubt sparked some particularly frank conversations among the sales leadership at AWS and Microsoft because what was once annoying has now become threatening.

Two sets of Q3 numbers will bring that assertion to life: first, the Q3 revenue numbers for each hyperscaler along with its overall Q3 revenue share; and second, the incremental new Q3 revenue versus Q2 for each company along with its share of that new Q3-over-Q2 revenue.

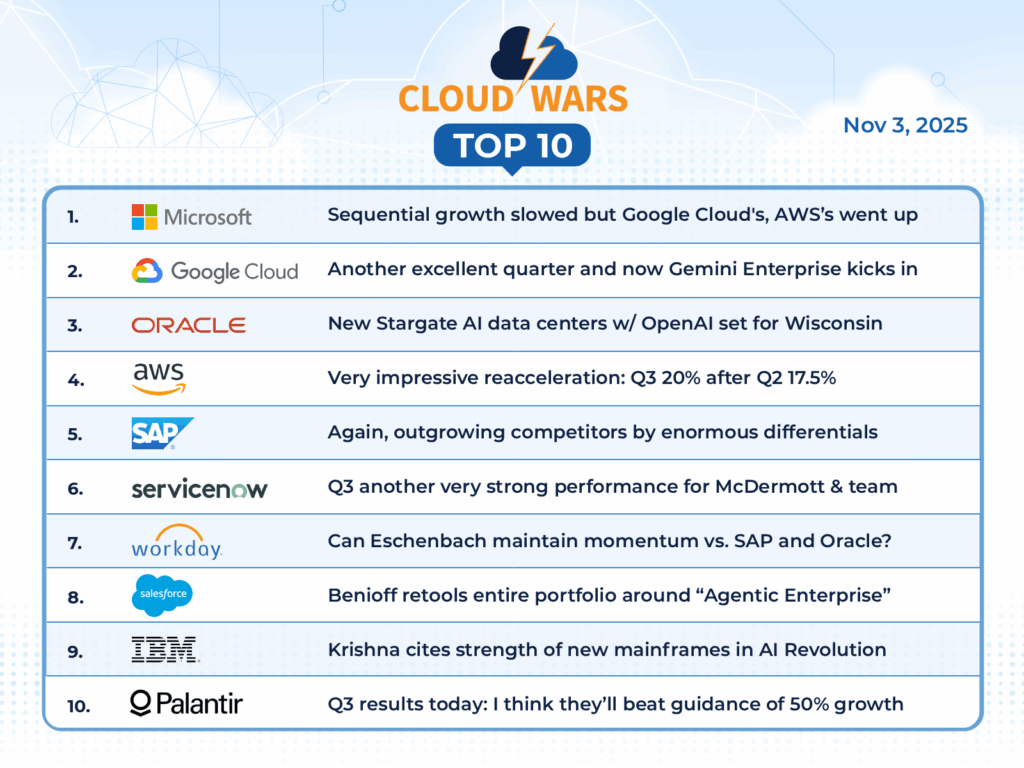

Q3 revenue and respective shares out of combined total of $97.3 billion

- Microsoft Cloud: $49.1 billion, representing 50.4% of Q3 total;

- AWS: $33.0 billion, representing 34% of Q3 total; and

- Google Cloud: $15.2 billion, representing 15.6% of Q3 total.

Now, check out which company won how much of the incremental new Q3 revenue.

Q3 incremental revenue versus Q2 out of combined total of $6.1 billion

- Microsoft Cloud: $2.4 billion, or 39.3% of new Q3-over-Q2 revenue;

- AWS: $2.1 billion, or 34.4% of new Q3-over-Q2 revenue; and

- Google Cloud: $1.6 billion, or 26.2% of new Q3-over-Q2 revenue.

So what do we see? Well, looks like AWS was very steady: 34% of Q3 revenue and 34.4% of new revenue among the three.

But Microsoft, while reaping 50.4% of the total, took “only” 39.3% of the new, whereas Google Cloud grabbed 15.2% of the total but snatched 26.2% of the new.

Here’s another way to look at this significant shift in who’s winning new business here in the AI Revolution:

Since Microsoft’s fiscal-Q1 revenue of $49.1 billion is more than 3X that of Google Cloud’s $15.2 billion, then is it not reasonable to think that — if nothing disruptive is happening — Microsoft would be able to leverage that huge disparity to generate 3X (200%) or even 2X (100%) more than Google Cloud in new business? But that is absolutely not the case: when it comes to new business, Microsoft’s volume advantage over Google Cloud was just 50%.

In the same way, AWS’s Q3 revenue of $33 billion is more than 2X (100%) greater than Google Cloud’s $15.2 billion — but when it comes to new business, its multiple over Google Cloud tumbles to 33%.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Momentum, Momentum, Who’s Got the Momentum?

Size matters, and there’s no disputing that, and to their great credit Microsoft and AWS have each spent the past 15 or so years building superb businesses with financial results that are the envy of most of the companies in the world.

But in the Cloud Wars, the customers’ needs and customers’ opportunities are changing and intensifying more rapidly than ever before — and that’s why this analysis of who’s winning how much of the new business is so important.

And the numbers show that while Google Cloud is by no means the biggest of the three original hyperscalers (Oracle is the new and untraditional entrant), it is doing many, many things so well that it is winning much bigger chunks of new business than its relative stature would lead us to believe.

The new-business numbers also show that Microsoft is not coming close to sustaining its commanding lead, and that Google Cloud has gouged out a huge chunk of new AI Revolution business that Microsoft (and AWS) were no doubt after.

Final Thought

Size matters. But right now, extreme relevance and innovation and capability and customer-alignment matter just as much if not more.

So kudos to all three companies for outstanding Q3 results, but Google Cloud deserves particular credit for showing that what customers wanted in the past is not necessarily what they want today and into the future.