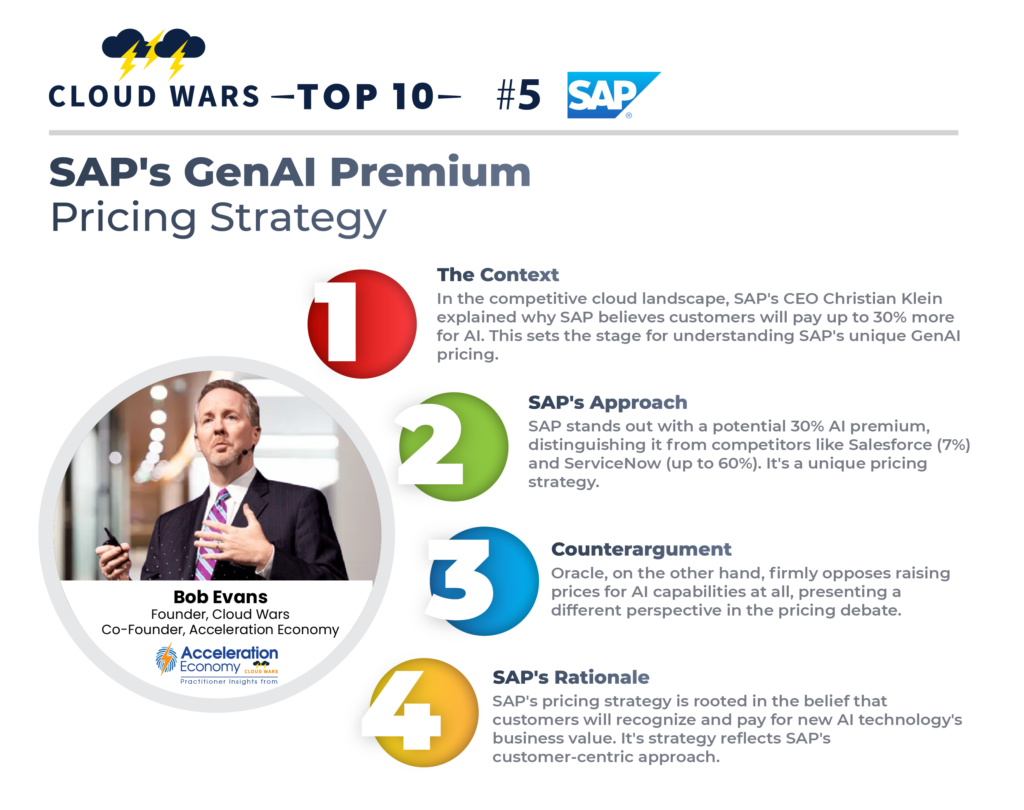

As the Cloud Wars Top 10 companies wrestle with whether to charge for their rapidly proliferating portfolios of new generative AI (GenAI) capabilities, SAP CEO Christian Klein last week explained in detail why he believes SAP customers will pay AI premiums of up to 30%.

I believe those decisions over whether to charge for these highly advanced and transformative new AI services will surely become one of the most intriguing factors in the GenAI Revolution, and SAP’s position of a 30% AI premium falls somewhere between that of Salesforce (about 7%) and ServiceNow (up to 60%).

However, Oracle’s top product executives said they will not be boosting prices as new AI capabilities are infused into the company’s broad product portfolio, with longtime executive vice-president of applications Steve Miranda going so far as to say that demanding that customers pay more for AI is “silly.”

As I wrote in a Sept. 25 analysis headlined “Oracle Execs Vow No Price Hike for GenAI; Premium Pricing ‘Silly’“:

“That’s just a silly viewpoint…. When self-service HR was created, did they want to charge extra for that?” Miranda emphasized that a single instance of Fusion Cloud applications means that all customers will get the new GenAI capabilities, and he scoffed at the notion that Oracle would ever consider offering “old ERP and also AI ERP.”

From that same piece, here’s Oracle EVP Juan Loaiza, who heads up mission-critical database technologies:

“Geez, I think 25 years ago when we added some AI stuff into the Oracle Database, we might have changed the price for that. But now, we’re making all of these new AI features free with the database — that’s just the new normal.”

Well, SAP CEO Klein certainly doesn’t see it that way, and during last week’s Q3 earnings call — during which SAP reported cloud revenue was up 23% to $3.82 billion — he spelled out in detail why SAP believes customers fully comprehend and will pay for the new business value that the new technologies and solutions can deliver.

During the Q&A portion of the call, analyst Adam Wood of Morgan Stanley asked about the pricing premium, with the heart of his question being this: “I think some of your competitors have said they feel AI copilots and so on are really just table stakes in the battle so they don’t feel there’s room to extract a lot more value from customers. Could you talk a little bit about what’s different in the SAP portfolio?”

From Klein’s lengthy reply, here are the key points:

- SAP has developed more than 100 AI use-cases;

- In procurement, SAP Business AI “is helping to source from thousands of suppliers: the best supplier based on cost, based on quality, and in the future also on ESG data.”

- “Joule [SAP’s new AI assistant] will be able to answer questions like, ‘Please help me to reduce the carbon footprint in my supply chain by 10% while making sure that my profit is not getting under pressure.’ Or, ‘Give me the suppliers where I can deliver on time but also reduce my carbon footprint and keep my contingent cost at the same level.’ “

- At the data level, Klein said, SAP has taken a number of steps to simplify the process for customers while also delivering better outcomes: “Because we can cross-correlate the data, we built this foundational data model in the neural network. And then with Datasphere, we can also enhance that with unstructured data.”

- As customers in every industry prepare to ramp up their AI capabilities, Klein reiterated the significance — and value — of clean data for businesses: “I mean, in the B2C end, you can ask ChatGPT for a question for speech and you get a proposal for a speech. In the B2B world, accuracy and data quality is of utmost importance. So all the work we did on BTP over the last three years to integrate and also harmonize our data model is extremely now paying off in high-quality data and is the foundation for SAP Business AI.”

- And while businesses are eager to get more data into the hands of more people, controls are still essential: “You can ask Joule a question, but not every employee and every company should see your group P&L. So you need an authorization concept and this is also very important that we have the authorization layer for almost every business data in the company.”

Later in the Q&A session, when another analyst raised the issue of charging a 30% premium for GenAI capabilities, Klein focused his response on the importance of giving customers a range of choices and allowing them to pick the approach best-suited for their business.

“Yes, the premium offering has a premium price, but, of course, we view that as ‘customer first.’ So we really looked at the value we’re creating, and so you find new sustainability capabilities in there. And advanced finance capabilities like cash-flow optimization: we asked customers who want to improve their cash flow by 2% or 3% using better payment terms, etc. And on top of all that, we have AI,” Klein said.

“So it’s a real premium package with real value, and we see actually positive customer feedback for those ones who actually are our first customers. And then second, let’s not forget, we’re also offering AI embedded in our products with a consumption-based pricing. So you don’t have to go for the premium package all at once — you can also consume our Business AI as part of our solution in a pure consumption-based pricing model.

“So we give customers choice, which I feel is the right way to go.”

Final Thought

One of the wonderful things about the Cloud Wars here in late 2023 is that the power of the cloud unleashed by the world-changing tech vendors is calculated and ultimately determined not in some hermetically sealed lab but by business-technology leaders who are desperately seeking transformative capabilities as the AI era kicks in.

Will they side with the approach advocated by Klein and SAP that a pricing premium is fully justified in exchange for the enhanced business outcomes GenAI can deliver? Or will they go with the outlook embraced by Oracle, which is that the infusion of GenAI capabilities into every product and technology does not deserve a price increase and is simply, as Oracle’s Loaiza put it, “the new normal”?

I believe we’ll find that there’s plenty of room for both approaches, as well as for ServiceNow’s 60% situations and Salesforce’s 7% models. It all depends on how committed the vendors are to not just meeting but certainly exceeding the customers’ highest expectations.

All in all, the big issue is not what the vendors propose — it’s what the customers decide.

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.