Sharply differentiating Workday’s value proposition in today’s challenging times, co-CEO Carl Eschenbach said the company’s strong Q3 results reflect strong customer demand for talent solutions, more consolidation among apps suppliers, and generative artificial intelligence (GenAI) as a business imperative.

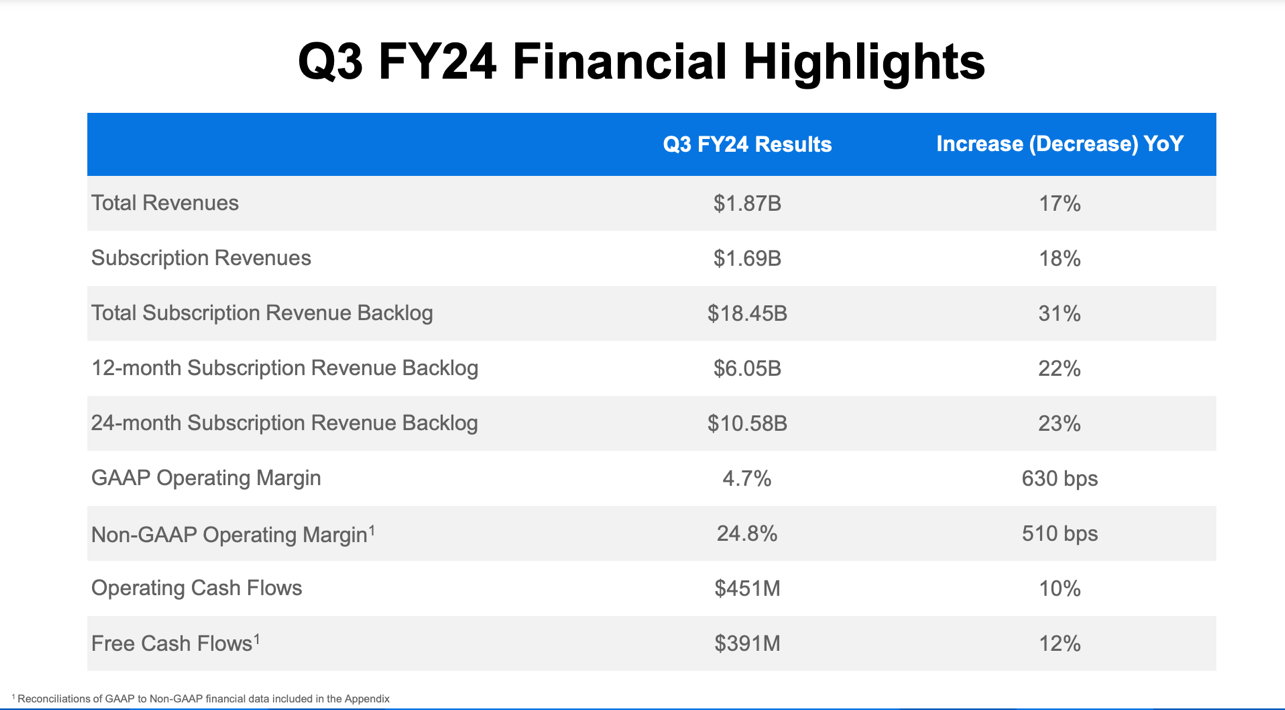

Eschenbach offered those perspectives in Workday’s fiscal-Q3 earnings call this week during which the company offered these key details:

Note that Eschenbach did not trot out the “digital transformation” line, did not cite “optimization” programs among customers, and did not conjure up the sound of fingernails scraping down the blackboard by intoning how customers want to “do more with less.”

I for one find that a very welcome indication of the type of candid and intelligent commentary that we can expect from the man who will, in a few months, become the sole CEO at Workday as co-founder and current co-CEO Aneel Bhusri makes his long-desired move to executive chairman.

Another mark of Eschenbach’s presence can be seen in the third line of the graphic above: total subscription revenue backlog jumped a whopping 31% to $18.45 billion as more customers are making large-scale commitments to Workday for HCM and Financials.

And those customers, said Eschenbach, are making it clear that they’re looking to Workday to help them:

- establish better talent programs to help drive better employee experiences;

- consolidate from an unwieldy portfolio of apps vendors to a manageable core; and

- turn their GenAI hopes and dreams into business outcomes.

Here’s how Eschenbach framed it in his opening remarks on the Nov. 28 earnings call:

“In speaking with customers, prospects, and partners at these events, a few things stood out to me. First, talent continues to be a top C-suite priority,” Eschenbach said. “In this macro environment, businesses are looking to scale and drive productivity. They can’t achieve both outcomes by simply hiring more.

“Leaders are turning to Workday to help them reskill and upskill their workforce, all while delivering a great employee experience that helps them reduce attrition and ultimately drives productivity.

“Second, leaders are continuing to consolidate their technology footprint on a true platform to realize total cost of ownership benefits while also accelerating their operations. Workday is perfectly positioned to benefit as the intelligent digital backbone businesses can rely on to manage their most precious assets — their people and their money,” he said.

“Finally, AI — in particular, generative AI — is becoming a business imperative.

“As a trusted partner and a market leader with over 65 million users under contract, we can uniquely drive efficiencies and improve the employee experience” via the ongoing fusion of AI into every element of Workday technology.

Later, during the Q&A portion of the call, Eschenbach was asked to describe the key drivers behind Workday’s Q3 performance and he offered some additional thinking on those three top-level issues for the C-suite.

“There are probably three demands we’re seeing right now out of the C-suite, and No. 1 is talent. Talent is clearly a C-suite priority, and companies are all focused right now on reskilling and upskilling their workforces,” Eschenbach said.

“At the same time, those leaders are also pushing hard to “consolidate their IT spend. And in doing so, they’re driving more of a platform approach, and we have the platform that people are consolidating on top of. And when you do that, you have a better total cost of ownership.”

Eschenbach then cited the ubiquitous topic of AI as the third driver for customers, noting that while it has clearly become “a business imperative,” customers are still not sure how “to figure out how to leverage it.”

But as they do, he said, trust will become a defining issue.

“They’re going to lean toward vendors who they trust, like Workday, to be able to deliver those AI solutions and really drive impact to their employees and their overall productivity gains they’re seeking as a company.

“And that’s what we’re seeing.”

Final Thought

In response to the strong customer demand Workday is seeing across those and other areas, Workday raised its fiscal 2024 subscription-revenue guidance to $6.598 billion, which represents growth of 19% for the fiscal year ending Jan. 31, 2024.

So that means Workday’s put together, under Eschenbach’s leadership, three straight strong quarters; it’s boosting expectations for its fiscal Q4; its forward-looking “total subscription-revenue backlog” jumped 32% last quarter and 31% in this most-recent quarter; and the company has carved out a unique and highly strategic position in the wickedly competitive Cloud Wars.

All in all, I’d have to say the Eschenbach Effect is in full swing.

Discover how AI has created a new ecosystem of partnerships with a fresh spirit of customer-centric cocreation and a renewed focus on reimagining what is possible. The Acceleration Economy AI Ecosystem Course is available on demand.