With the second half of 2023 in full swing and 2024 on the horizon, it’s an opportune time to evaluate the state of the process mining market, which has been a powerful, reliable source of cost reduction in financial processes such as accounts payable and procure to pay.

Now customers are building upon those considerable gains by taking steps to fully optimize processes that directly impact revenue and customers.

Some of the highest priority and highest impact process-mining initiatives — based on interviews with the five vendors participating in Acceleration Economy’s Process Mining Battleground — customers, and CXOs, include:

- Streamlining the move of core business applications, notably enterprise resource planning (ERP), to the cloud while transforming their underlying processes

- Optimizing customer-facing processes that are core to the business such as policy management in insurance, loan processing in banks, and managing airplane schedules and logistics in transportation

- Using generative AI and other approaches to democratize process mining in customer organizations with the goal of multiplying its financial impact

Streamlining Application Migrations

Process mining has long relied on data from customers’ core, run-the-business ERP systems to evaluate the performance of underlying processes and recommend optimizations. That means process mining and ERP systems are tightly integrated.

Now these systems are growing even closer as customers look to process mining to help them move them to the latest, most optimized versions of ERP, which typically means migrating to the cloud. And vendors are tailoring products and methodologies to make the transitions go smoothly.

That’s a critically important development because ERP migration (or “re-platforming,” depending on the company you speak with) has been one of the more nettlesome processes for customers, at times impeding their moves to the cloud because of the time, cost, and risks involved. Factors that stand in the way: acquisitions that lead to a diverse set of incompatible or inconsistent ERP systems, non-optimized underlying processes that make it difficult for customers to clearly understand the current “as-is” state, and custom code that may or may not need to be migrated.

The typical digital transformation or ERP migration requires an evaluation of current processes in order to build a robust migration plan. “The way we usually do that is we sit in a room together and we map out that process,” says CIO Kenny Mullican, an Acceleration Economy practitioner analyst. “It’s all a matter of people remembering what they do, and what I found is that people aren’t very good at remembering what they do.” Contrast that with the “empirical view of real-world process performance” that process mining can provide.

So how is the vendor community addressing this need?

SAP Signavio’s Approach

SAP Signavio has lots of direct experience: With an ERP-installed base of 40,000 companies, many looking to migrate to its latest S/4HANA, the company applies a fast-time-to-insight approach that is streamlined relative to “classical” process mining, according to SAP Signavio general manager Rouven Morato.

The company’s Process Insights application allows customers to connect to an existing ERP system in less than an hour and gain insights that will help them understand, for example, the automation rate in their procure-to-pay process vs. how much automation is possible.

“We are mapping the process problem that we identify based on the capabilities that S/4 has,” Morato explains. “So we can tell a customer, if your automation rate is only 8%, there are four capabilities in S/4 that would help you to automate your process further. It does that automatically for you.”

This approach to rapid insights is important for large enterprises in particular, Morato says, citing the example of a current customer that can’t use the full process mining approach with the 50+ ERP systems it has in place today. “Time to value is very important specifically for ERP transformations because you don’t have 18 or 24 months to prepare such a transformation just to identify the value.”

SAP Signavio officials note the company aims to guide customers to aim higher than an ERP migration to a mindset of launching a new, optimized system with ongoing evaluation of how it’s functioning.

Celonis’ Approach

Celonis is actively engaged with a number of Fortune 100 companies that are looking to migrate to SAP’s S/4HANA as well. The company has developed an application called System Transformation Readiness and is working with its ecosystem partners to deliver successful migrations.

One of the major objectives, according to customer transformation advisor Kerry Brown, is to develop a clearly defined scope to ensure customers are migrating what they need to migrate — and not a lot more. Companies sometimes find that not all of the custom code they build gets used in production. “We want to help customers shorten the implementation by doing only what they need to do,” she says. “It’s a matter of tightening the scope so you have less scope creep issues.”

That’s an important consideration given the high stakes and financial pressures associated with major ERP projects: “You’re making a big investment with an ROI expectation. The kind of visibility you see now [with process mining] is going to allow those companies to really be successful by seeing what’s happening and continuing to reinforce and move towards ROI and a value-based outcome,” Brown says.

Application of process mining replaces the typical approach of “cross-functional process mapping on the wall” driven by the individual — and not always consistent — experiences of subject matter experts. Celonis’ methodology is designed to help customers control costs and scope, minimize risk, and maximize value realization.

Apromore’s Approach

In the case of Apromore, the company positions its methodology for major software enhancements as accelerating digital transformation through “re-platforming.” That can entail an upgrade to the latest version of the same vendor’s system (e.g., SAP to S/4 HANA) or it can be a change from one system or legacy platform to a modern cloud system.

Marcello La Rosa, CEO and co-founder, described Apromore’s methodology and product features for re-engineering processes:

- Mining the “as-is” process to understand how it’s performing

- Designing and modeling the process to be implemented

- Simulating the future process under different workload scenarios

- Monitoring after the transformation to ensure things are improving as expected

ANZ Bank is a customer that has worked with Apromore to re-platform from a legacy system to Salesforce and other applications. The bank delivered a dramatic increase in the level of automation within its new retail banking products by using Apromore’s simulation to determine the optimal number of resources to support the new products against different requirements.

Another customer, a multi-utility company in Europe, is using Apromore as it looks to consolidate and identify best practices in procure-to-pay processes on S/4 HANA, moving from multiple SAP ERP systems brought in through mergers and acquisitions.

Mindzie’s Approach

James Henderson, the CEO of process mining vendor mindzie, says that the introduction of process mining data into these analyses replaces individual opinions or lore with facts and data. “That’s huge when you sit in front of an executive or a board that you need to sponsor you for millions of dollars as part of a migration,” Henderson says.

Mindzie’s Henderson says his company has focused on helping customers address the sheer labor involved in documenting how current processes and systems operate as a migration is planned. The key benefit of using process mining is the opportunity to make data-driven decisions with confidence that “you know exactly how a process works for your business and, in that data-driven decision, you can also decide where you need to invest resources,” he says.

Major system migrations, particularly those involving the ERP systems that literally run businesses, are fraught with risk if they are not managed proactively. As CXO practitioners have noted, that migration in the past has too often started with inconsistent human interpretations of how things currently work.

With those dueling points of view, it’s no wonder that migrations can go off the rails, especially when they start off from a point of inaccurate and biased views. Being able to apply a neutral, data-driven perspective on the current environment sets an important and accurate baseline to move system migrations forward. Post-migration, process mining can play an ongoing role of ensuring that processes, and the systems supporting them, stay on track and optimized.

Facing the Customer

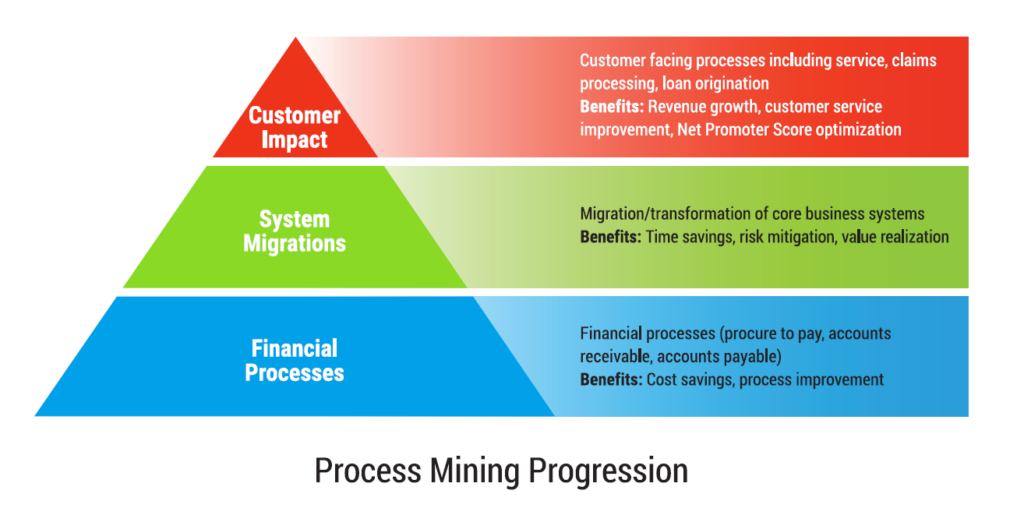

Above and beyond supporting the migration of core ERP systems, process mining leaders say they increasingly see customers moving beyond the financially oriented internal processes (procure to pay, order to cash), where these systems initially gain a toehold in a company, and into those applications that more directly impact customers and, therefore, revenue.

The most common pattern is to start in finance and progress to “front-office,” customer-facing applications. As that progression takes place, the goal for customers is to ensure process mining is creating value continuously. “Processes are really the engine that makes value repeatable in every business,” says Alex Rinke, co-founder and co-CEO of Celonis.

Rob Enslin, co-CEO of UiPath, said claims management functions in insurance and financial services are use cases that customers increasingly look to optimize through the application of process mining and the process intelligence it affords.

SAP Signavio casts process mining as technology that can be applied directly to helping customers improve upon a core indicator of customer satisfaction, namely their Net Promoter Score. Morato says SAP Signavio’s customers use the software to “really understand the process performance in conjunction with the impact on the experience of their customers.”

For Apromore, the company’s software has long supported customer-facing processes. Chief product officer Marlon Dumas says that includes core operations such as customer onboarding and loan processing in banking, as well as policy management in insurance. In the latter example, process mining helps customers reduce the time it takes to handle claims. In the financial world, few, if any, customer-facing processes than these more directly impact revenue, again placing process mining at the core of customer engagement and satisfaction.

Mindzie and Henderson describe their customers as squarely focused on those activities that will yield better financial performance, and many of those directly touch the customer: order management, customer support, and customer success, to name three. “If they are run more efficiently, all of these areas of the business have a significant impact on the bottom line,” he says.

A great example of process mining being used to optimize customer experience comes from the airline Lufthansa, which uses Celonis software to optimize the complex processes involved in orchestrating and managing flights across all the factors that impact timeliness and customer experience: arrivals, departures, weather, regulations, crew duty time limitations, airspace capacity, and more.

In the past, operations center professionals would conduct manual analyses to determine which flights to delay or cancel factoring in all the areas of impact. When it’s purely human driven, that process takes 90 minutes to two hours; with a combination of Celonis and other applications, that time is compressed to minutes, Dr. Detlef Kayser, member of the executive board, fleet and technology group for Lufthansa, said at the Celonis customer conference in late 2022.

“I’m 100% convinced this is the future in our industry, because the complexity will not go away,” Kayser says. Without technology including process mining, “we will not be able to handle that complexity in the future.”

Manny Korakis, Acceleration Economy practitioner analyst and CFO, says he’s used process mining to track customer satisfaction when it comes to his company’s billing and vendor engagement processes, with the goal of being a good partner to customers. “You want to make your company as easy to do business with as possible,” Korakis says. “With process mining, we found that a lot of our processes weren’t set up to make that customer journey very easy and that resulted in poor customer satisfaction. We didn’t know about those until we were able to implement process mining.”

The Power of Generative AI + Process Intelligence

Process mining systems have long leveraged artificial intelligence (AI) and machine learning (ML) to conduct analysis at scale: identifying patterns in data, pinpointing anomalies or compliance issues, and making improvement recommendations.

So when process mining companies embrace generative AI, it’s not a knee-jerk reaction to a white-hot tech trend for the sake of checking a box or appeasing customers.

A common theme that emerges in discussions with these industry leaders is how their systems will supply highly targeted business process data to large language models (LLMs) including ChatGPT; this should ensure that the new interface enhances customers’ ability to drill into core business issues.

SAP Signavio aims to combine the power of generative AI with business process context to turn generic information into results that are tailored to the customer’s business. SAP Signavio calls this Process AI: It’s built on process models and large language models that are fine-tuned by leveraging SAP data sets, content, and knowledge of industry best practices from engagements with thousands of customers. “Our engine will have exceptional capabilities to answer, in this case, specific process-performance questions like ‘Where can I improve my procurement process in Europe?’” Morato says.

Celonis has been demonstrating its flagship tools operating with generative AI; think of generative AI as a natural language front end that lets all manner of business users query the process mining system without needing to know how to structure process queries that would otherwise be required. Celonis can also provide enterprise context that is currently lacking in more generic LLMs. That context includes business rules, processes, and thresholds. “If you want large language models more deeply in your organization as, for example, agents to automate things that humans do today, these systems always need the enterprise context of the company,” Rinke says.

UiPath recently detailed a comprehensive AI roadmap that includes connectors from its applications to multiple generative AI models including those from OpenAI, Microsoft, Amazon, and Google. Edward Challis, head of AI strategy for the company, also notes the vital role of “specialized AI” to account for business-specific processes and tasks that these out-of-the-box LLMs don’t recognize. Specific to process mining, generative AI support will make it simpler for business users to perform analyses or even create dashboards through natural language prompts, adds Kevin Kimes, director of analyst relations at UiPath.

Apromore is tapping generative AI but has a different focus — it doesn’t view the tech as a way to generate code, given that its product is already a no-code platform. Instead, it will tap generative AI to automate process improvement: improvement recommendations from generative AI are fed into the process mining system, then reviewed by people to determine which are feasible to implement.

Mindzie, like some of its competitors, has approached Generative AI as a means to make the technology accessible to more users; it has moved aggressively to implement generative AI. “You now have this whole new layer of people not only from business analysts and process analysts, but all the way up to executives, that can interact with the platform,” CEO Henderson says. That value was reinforced in a recent discussion Henderson had with a CFO. Lacking in-house skills to capitalize on process mining previously, this CFO noted: “The idea that my people can now simply ask business questions and gain insight into how we operate changes the entire landscape.”

A Look Ahead

Two common threads tie together virtually all the discussions that factored into this analysis. The first: Economic and organizational pressures are forcing customers to shorten their time-to-value expectations in order to capitalize on their process mining investment. In fact, in many cases, the investment is predicated on rapid time to value. It’s clear that the top process mining vendors feel the pressure to respond and deliver.

The second, related thread: One common way the vendors are expediting time to value is by taking steps to democratize their technology so that more businesspeople can use it. The more deeply it penetrates an organization, the more impact it has, more quickly. Whether it’s no-code tools, embracing generative AI, or building and packaging versions of their systems for non-technical users, the process mining market is moving closer to a democratized state that continues the rapid maturation of this tech sector.

These developments position process mining to play an even larger strategic role, taking its place among the core systems that drive business results while gaining broad acceptance in the C-suite.