Oracle is on the verge of becoming the world’s fastest-growing major cloud provider as CEO Safra Catz said the company expects cloud revenue, including Cerner, to surge from 44% to 47% in its coming quarter.

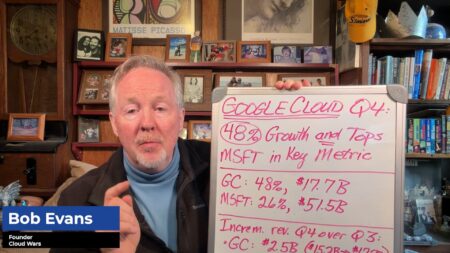

The current high-growth leader is Google Cloud, which has been growing at around 44%-45% for the past 4 quarters. If Oracle comes in even at the low end of its guidance range, it would equal or top the pace Google Cloud has set — and if Oracle comes in closer to the high end of Catz’s guidance, it would become the world’s fastest-growing major cloud provider.

While the inclusion of Cerner’s cloud results is surely adding a huge portion of that hypergrowth, the results showed by Catz indicate that Oracle’s organic cloud businesses — that is, excluding Cerner — are accelerating rapidly and could top 30% for the coming fiscal year. And again, that is without Cerner.

In a memorable fiscal-Q4 earnings release that saw Oracle post its highest organic growth rate since 2011, several details stood out to me from Catz’s commentary on the earnings call:

- While the company’s cloud growth rate slipped in Q4, Catz projected that for FY 23 ending May 31, its organic cloud business — without Cerner — will grow more than 30% in constant currency.

- For Q1, the addition of Cerner’s projected revenue will push the growth rate for the total cloud business of Oracle — including Cerner — to 44% to 47%, or in constant currency from 47% to 50%.

- For Q4, total cloud revenue (SaaS apps plus cloud infrastructure) was up 19% to $2.9 billion.

- For Q4, license revenue jumped 25% to $2.5 billion, “led by database sales for use in the cloud by major SaaS companies,” Catz said, describing those results as “exceptional.” For the quarter, she said, total database revenue was $11.8 billion, up 10% in constant currency.

- While total cloud revenue for full fiscal 2022 was up 22% in constant currency, Catz guided to 30% or higher revenue for the coming fiscal year. Like CEOs of other major cloud vendors, Catz cited full awareness of “the macro environment” but nevertheless expressed a bullish outlook for the future: “Going forward and despite the macro environment, we continue to expect the revenue growth in our loud business will accelerate substantially in the fiscal year 2023” (for Oracle, that is June 1 through May 31).

One cloud number that surprised me was the Q4 growth rate for Fusion ERP, which came in at 20% following growth rates for the past 3 fiscal quarters of (going back in time) 33% for Q3, 35% for Q2, and 32% for Q1. None of the analysts asked about that fairly precipitous tumble in growth rate for the company’s most important applications. Chairman Larry Ellison spoke passionately about Fusion ERP’s rising significance in both financial services and in plans for automating B2B commerce. We’ll take a look at that in a future piece.

A few other numbers from Catz about Oracle’s cloud results:

- Fusion ERP, Fusion HCM, and NetSuite ERP now have annualized revenue of $5.4 billion and grew 24% in constant currency in Q4.

- Infrastructure cloud services now have annualized revenue of more than $3.2 billion and, excluding Oracle’s legacy hosting services, grew 49%. Within that category of infrastructure cloud services, OCI consumption revenue was up 83%, Cloud@Customer consumption revenue was up 108%, and Autonomous Database was up 29%.

Want to gain more insights from Cloud Wars Expo?

Starting on July 20th, more than 40 hours of on-demand cloud education content will be available for free to Acceleration Economy Subscribers.