While Salesforce, SAP, Oracle and Google all have high-growth cloud businesses, a true measure of Microsoft’s mass and momentum is that its cloud revenue will exceed the combined total of those four competitors’ cloud revenue for the quarter ended Sept. 30.

Here’s how I expect the numbers to line up for these heavyweights in my Cloud Wars Top 10 rankings:

#3 Salesforce: $4.3 billion.

Marc Benioff’s company has said it expects revenue for its fiscal Q3, ending Oct. 31, to be $4.44 billion. So for the 3 months ending Sept. 30, I’m pegging Salesforce’s revenue at $4.3 billion. That would be up about 30% from the year-earlier quarter.

#4 SAP: $1.9 billion.

As Bill McDermott’s company looks to unleash the Experience Economy, his cloud portfolio has been growing at around 40% for the past several quarters. The opportunity to help business customers marry operational data with experience data should keep that streak going. To get an inside look at that effort, please see Salesforce vs. SAP: Who Will Lead the Customer-Experience Revolution?.

#5 Oracle: $1.9 billion.

Oracle no longer breaks out its cloud revenue, but based on past levels and the smattering of growth-rate details the company offers during earnings calls, I believe Oracle’s on the verge of reaching an $8-billion annualized cloud-revenue run rate. If its Autonomous Database takes off the way Larry Ellison expects it to, Oracle’s cloud business will really begin to take off.

#6 Google Cloud: $2.3 billion.

While parent company Alphabet does not break out detailed financials for its cloud business, last quarter it did reveal that Google Cloud revenue exceeded $2 billion. With Thomas Kurian creating a customer-centric culture to go with Google’s superb technology, this is the company that, long-term, poses the biggest threat to #1 Microsoft. For more on that, please see Can Google Cloud Beat Microsoft? Could Salesforce + IBM? Or Amazon + SAP?.

Clearly, very impressive performances by each of those four cloud powerhouses. My projections for their cloud revenue for the 3 months ended Sept. 30 add up to a total of $10.4 billion.

So how does that combined total of $10.4 billion stack up against Microsoft’s likely cloud-revenue numbers for that 3-month period, which is Q1 for Microsoft’s fiscal 2020? Here’s my projection:

#1 Microsoft: $11.5 billion.

Last quarter, which was Q4 for Microsoft, the company said its commercial-cloud revenue was up 42% to $11 billion. That represents the largest quarterly cloud-revenue figure any cloud vendor has ever posted—by far. And while Microsoft’s fiscal Q4 is always its largest of the year, I expect Satya Nadella’s company to keep the big momentum rolling. I’m predicting a fiscal Q1 commercial-cloud revenue figure of $11.5 billion. That puts Microsoft on pace to finish its fiscal 2020 with cloud revenue of a staggering $50 billion.

The sheer scale of Microsoft’s cloud business is reflected in the megadeals it has signed with global corporations such as AT&T, Walmart, Chevron and others. The total contract value of each of those deals is estimated to be in the range of $1 billion or more. I dug into the nature of those deals recently in a piece called Inside Microsoft’s Billion-Dollar Cloud Deals: Driving ‘Innovation Agendas’.

And according to Nadella, that’s only the beginning: “We have line of sight to many more such deals,” he said 3 months ago during the company’s last earnings call.

For a detailed look at what’s driving Microsoft’s booming cloud business, please check out Microsoft’s $50-Billion Moonshot: #1 Cloud Vendor Lays Out New Growth Plans.

And as always, a reminder that the ultimate winners in the Cloud Wars are the business customers who get to pick and choose among the fabulous cloud vendors laying the foundation for the digital economy.

Cloud Wars

Top 10 Rankings — Oct. 7, 2019

| 1. Microsoft —If any company can take over #1, I’d nominate Google Cloud |

| 2. Amazon — AWS Q2 revenue jumps 37% to $8.38B, cites broad innovation in ML |

| 3. Salesforce — Benioff pivots to Customer 360, battles SAP for cust. experience |

| 4. SAP — Q2 cloud revenue up 40%; McDermott vows China slip short-term blip |

| 5. Oracle — Ellison: Autonomous DB growth “so extraordinary, we’re not forecasting” |

| 6. Google — Q2 cloud rev. tops $2B; Kurian’s customer focus leads jump from #7 to #6 |

| 7. IBM — Q2 cloud growth rate slips to 5% (8% in cc)—huge bet on Red Hat impact |

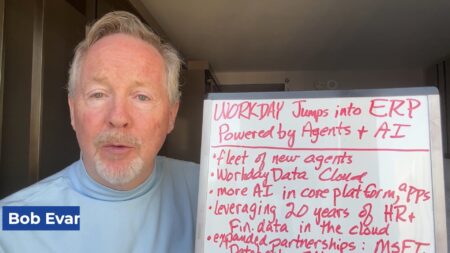

| 8. Workday — CEO Aneel Bhusri says Oracle, SAP can’t match it in Fortune 100 mkt. |

| 9. Accenture — Up from #10 on ties w/ MSFT AWS GOOG; $9B cloud biz up 23% in ‘18 |

| 10. ServiceNow — Donahoe looks to Microsoft & mobile to drive next growth wave |

Disclosure: at the time of this writing, Microsoft, SAP, Oracle and Google were clients of Evans Strategic Communications LLC and/or Cloud Wars Media LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!