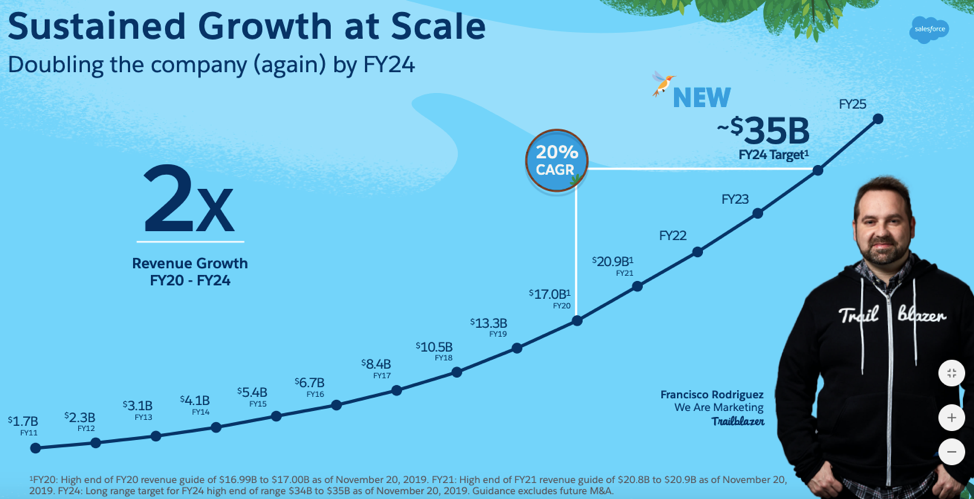

Supremely confident that its revenue will top $20 billion in calendar 2020, Salesforce this week laid out how it intends to stay far ahead of rivals Oracle and SAP in the SaaS market and reach a staggering $35 billion in revenue by 2024.

At its Dreamforce Investor Day presentation, Marc Benioff’s company laid out in bold strokes the market dynamics and internal plans that it says will allow it to double its revenue in a 4-year span from $17 billion for fiscal 2020 (ending Jan. 31, 2020) to $35 billion for fiscal 2023 (ending Jan. 31, 2024).

Here’s what such an achievement would look like, per the investor presentation:

While both SAP (#4 on the Cloud Wars Top 10) and Oracle (#5 on the Cloud Wars Top 10) have aggressive growth plans for their cloud businesses, it’s hard to imagine how either company could come close to matching the trajectory Salesforce has laid out for itself.

Salesforce will finish calendar 2019 with close to $17 billion in cloud revenue. SAP expects to reach $7 billion and Oracle is estimated to be close to that number. So for either Oracle or SAP to reach $35 billion by the end of 2023, they’d have to grow current cloud revenue by 400% over that 4-year span.

For Salesforce to do so, it has to grow by “only” 100% over that time.

So what makes Salesforce think it can pull this off? Why does it believe it can sustain growth rates of 20% and more, even as its annual revenue jumps past $20 billion to $25 billion and even $30 billion?

The entire Investors Day presentation is quite compelling, and I’d urge you to give it a look. But because I love you all so much, I’ve pulled out some of the most significant slides and have packaged them below to give you the strategic overview. Here’s the basic framework, and the slides will follow:

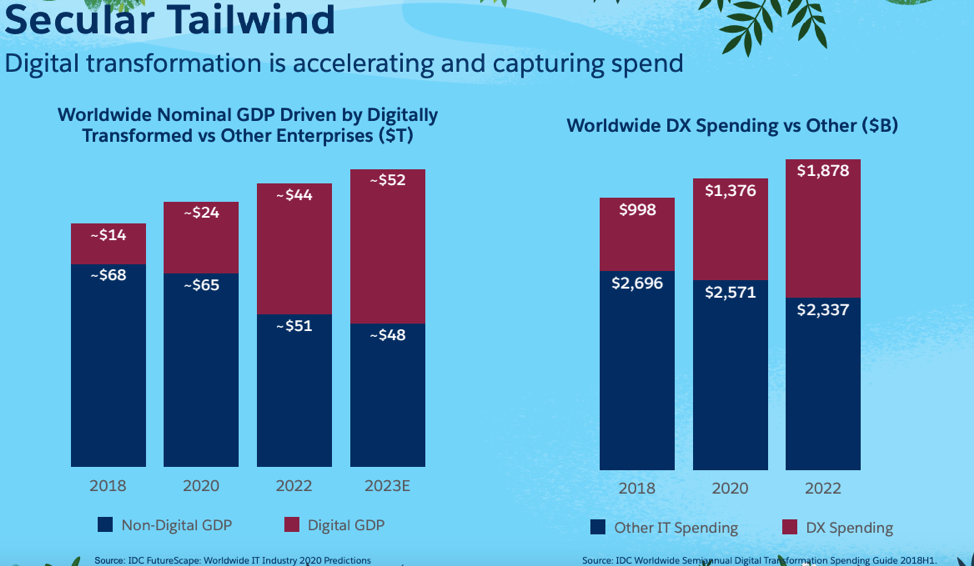

- Digital Transformation will continue to drive higher levels of spending

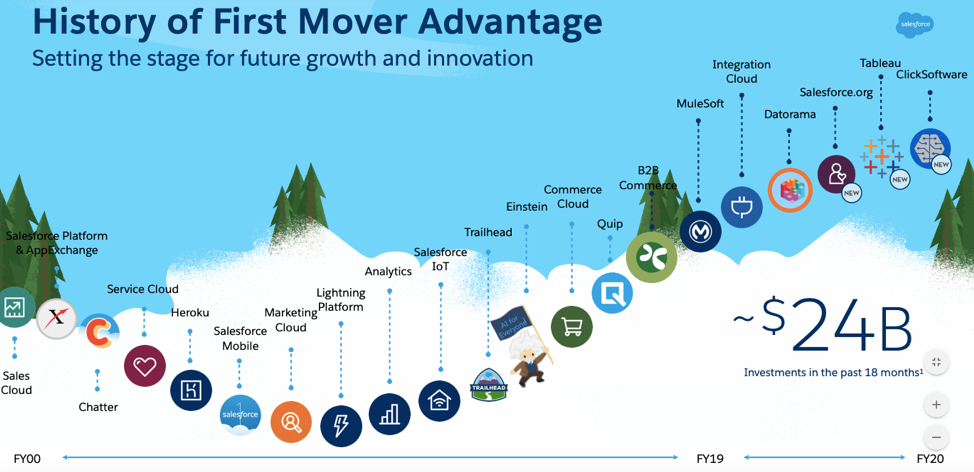

- Salesforce has and continues to have first-mover status in key segments

- The philosophy of “put the customer at the center” is paying big dividends

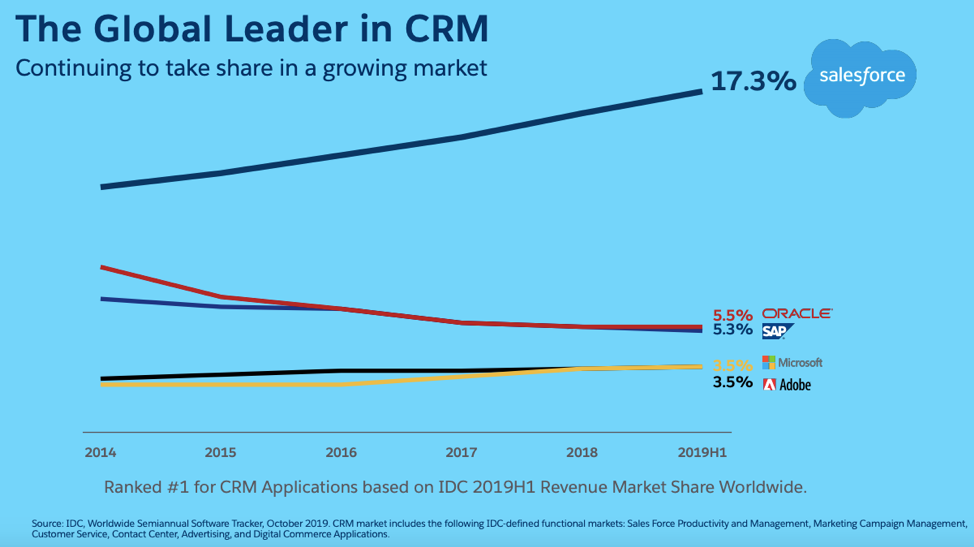

- Salesforce’s CRM market share is almost as big as the combined total of the CRM shares for Oracle, SAP, Microsoft and Adobe

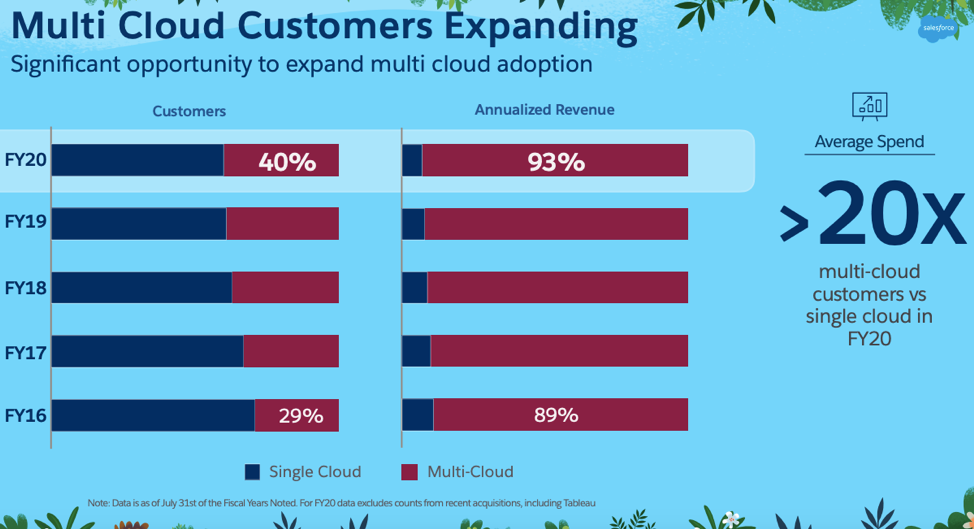

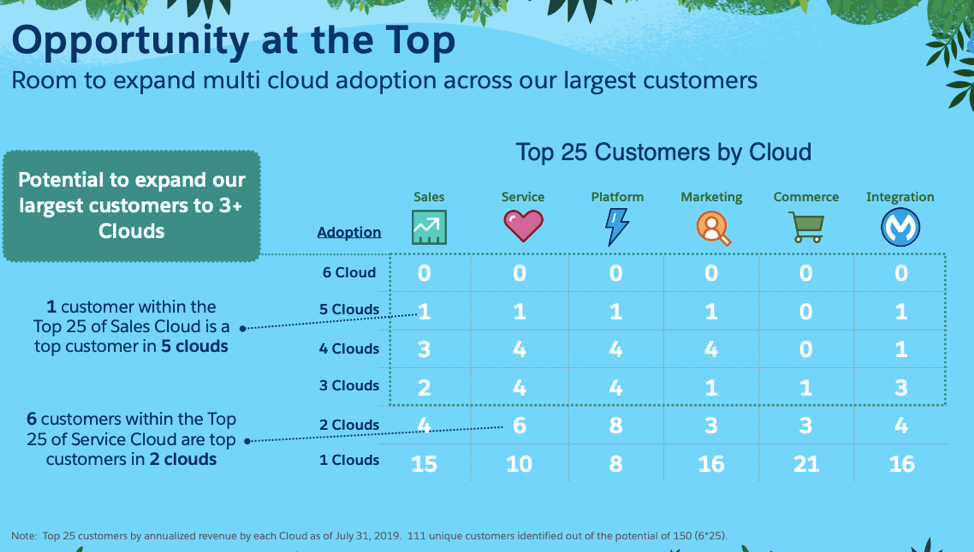

- Customers’ embrace of multicloud environments will benefit Salesforce

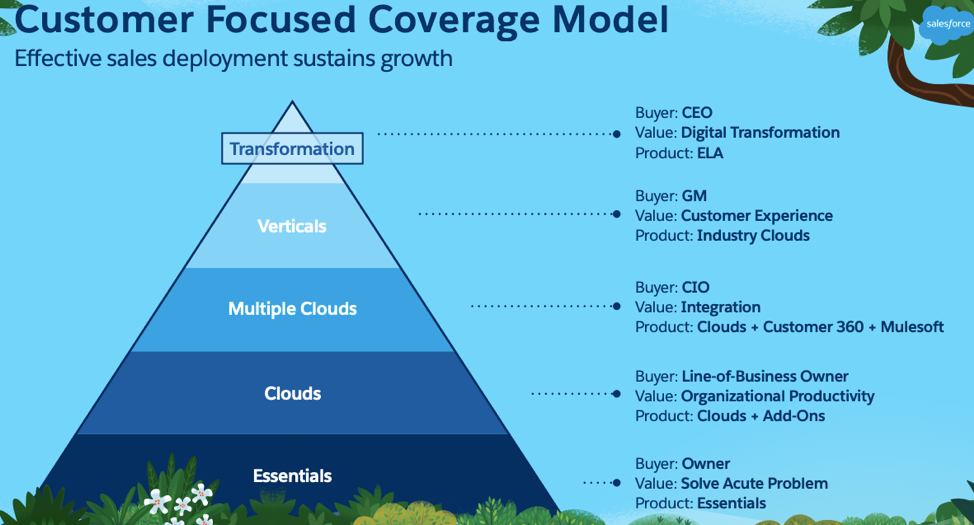

- Salesforce has specific approaches for each member of the C-suite

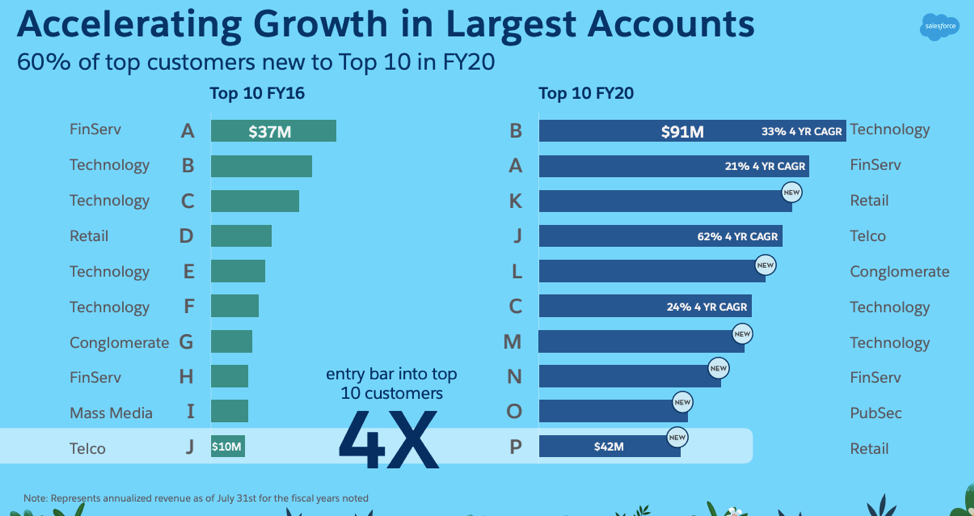

- Revenue growth is rising among Salesforce’s largest clients

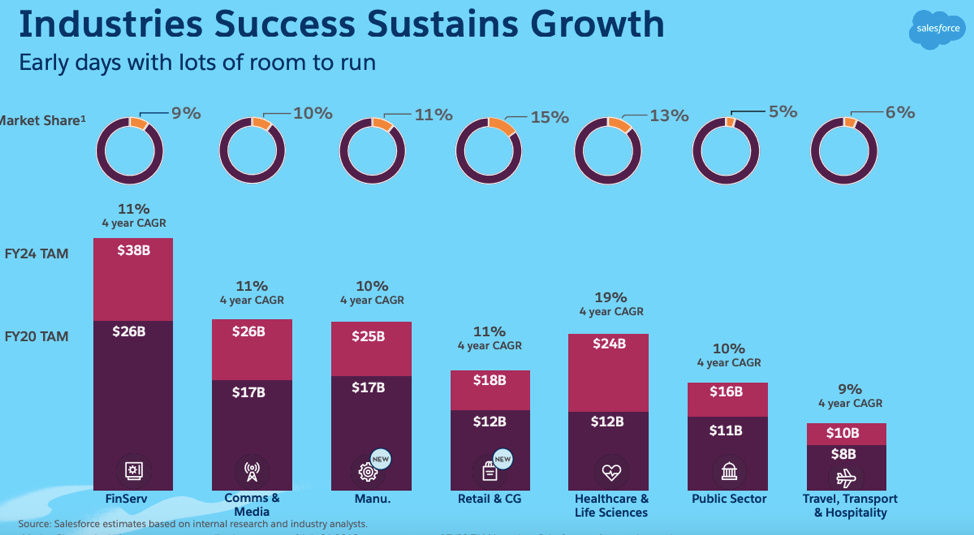

- The creation of industry-specific clouds for key industries is paying off

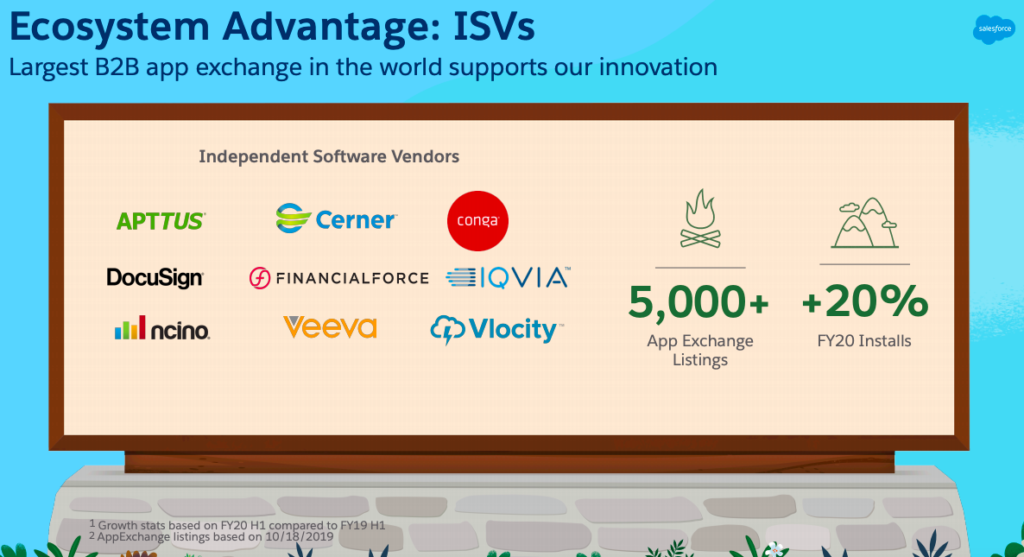

- Salesforce says it has the largest app exchange in the industry

- Its broad and deep product lineup gives it more growth opportunities

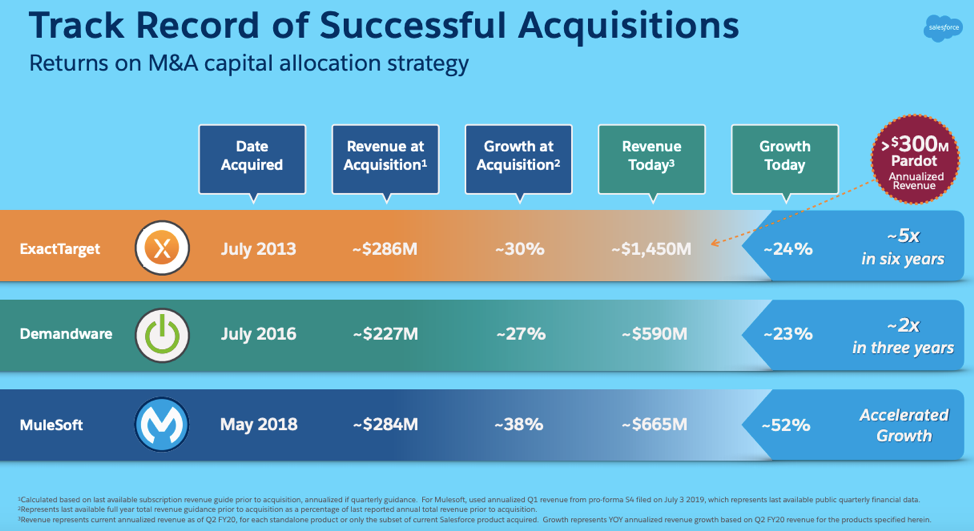

- An aggressive M&A strategy supplies Salesforce with fresh entrepreneurial talent in key leadership positions

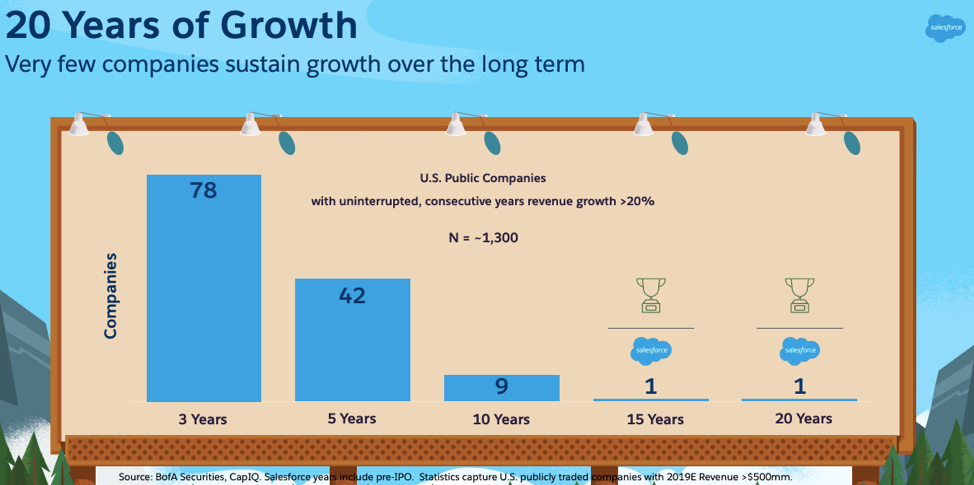

- Salesforce is the only public company to grow more than 20% per year for 20 straight years.

And here’s how Salesforce laid out its mega-plans via slides. This numbering system is not designed to match the Salesforce presentation; I’ve inserted numbers here to make it easier for you to refer back to them. I’m sharing a total of 14 slides from the 64 in the Salesforce presentation.

1: Digital Transformation Expands Spending

2: The Power of Being the First Mover

3: Putting the Customer at the Center of Everything

(This is, by the way, a core element in our content philosophy here at Cloud Wars.)

4: Salesforce Is the Overwhelming Market-Share Leader in CRM

5: The Multicloud Market Is Booming

6: Salesforce Is Planning to Fully Exploit that Multicloud Opportunity

7: Across the C-Suite, Precisely Targeted Messages

8: Among Largest Accounts, Growth Rates Are Rising

9: Specific Industry Capabilities Driving New Growth

10: App Exchange Becomes Force-Multiplier

(“Force”-multiplier: get it??)

11: Broad and Deep Product Lineup Creates New Revenue Opportunities

12: Active M&A Philosophy Drives Entrepreneurial Culture Among Leaders

13: Acquisitions’ Growth Rates Accelerate within Salesforce

14: A 20-Year History of Growth no Other Company Has Achieved

Any way you slice it, that’s quite a remarkable story. And yes, of course, at this point it’s still just a plan. But I can’t find any holes in it—please let me know if you do.

Marc Benioff has planted a flag way the hell out there, where no one else has ever ventured. And as he and Salesforce set off on this next leg of their journey, they can be sure that if they stumble at any point, SAP and Oracle will be right there to keep them motivated.

And for sure, the big winners in this portion of the Cloud Wars are the business customers benefitting from all that competition and the stunning levels of innovation it generates.

RECOMMENDED READING

Salesforce’s Top 3 Challenges: Love Microsoft, Fight Oracle, Keep Benioff

Amazon Jilted as Salesforce and Microsoft Pair Up for IaaS and Teams

Who’s Top CEO: Salesforce’s Benioff? Oracle’s Ellison? Google’s Kurian? Or??

The World’s Top 5 Cloud Vendors: Microsoft, Amazon, Salesforce, SAP, Oracle

Attention Salesforce: SAP CX Revenue Surges 75%, Key Exec Jumps Ship

Disclosure: at the time of this writing, SAP and Oracle were clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!