If Microsoft’s able to deliver a typically outsized revenue figure for its fiscal Q4 ending tomorrow, it will blow past the remarkable figure of $50 billion in annual cloud revenue.

But the primary variable in that that “if” condition is a huge one: the global recession triggered earlier this year by the COVID-19 pandemic.

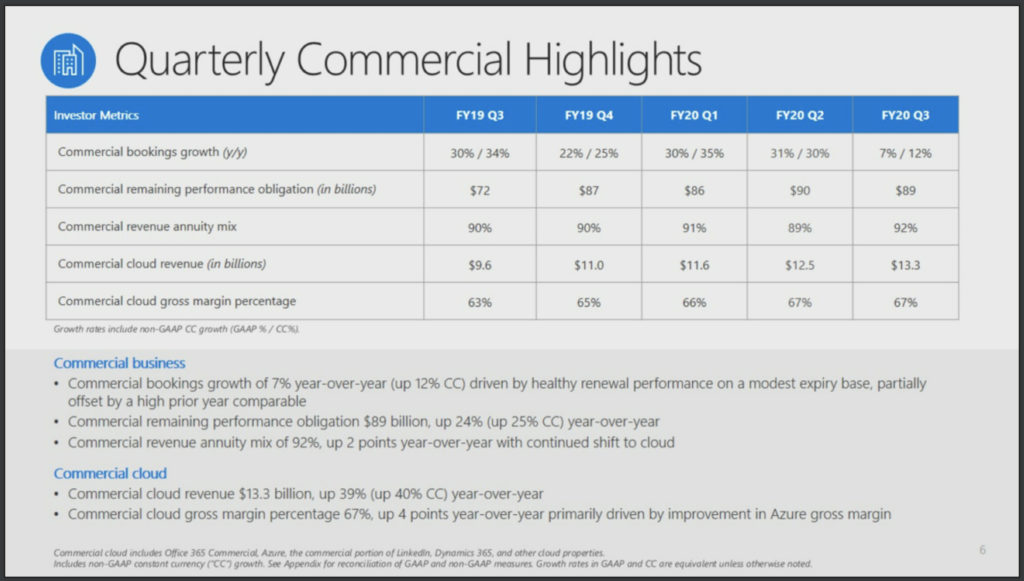

Last quarter, Microsoft—the longtime #1 in my Cloud Wars Top 10 rankings—reported that COVID-19 had a “minimal net impact” on the company’s overall results. That was certainly true for its commercial-cloud business for which Microsoft posted a 40% jump in fiscal-Q3 revenue to $13.3 billion. (Microsoft’s fiscal year runs July 1 through June 30.)

That $13.3 billion figure for Q3 brings the 9-month total for Microsoft’s enterprise-cloud business to $37.4 billion.

That means that if Satya Nadella’s company can fight off the marketplace ravages of COVID-19 and boost its fiscal-Q4 revenue by 23.6% to $12.6 billion, Microsoft will cross a numerical threshold that no other cloud vendor has approached in even its wildest dreams: $50 billion in real, tangible revenue for a 12-month period.

By contrast, last quarter Amazon’s AWS reached $10.2 billion in quarterly revenue, which is by any measure an outstanding achievement and far exceeds what any cloud vendor other than Microsoft has accomplished.

That gives AWS an annualized run-rate of $41 billion, which is among the primary reasons why Amazon has long held the #2 spot on the Cloud Wars Top 10.

On that same basis of annualized run-rate, Microsoft’s comparable figure would be $53.2 billion (its fiscal-Q3 enterprise-cloud revenue of $13.3 billion multiplied by 4).

As we consider the chances of Microsoft topping $50 billion in trailing-12-month revenue, bear in mind that the growth rate required to reach that mark in fiscal Q4 is just 23.6%. I say “just” 23.6% because even though that’s an impressive number, Microsoft’s been able to post commercial-cloud growth rates of 40% or more for many consecutive quarters.

So why do I believe Microsoft will be able to fight off COVID-19’s impact in its Q4 in much the same way it did in its Q3?

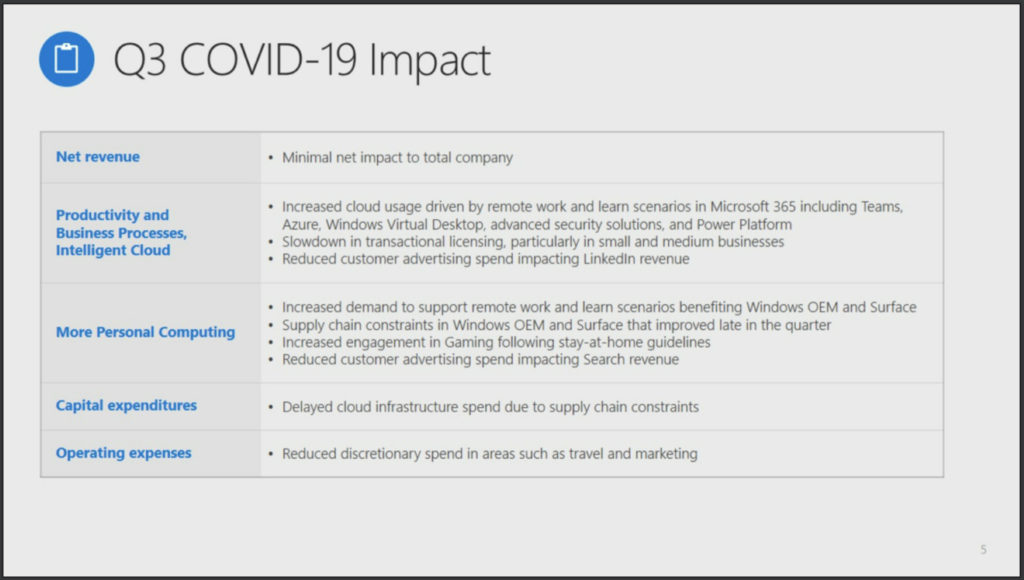

The answers lie within one of the slides from Microsoft’s Q3 presentation. Slide 5 of that deck is headlined “Q3 COVID-19 Impact” and includes the following factors for two of the company’s business units—Productivity and Business Processes, and Intelligent Cloud:

- “Increased cloud usage driven by remote work and learn scenarios in Microsoft 365 including Teams, Azure, Windows Virtual Desktop, advanced security solutions, and Power Platform” and

- “Slowdown in transactional licensing, particular in small and medium businesses.”

Both of those factors have certainly been in play throughout Microsoft’s Q4 as well. The company’s taken some hits from SMB customers unable or unwilling to commit to new licenses during the slowdown and the related uncertainty. But it’s also experienced vigorous demand for its cloud services due to the boom in remote work and remote learning.

In addition, the very first comments CEO Nadella made on Microsoft’s April 29 fiscal-Q3 earnings call reveal and reflect the profound position that the cloud has now achieved in Microsoft’s overall business. Here are those comments:

We delivered double-digit topline and bottom-line growth once again this quarter, driven by the strength of our commercial cloud. As COVID-19 impacts every aspect of our work and life, we have seen two years’ worth of digital transformation in two months.

From remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security, we are working alongside customers every day to help them stay open for business in a world of remote everything. There is both immediate surge demand as well as systemic, structural changes across all of our solution areas that will define the way we live and work going forward.

Our diverse portfolio, durable business models, and differentiated technology stack across the cloud and edge position us well for what’s ahead.

Taking all that into account, I expect that when Microsoft releases fiscal-Q4 earnings late next month, they will show commercial-cloud revenue up 27.3% to $14 billion, pushing Microsoft’s total enterprise-cloud revenue for its fiscal 2020 above $50 billion, to $51.4 billion.

RECOMMENDED READING:

Hey Larry Ellison: Microsoft’s #1 Priority Is Replacing Oracle Database

SAP and IBM Team Up to Help Customers Avoid Extinction

Oracle and Larry Ellison Go Silent on Snatching Huge SAP Customers

Amid Wicked Competition with Salesforce, Adobe Enterprise Business Stalls

Oracle-Workday Showdown: Larry Ellison Says Analysts Prefer Fusion HCM—Do They?

Microsoft-SAS Alliance Is Great, But When Will Microsoft Buddy Up with Amazon?

COVID Crisis May Bring a Cloud Moment for the Banking Industry

Disclosure: at the time of this writing, Microsoft was among the many clients of Cloud Wars Media LLC and/or Evans Strategic Consulting LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!