As Bill McDermott has flipped ServiceNow from a fast-growing niche player to a high-growth global powerhouse, he’s made it very clear that he has no quarrel with the traditional enterprise-software vendors such as SAP, Oracle, and Salesforce.

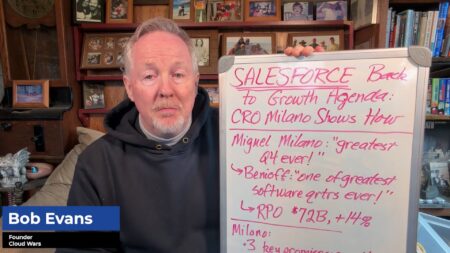

(On my weekly Cloud Wars Top 10 rankings, ServiceNow is #9, SAP is #5, Oracle is #6, and Salesforce is #3.)

In fact, during his inaugural year as ServiceNow CEO, McDermott has occasionally sprinkled subtle hints about the unique value that a partnership with ServiceNow could bring to any or all of those enterprise giants.

But now, with the extraordinary rise of not only digital business and digital workflows but also digital lifestyles and, increasingly, digital lifeflows, I believe it won’t be long before at least one—or two or perhaps even all three—of those huge enterprise-applications companies decides to sign up for ServiceNow’s “workflow revolution.”

So why do I feel that ServiceNow—one-fifth the size of Salesforce, one-eighth the size of SAP and one-tenth the size of Oracle—can deliver such meaningful impact and value to those much-larger software vendors?

In the past year under McDermott’s leadership, ServiceNow has continued to be one of the fastest-growing major cloud vendors (Q3 subscription revenue up 29% to $1.09 billion) and doubled its market-cap to almost $100 billion.

During that time, McDermott has captured the attention and imaginations of customers, prospects, and partners,with his powerful vision of a workflow revolution that interconnects and enhances the value of incumbent LOB apps from SAP and Oracle and Salesforce.

“As enterprises are adapting to the workplace of the future, CXOs are using the Now Platform to create new workflows for new value chains, transforming experiences across siloed systems and functions across the enterprise,” McDermott said on ServiceNow’s Oct. 28 Q3 earnings call.

“The Now Platform is the missing integration layer that multiplies the power of enterprises’ existing technology investments and delivers exceptional time to value.”

Sounds good—are customers as enthusiastic as is the effusive McDermott? Consider this set of financial highlights, with the first few coming from McDermott:

-

“We beat expectations across the board. We surpassed 1,000 customers with ACV over $1 million.”

-

“We landed our largest deal ever with our largest customer who has now crossed over $40 million in ACV.”

-

“We’re driving sustainable growth and we’re well on our way to $10 billion and beyond.”

And these from CFO Gina Mastantuono:

-

“Our sales teams continued to win bigger deals in Q3, including our largest-ever $13 million ACV deal.”

-

“We closed 41 deals greater than $1 million in ACV in the quarter, and what’s more, nine of those were with net new customers.”

-

“We now have over 1,000 customers paying us more than $1 million of ACV.”

-

“We are raising guidance for the full year. We’re raising our subscription-revenue range to between $4.257 billion and $4.262 billion, representing 31% year-over-year constant currency growth.”

-

“We’re reinvesting in R&D and quota-bearing resources to drive innovation and pipeline to fill our tremendous organic growth engine, ensuring that we maintain our market leadership and are well positioned to take advantage of the digital acceleration heading into 2021 and beyond.”

Okay, the growth is very real. But what’s the hook for Salesforce and SAP and Oracle? Why would they choose to join forces in partnership with a much-smaller company that, should the alliance prove successful, could end up getting the lion’s share of the credit and attention?

In other words, what’s in it for those Big 3?

Without mentioning any of them by name, McDermott outlined the current state of enterprise-software health and capability:

“All value chains are being split apart. They are being reformed into modern digital workflows across the enterprise.

“More than $3 trillion have been invested in digital-transformation initiatives. But as IDC research shows us, only 26% of the investments have delivered meaningful ROI.

“Massive investment is simply not creating massive change. This is fueling the workflow revolution, and the missing link is integration. Systems, silos, departments and processes must come together into holistic, cross-enterprise workloads.

“The Now Platform unlocks this ROI by offering speed, agility and resilience. Companies need it now. It gives companies the ability to deliver at scale the experiences employees and customers demand.

“That’s the power of the Now Platform, a single architecture and data model that serves as the enterprise platform for all other platforms.

“In other words, it’s the platform for digital business” (emphasis added).

Now, is Bill McDermott one of the world’s most persuasive people? Yes he is.

Is Bill McDermott doing his considerable best to position ServiceNow as uniquely capable to drive the digital revolution? Yes, he certainly is.

But even with those factors fully acknowledged, is McDermott accurately describing the challenges, obstacles and potentially lethal impediments that many businesses face?

Again, the same answer: yes he is.

And that’s why I believe that Salesforce and SAP and Oracle will all, within the next few months, elect to form some manner of partnership with ServiceNow to see if McDermott’s vivid promises about the power of the Now Platform can come true.

Heck, it’s not like it’s an untested approach—several months ago, Microsoft significantly expanded its relationship with ServiceNow, and within the past week or two, both Accenture and IBM have created new business units in partnership with ServiceNow to pursue various slices of the digital revolution.

And McDermott addressed the question of competition in the Q&A portion of the earnings call. Here’s the question he was asked by Morgan Stanley analyst Keith Weiss: “I definitely feel your excitement about the kind of workflow space, but it seems like there’s a lot of other vendors that are trying to converge on this opportunity as well and trying to automate people’s workflows in perhaps a sort of different competitive set or environment that ServiceNow has seen historically…. Who are the main competitors for the big vision of ServiceNow?”

And here are the key parts of McDermott’s reply:

“Keith, that’s the amazing thing: we don’t need anyone to lose for us to win. So if you think about the large system-of-record providers out there, we have no quarrel with them. Most of the CEOs and technology leaders out there have invested heavily in those platforms.

“And the last thing they’re interested in doing right now is switching out those platforms, especially in the COVID environment where speed, acceleration, resiliency and serving customer and employees are at the top of their to-do list. So that’s not a problem for us.

“And then if you think about the point-solution providers, of course, there’s always going to be point solution providers running around. But we became the platform standard for workflow automation.

“And now we’ve extended the perimeter into the employee and the customer service management areas, which are huge TAMs. Also, as Gartner indicated, we’re really gaining tremendous traction on the platform itself where people are building innovation onto the platform. So what I see happening is large companies in the Fortune 2000 are basically taking legacy and they’re putting it on to Now. They’re basically saying, ‘How can I fire my legacy? Because I can go to ServiceNow to give the consumer a great experience. I can automate my workflows across domains, systems, silos and give my employees and their customers a great experience.’

“And that’s so important to them, they don’t even ask about price as much as they ask about how quickly can you get it done. And then when we tell them how quickly we can get it done, they’re literally in awe because we’re talking weeks—we don’t talk in years, and that’s a very different language for most large-scale companies.

“So, really, there’s no competitor that we go into these large deals worried about.”

Final thought

If you’d like to dig into McDermott’s thoughts on this a little more deeply, here’s an excerpt from an analysis I wrote on Feb. 10 called Salesforce-SAP Showdown: Will Bill McDermott and ServiceNow Be CRM King-Makers?.

It’s a fascinating look into the mind of a guy was CEO of SAP for 10 years and who knows business customers and other software vendors about as well as anybody on Earth.

“If you look at some recent data from Morgan Stanley, if you were just to automate manual or paper-based processes in the enterprise, you have a TAM in the United States alone of more than $225 billion,” McDermott said in the Q&A portion of that Jan. 29 earnings call.

And when asked to talk about the growth opportunities in the CSM [Customer-Service Management] space, McDermott eagerly laid out his very bullish expectations for not only what ServiceNow can do on its own but also its potential for large-scale partnerships with the big enterprise-apps vendors.

“I’m really excited about CSM because I like swimming in big ponds, and that’s the big TAM,” McDermott said.

“There are really three layers within customer-service management that matter to the customer. One is the engagement layer: do you know who I am, and can you have a multi-channel strategy around creating value with me? The second is really huge operational things that go on in the mid and the back office as it relates to workflow in providing the customer an excellent service.”

The third, McDermott said, is service management.

“So think of us as field service with service management more broadly, because we can get to the root causes of things like no other company can. That’s what our platform was built to do.”

So how might ServiceNow position itself to extract the greatest value from these big opportunities?

“We could do engagement—clearly other people are there too—we can do operations like no one else, we can do service management like no one else, or we can do all three.

“In my opinion, the folks that are doing engagement”—hello, Salesforce and SAP—“should try to team up with ServiceNow, because in operations and on the service-management side, we’re the best.”

And then as an additional alternative, he offered a classic McDermott hypothetical. “Or, we could do it all.”

In light of that, McDermott suggested to the enterprise-apps community, “If you have any doubts about what you should do with ServiceNow, you’re probably better off partnering with us.”

RECOMMENDED READING

Salesforce-SAP Showdown: Will Bill McDermott and ServiceNow Be CRM King-Makers?

Google Cloud Growing 50% Faster than Microsoft, Amazon; Q3 Pace Tops Q2

#1 Microsoft Still Rules the Cloud: 5 Numbers Show Why

Microsoft’s Top 10 Customers for Digital Transformation: the Satya Nadella Touch

Larry Ellison Takes on Salesforce and SAP as Oracle Intensifies CX Battle

SAP Versus Salesforce: Is Marc Benioff Missing the CX Boom?

Can SAP Leapfrog Salesforce by Going All-In on CX plus ERP?

SAP Thumps Salesforce, Oracle, Adobe in B2B Digital Commerce: IDC

Market-Cap Madness: ServiceNow Jumps to $100 Billion, IBM Slumps to $104 Billion

AI Triggers New Industrial Revolution for Microsoft and Honeywell

The Magic of Marc Benioff: 10 Key Drivers behind Salesforce Q2 Surge

Larry Ellison’s Trojan Horse: Oracle Exadata in 86% of Fortune Global 100

Disclosure: at the time of this writing, SAP and Oracle were among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!