Based on the rapturous commentary from multiple Salesforce executives about Slack, I get the feeling that Marc Benioff would have been willing to pay $40 billion rather than “just” $27 billion for what he and his team are portraying as a generational chance to reset the trajectory of the enterprise software industry.

On my weekly Cloud Wars Top 10 rankings, Salesforce is #4, and it surely tightened its hold on that spot by reporting last week that fiscal-Q2 revenue jumped 23% to $6.35 billion.

While the financial numbers presented on Salesforce’s Aug. 25 earnings call were certainly attention-grabbing, the ultimate show-stealer was the lavish praise poured on Slack by Benioff, COO Bret Taylor, CFO Amy Weaver and chief revenue officer Gavin Patterson.

Of course, new acquisitions are always portrayed in favorable lights by the people who just made the decision to shell out billions for those deals, but even by those standards, the commentary about Slack from the Salesforce execs was a lovefest of bedazzled proportions.

I’m sharing this perspective on the rapture-factor because often the potential of a deal is revealed not only in the numbers but in the very public commitments made by the execs who approved the deal and are putting their company and their reputations on the line. I said as much before the earnings call in a piece called Salesforce Unleashes Slack and Rocks the Cloud.

But after hearing the earnings call, I don’t think I’ve ever heard an acquisition described with more passion, more commitment and more unshakeable excitement than Salesforce’s purchase of Slack.

Here are my choices of the 10 most-compelling comments made by the Salesforce executive team about Slack and its potential for disrupting and redefining what enterprise software is all about here at the dawn of the digital age.

1. Marc Benioff on “everything being Slack-first.”

“I don’t think Salesforce has really ever had better execution, better management team, greater momentum. And as I have spoken to so many customers today, I don’t think we’ve ever been more well-positioned for them. And I’ll say that in two areas. One is in our core products, our focus on customer success, the Customer 360 now with the Slack user interface and everything being Slack first.”

2. COO Bret Taylor on the incredible wide-ranging relevance of Slack.

“And now with Slack, we’re bringing a whole new dimension to Salesforce. There could not be a more relevant product at a more relevant time for every single one of our customers. If you talk to any CEO, read the headline of any paper, or even look around the home office you’re sitting in, you can see the depth of the transformation work has gone through this year. Sales meetings have moved from conference rooms to Slack and Zoom. Contact centers used to be in buildings, but now they exist entirely in the cloud. My commute has moved from the highway to primarily my hallway, and Slack is at the center of this.

“Slack is how organizations all around the world are finding success in this all-digital work anywhere world. It’s your digital HQ. It connects your employees, your partners, your customers on a single platform and a platform that people love to use. And the Slack-First Customer 360 makes every Salesforce product more powerful and more effective for our customers.”

3. Taylor: a “once-in-a-generation company.”

“Slack comes up in every single one of my customer conversations, and I could not be more thrilled with the momentum in the business… Slack Connect is the capability to enable you to connect not just with your fellow employees but to connect with your partners, with your vendors, and your customers. Slack Connect grew 200% year over year… Slack is a once-in-a-generation company that is transforming the way we work, and it’s transforming the vision we have for our company over the next decade.”

4. CFO Amy Weaver: Slack approaching billion-dollar run rate.

“In Q2, Slack’s revenue grew 39% year-over-year on a stand-alone basis, which excludes any impact of purchase accounting. Slack also saw strong performance in customer acquisition, especially in the enterprise. The number of paid customers spending greater than $100,000 annually accelerated during the quarter, up 41%… This guidance incorporates an expected revenue contribution of $530 million from Slack in the second half of fiscal ’22, an increase of $30 million over our previous guide.”

5. Taylor: Slack is “your digital HQ.”

“I’ve started two companies and both times I started by planning my office space. But if you’re starting a company today, you start by planning your digital HQ. And that’s really what we want to bring to every company in the world: we want to help them build the digital infrastructure that lets them succeed in this new normal.”

6. Chief revenue officer Gavin Patterson: selling through Slack.

“Slack-on-Slack is a very compelling way to explain how we use the product and we’re beginning to do more and more of that. We’re leaning in to close deals through closing the deal itself on Slack, creating channels between us and the customer, and ensuring that everybody who’s working on the deal can have real-time access to those channels. That also means we can close deals much more quickly. And in fact, the Slack deal itself was closed on Slack, which I think is the perfect example of Slack-on-Slack.”

7. CFO Weaver on the Slack-on-Slack deal:

“We conducted our due diligence, our negotiation, and integration through Slack. So yes, I do think that’s the ultimate example of a terrific sale all conducted with Slack and Slack Connect.”

8. Taylor on the power of Slack and Tableau.

“We’ve created what I think is a really wonderful integration between Tableau and Slack. Because now, your data can talk to you, sending you automated notifications so that when you need to take action on data, you’re getting notified in Slack. You can collaborate with your colleagues to diagnose a business issue, and that shows just an incredible combination…

“Data is at the center of all these digital transformations our customers are going through, and they need to integrate that data with MuleSoft. They need to see and understand it with Tableau. And then they need to act on all that, and that’s going to happen with Slack, which is the system of engagement for not only Customer 360 but also the system of engagement for every application at your company.”

9. Taylor on IBM lighting up 1 million employees, partners and customers on Slack.

“IBM is one of my favorite examples of a Slack-First Customer 360 company. Arvind Krishna is a close friend of mine and he believes that bringing Salesforce and Slack together is key for IBM to become even more connected, more productive and more innovative. IBM has built their entire Customer 360 on Salesforce and now has more than 530,000 customers, 380,000 employees and 50,000 partners using our platform. And all of these employees are working in Slack.”

10. Benioff on “why we paid $27 billion for Slack.”

“And I think that what Bret said was very powerful: if you’re starting a new company, you’re not planning physical office place—you’re planning digital office space. Right now, we’re running this call now on a cellphone and on Zoom, and that’s a very much an example of success from anywhere. But every company has to make this transformation. And that’s what’s driving our success going forward. This is not a small transformation—this is not a small change. This is why we would pay $27 billion for Slack: because we believe so strongly that the world has changed, that the past is gone, and that we are in a new world.”

RECOMMENDED READING

How Evan Goldberg and Larry Ellison Made Magic—Twice—with NetSuite and Oracle

Salesforce Unleashes Slack and Rocks the Cloud

The Remarkable Larry Ellison: Oracle’s Legendary Disruptor Turns 77

Cloud Wars Top 10 Crush Q2: $60 Billion Led by Microsoft, Amazon, Google

Infor and AWS: CloudSuite Vendor Bets the Company on Amazon R&D

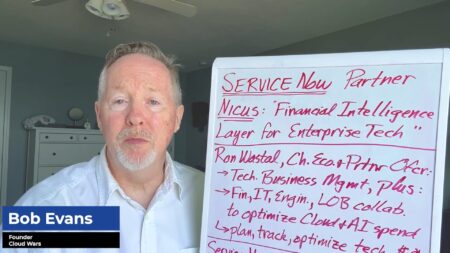

ServiceNow CEO Bill McDermott Playing Dangerous Game w/ SAP, Oracle

Amazon-Workday Kerfuffle: Big Winners Are Workday and Google Cloud

SAP Slaps Back at Larry Ellison: ‘Hundreds’ of Q2 Wins Over Oracle

Microsoft Thumps Amazon by 31% in Q2 Cloud Revenue; Bigger than AWS + Google Cloud

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.