In its Q2 earnings presentation, Salesforce included a CRM revenue market-share chart from IDC showing its increased dominance in 2019.

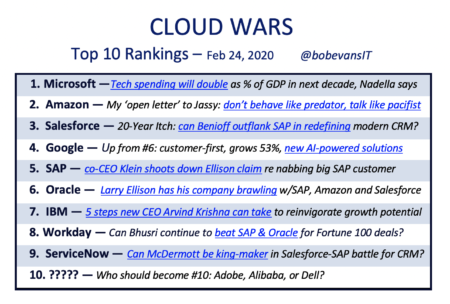

Top 10

Market-cap valuations can be fleeting, but they provide an objective view of how the global market values companies like SAP, Salesforce and Oracle.

An overview of what we know and don’t know about the high-level details of Microsoft Azure revenue and Microsoft cloud revenue in general.

A few thoughts on why Microsoft, Amazon, Salesforce, and Google top the Cloud Wars list of the world’s largest and most-influential cloud providers.

In contrast with Salesforce, ServiceNow and IBM, Larry Ellison and Oracle have all but banished “platform” from their public presentations.

On the recent Amazon earnings numbers, to clarify: anyone who thinks that AWS is “in trouble” or because its growth rate was “only” 29% is nuts.

With a 43% revenue-growth rate that was much higher than those of its larger rivals, Google Cloud continued to be the fastest-growing major cloud vendor.

First in a 10-part series on the biggest challenge facing each of the Cloud Wars Top 10: Microsoft has forged lots of partnerships. Can it keep them?

Amazon’s new enterprise-cloud business unit is called Aerospace and Satellite Solutions, building on the AWS Ground Station capabilities announced in 2019.

On the Workday fiscal Q1 earnings call later today (May 27), I expect CEO Aneel Bhusri to make some pointed comments about the competitive landscape.

Despite the cloud revenue totals that Microsoft and Amazon announce each quarter, the media will continue its delusion that AWS is #1. Watch and see.

Continuing its rapid ascent under CEO Thomas Kurian, Google Cloud as jumped two spots to #4 on the Cloud Wars Top 10. Here are the 3 main reasons.

Revenue is just one of many factors we use in our weekly ranking of the world’s top cloud vendors, but the raw dollar data reveals some interesting points.

Google Cloud CEO Thomas Kurian said to CNBC this week that his company’s 53% jump in revenue means it’s growing faster than Microsoft and Amazon’s AWS.

Google Cloud reported a Q4 53% growth rate and a $10.4 billion annualized run rate, but the only way it can catch Amazon is through aggressive M&A.

TechCrunch recently stated that “Microsoft is miles behind [ AWS ].” But official financial documents show that Microsoft’s cloud biz is much larger.

For Microsoft, another blowout quarter brings its total enterprise-cloud revenue for calendar 2019 to $44.7 billion. I expect Amazon’s to be $34.8 billion.

Google Cloud CEO Thomas Kurian is buying and building new firepower to outflank Microsoft and Amazon in the competitive enterprise-cloud marketplace.

How does new CEO Bill McDermott plan to meet ServiceNow’s 2020 challenge, of reaching $10B in revenue & setting new standards for the biz-software industry?

Workday has set itself apart from primary rivals SAP and Oracle. But the challenge for Workday in 2020 will be this: can it hold or even extend that lead?