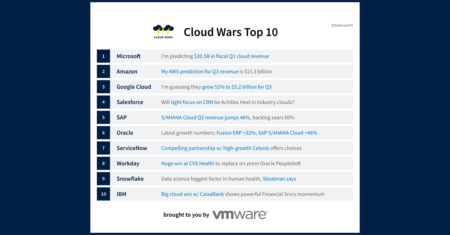

In this Cloud Wars Minute, Bob explains why the market cap for the top ten Cloud Wars companies still demonstrates confidence in the power of the cloud.

Top 10

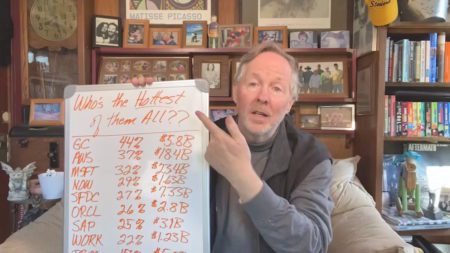

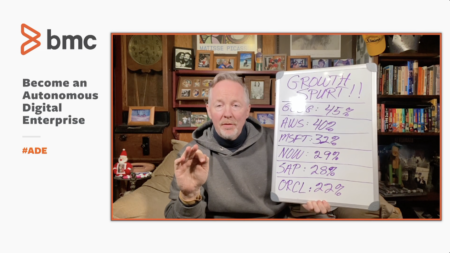

As the first reporting period of 2022 comes to a close, Bob reports the hottest cloud companies and their growth rates.

As Q1 comes to an end, Bob reviews the growth rates of the Cloud Wars Top 10 and identifies the hottest cloud provider.

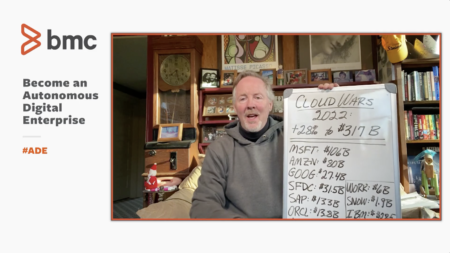

Cloud revenue growth exploded across the Top 10 vendors in Q4, which conveys important truths about the present & future business world.

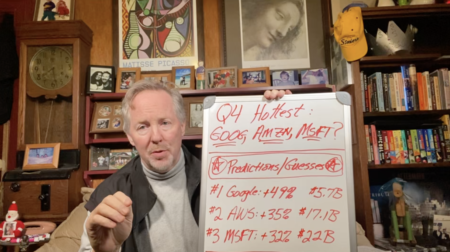

Microsoft is closing out 2021 with cloud revenue that should reach $22 billion for Q4 and $80 billion for the calendar year.

In Q4, who’s the hottest cloud vendor of them all? Can AWS best Microsoft in growth for another quarter? Let’s peer into the crystal ball.

Watch to hear Bob Evans’ predictions for each Cloud Wars Top 10 vendor’s calendar 2022 cloud revenue total and growth rate.

From #1 Microsoft at $80 billion to #10 IBM at $26 billion, Bob Evans shares his projections for the Top 10 vendors’ cloud revenue totals for calendar 2021.

The vision of CEO Thomas Kurian has helped push Google Cloud to the #3 spot in the weekly Cloud Wars Top 10 rankings. Read more here.

IBM has outlined its specific focus on four heavily regulated industries and feels bullish about its opportunities with industry clouds.

IBM has elected to form alliances w/ cloud heavyweights Microsoft, Amazon & Google, according to IBM Cloud senior VP Howard Boville.

The unifying trend that’s boosting Salesforce, Snowflake & Workday’s combined market cap to $500 billion is industry-specific solutions.

Salesforce has oriented more than half its global sales org toward industry-specific goals & objectives in a move to strengthen its position.

Six of the world’s top cloud vendors shared their visions for the future of business, including Industry Cloud Top 10 #1 Salesforce.

On the Amazon earnings call last week, CFO Brian Olsavsky called out machine learning as the primary catalyst behind the AWS surge.

On the Oct. 26 earnings call for Alphabet, CEO Sundar Pichai said that a focus on industry-specific solutions is driving Google Cloud growth.

Competing with Microsoft cloud is not for the faint of heart. Amazon & Google should be paying very close attention to MSFT’s latest numbers.

Despite having revenue only 1/75th the size of IBM’s, data-cloud disruptor Snowflake has vaulted past IBM to #9 in the Cloud Wars Top 10.

With solid if unspectacular Q2 cloud revenue up 13% to $7 billion, IBM has pushed past Salesforce as the third-highest earner.

10 months ago, Salesforce had a market cap 40% higher than that of Oracle. Now, it’s 10% lower. What happened to impact these numbers?