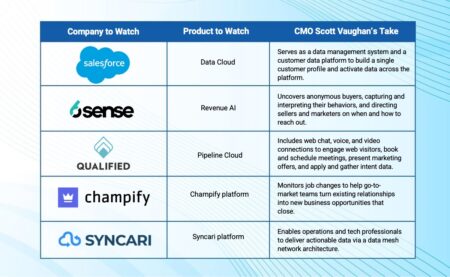

Overview of business intelligence and reporting tools to watch delivers an explanation of key features such as AI-enhanced analytics, data visualization, and cloud functionality.

Salesforce

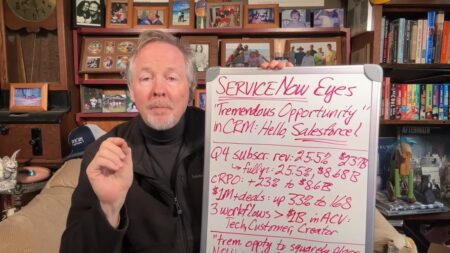

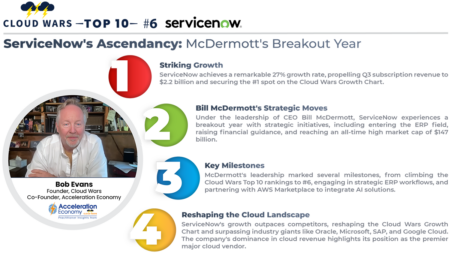

ServiceNow has had substantial subscription revenue growth and is making a strategic pivot into Customer Relationship Management (CRM).

IBM CEO Arvind Krishna emphasizes customer-centric innovation and co-creation, shifting from traditional selling to shared thinking, innovation, and opportunity with partners for mutual growth.

Learn about our top five revenue technology products to watch this year, including offerings from Salesforce, 6Sense, Qualified, Champify, and Syncari.

AI Index Report Ep 22: Salesforce announces latest additions to its Einstein AI; Nabla secures funding for its specialized copilot; and Articul8 provides high security AI.

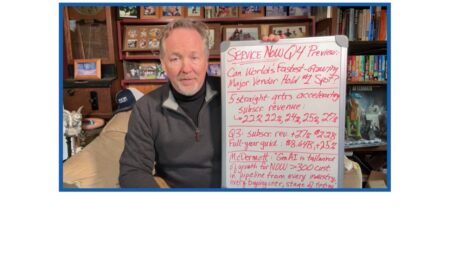

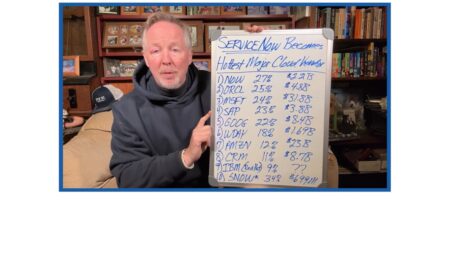

ServiceNow emerges as the fastest-growing major cloud vendor globally, boasting a fifth consecutive quarter of accelerating subscription revenue and a robust outlook in 2024.

The Salesforce Trailblazer Career Marketplace will enable users with AI, data, and CRM skills to connect with employers in the Salesforce ecosystem.

In another example of the evolving nature of partnerships in the Cloud Wars Top 10, AWS and Salesforce expand their collaboration to data and AI initiatives.

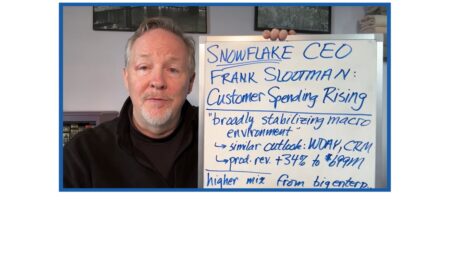

Snowflake CEO Frank Slootman recently discussed a shift in customer behavior, and the pivotal role of unstructured data in the GenAI revolution.

Snowflake, positioned at the forefront of the GenAI revolution, reports robust Q3 results, emphasizing data-centric GenAI strategies and a transformative focus on unstructured data.

ServiceNow claims the top spot as the world’s hottest cloud vendor with a remarkable 27% growth rate, outpacing all the other Cloud Wars Top 10 companies.

Robotics as a Service (RaaS) extends the widely embraced SaaS model to robots. Certain sizes of companies and scenarios are solid candidates for RaaS.

ServiceNow, led by CEO Bill McDermott, claims the top spot on the Cloud Wars Growth Chart with a 27% growth rate, outpacing competitors and achieving key milestones in a breakout year, reshaping the cloud landscape.

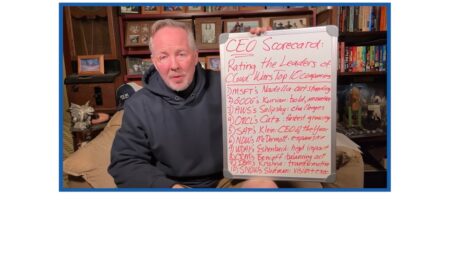

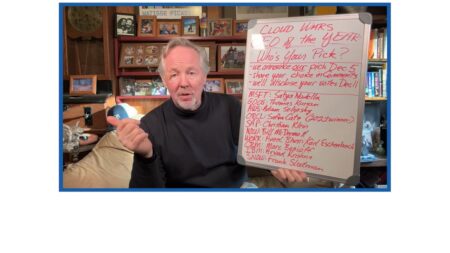

The Cloud Wars Top 10 companies, with a combined market cap exceeding $7 trillion, have experienced a range of performance in 2023, with CEOs including Microsoft’s Satya Nadella and SAP’s Christian Klein standing out.

Insights into the strategies and performances of the Cloud Wars Top 10 top CEOs, highlighting their impact on company growth, innovation, and customer-driven alliances.

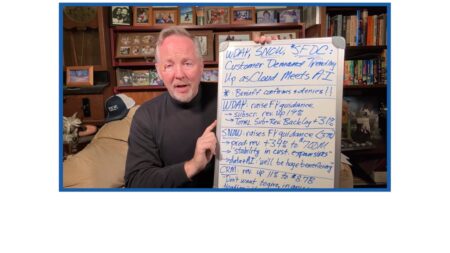

Major enterprise vendors, Workday, Snowflake, and Salesforce, collectively reveal a robust fiscal-Q3 with strengthened customer spending, notable revenue surges, and strategic positioning.

A look at Q3 earnings reports from major cloud companies (Workday, Snowflake, Salesforce), emphasizing the consistent surge in customer demand, while noting Salesforce’s CEO, Marc Benioff, skillfully balances cautious language with optimistic insights about AI and enterprise technology trends

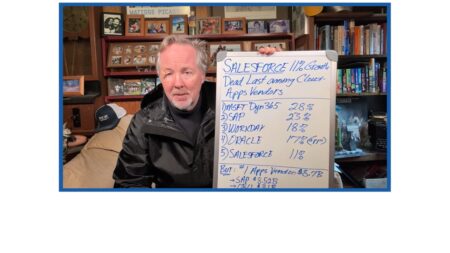

Salesforce, the leading global enterprise-apps vendor with fiscal-Q3 revenue of $8.7 billion, faces challenges as it trails competitors in quarterly growth rates.

Salesforce, led by Marc Benioff, has a slow growth rate at 11%, prompting questions about CRM’s relevance and Salesforce’s ability to innovate across various fronts amid changing market dynamics.

Who is the Cloud Wars CEO of the Year? A call to vote for your pick for Cloud Wars CEO of the Year.