In Q2, IBM showcased how AI is expanding — not replacing — its legacy products, with strong adoption of AI-assisted tools for mainframes.

Oracle

Enterprise apps and AI software giant endorses AI standard, adding momentum and simplifying access to dominant database platform.

Oracle’s Kim Lynch outlines how the company is accelerating government transformation through AI, cloud, and defense innovations while ensuring security, flexibility, and rapid technology adoption.

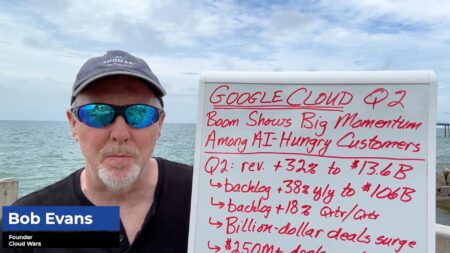

Google Cloud’s AI-native infrastructure and enterprise partnerships are fueling its fastest growth rate in years.

SAP’s Q2 cloud revenue rose 24% to $6B, marking a slowdown from past quarters but still outperforming major competitors like Oracle and Salesforce.

SAP posted strong Q2 results with 24% cloud growth, but backlog growth slowed to 22%, down from 28% in Q1, raising questions about market uncertainty, especially in the U.S. public sector.

SAP is projected to post 27% Q2 cloud revenue growth and a 29% rise in backlog, driven by AI adoption and a strong ecosystem strategy, outpacing rivals like Oracle and Microsoft.

Oracle reignites the Cloud Wars with bold claims on unmatched AI deployment flexibility, prompting rivals to redefine what cloud leadership really means.

Oracle claims unmatched cloud capabilities—Google Cloud pushes back in a major way. The hyperscaler debate heats up as customers seek clarity on what really matters.

Oracle shares soar as company eyes $30B annual cloud deal, redefining its revenue future.

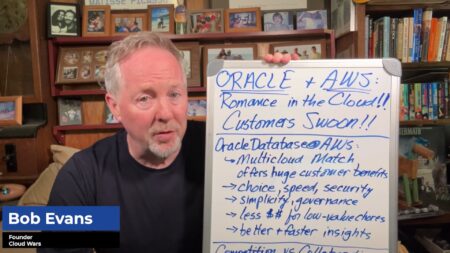

Oracle and AWS are turning rivalry into results with Oracle Database@AWS now generally available.

In under a year, AWS and NVIDIA co-engineered a hybrid liquid-air cooling system, showcasing the speed and depth of tech collaboration in the AI era.

The Oracle-AWS partnership represents a massive shift from competition to cooperation, benefiting customers with innovation and speed.

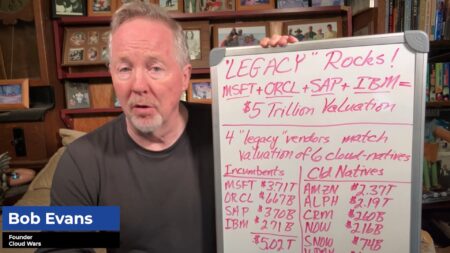

Veteran tech giants prove resilience and innovation still win, matching the market power of cloud-native disruptors.

Despite their age, legacy companies like Microsoft, Oracle, SAP, and IBM match the market value of newer cloud-native leaders, proving the power of incumbency in the cloud and AI era.

The Cloud Wars Top 10 have surged past a $10 trillion market cap, reflecting unprecedented business confidence in the AI- and cloud-powered future.

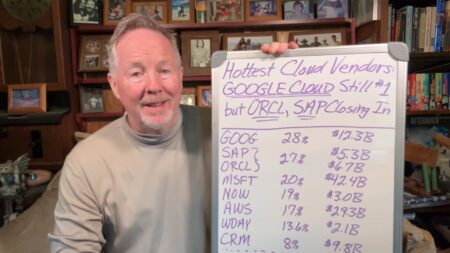

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

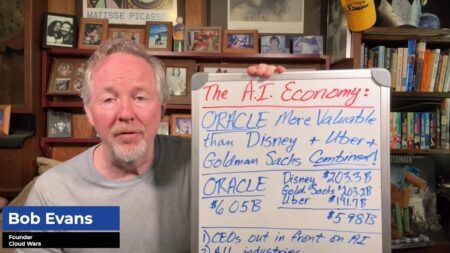

With CEOs leading the charge, AI is redefining how businesses function across all sectors, and Oracle’s market surge is just the beginning of a seismic economic shift.

Market perceptions are shifting, valuing those who leverage AI effectively, with Oracle leading by example.