Google Cloud allies with AI chip giant NVIDIA to deliver new compute instances that make it faster and easier to develop and deploy AI apps.

Google Cloud

AI Index episode 11: Bayer partners with Google to optimize drug discovery and clinical trials with AI; Imbue raises $200 million to build advanced AI agents; and Walmart launches generative AI assistant.

Discover why smaller cloud providers often outperform industry giants for MSPs and SIs in terms of customization, support, pricing, and competitive considerations.

Generative AI holds the potential to introduce greater efficiency by helping procurement leaders create RFPs. See what our testing of three prominent platforms revealed.

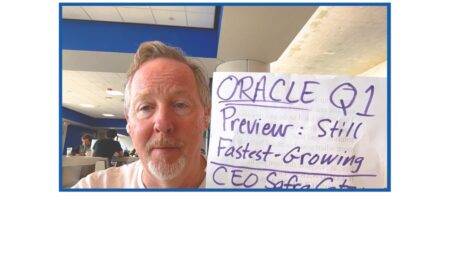

Oracle is expected to announce strong Q1 earnings results with significant cloud growth, distinguishing itself from other top cloud providers.

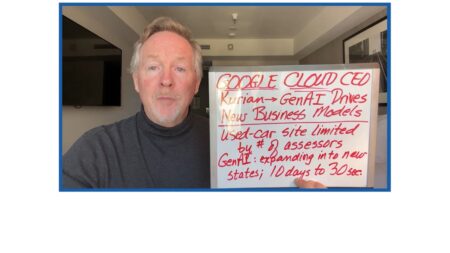

CEO Thomas Kurian discusses how Google Cloud’s Generative AI tools are reshaping business models and sparking expansion opportunities with real-world examples and predictions for the future.

Google Cloud emerges as the preferred choice for over 70% of generative AI startups due to its advanced AI capabilities, reliable infrastructure, and open-source commitment.

The Cloud Wars Top 10 are in the thick of quarterly financial reports. The numbers and outlook are making it clear: some investment caution is dissipating.

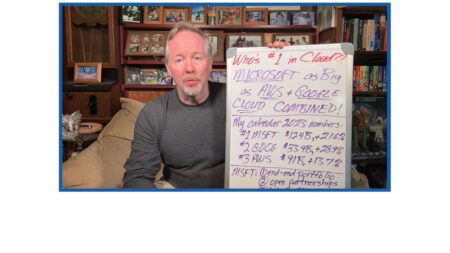

Microsoft’s cloud business is projected to generate as much revenue in 2023 as both AWS and Google Cloud combined, highlighting its dominance in addressing customer needs and pioneering in technology.

Microsoft’s cloud success vs. AWS and Google Cloud is driven by its end-to-end portfolio, strategic partnerships, AI initiatives, and impressive scale.

The Cloud Wars Top 10 companies are projected to generate $359.4 billion in cloud revenue in 2023, despite economic challenges, with Microsoft leading at a growth rate of 21.6%, while Oracle is the fastest-growing member with a 38.8% growth rate.

Projected growth rates for the Cloud Wars Top 10 companies in 2023 showcase the sector’s resilience and rapid expansion.

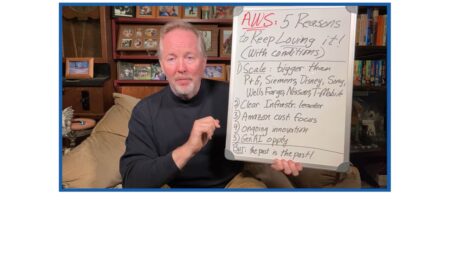

Its growth rate has declined over 18 months, but AWS remains a dominant cloud infrastructure force and customers benefit from its scale, focus on innovation, and generative AI strategy.

Despite declining growth rates, AWS has plenty going for it including its massive scale, cloud infrastructure leadership, customer focus, and potential in the generative AI market.

Despite its smaller size, Google Cloud leapfrogged AWS in the Cloud Wars Top 10. Innovation, CEO vision, and generative AI tools are some of the reasons for its rise.

An update on the Cloud Confidence Index, with Amazon, Google, and SAP leading the index higher.

The Cloud Confidence Index uses market caps of top 10 cloud companies as a proxy for business leaders’ confidence in their growth, reflecting customer demand and technology trends. The index is up slightly.

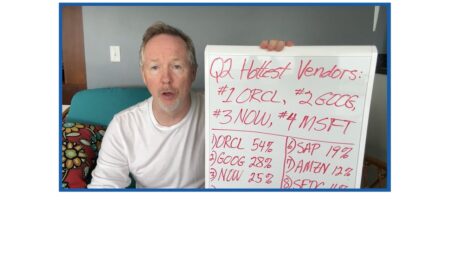

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

The four fastest growing cloud vendors’ financial results indicate an upturn in customer spending and preparation for the generative AI revolution.

Despite AWS’s impressive scale and achievements, its rivals are gaining ground in other software-centered segments of the cloud. AWS may face challenges in the Cloud Wars going forward.